When Finance Meets Data: How Integration Redefines the Car Buying Experience

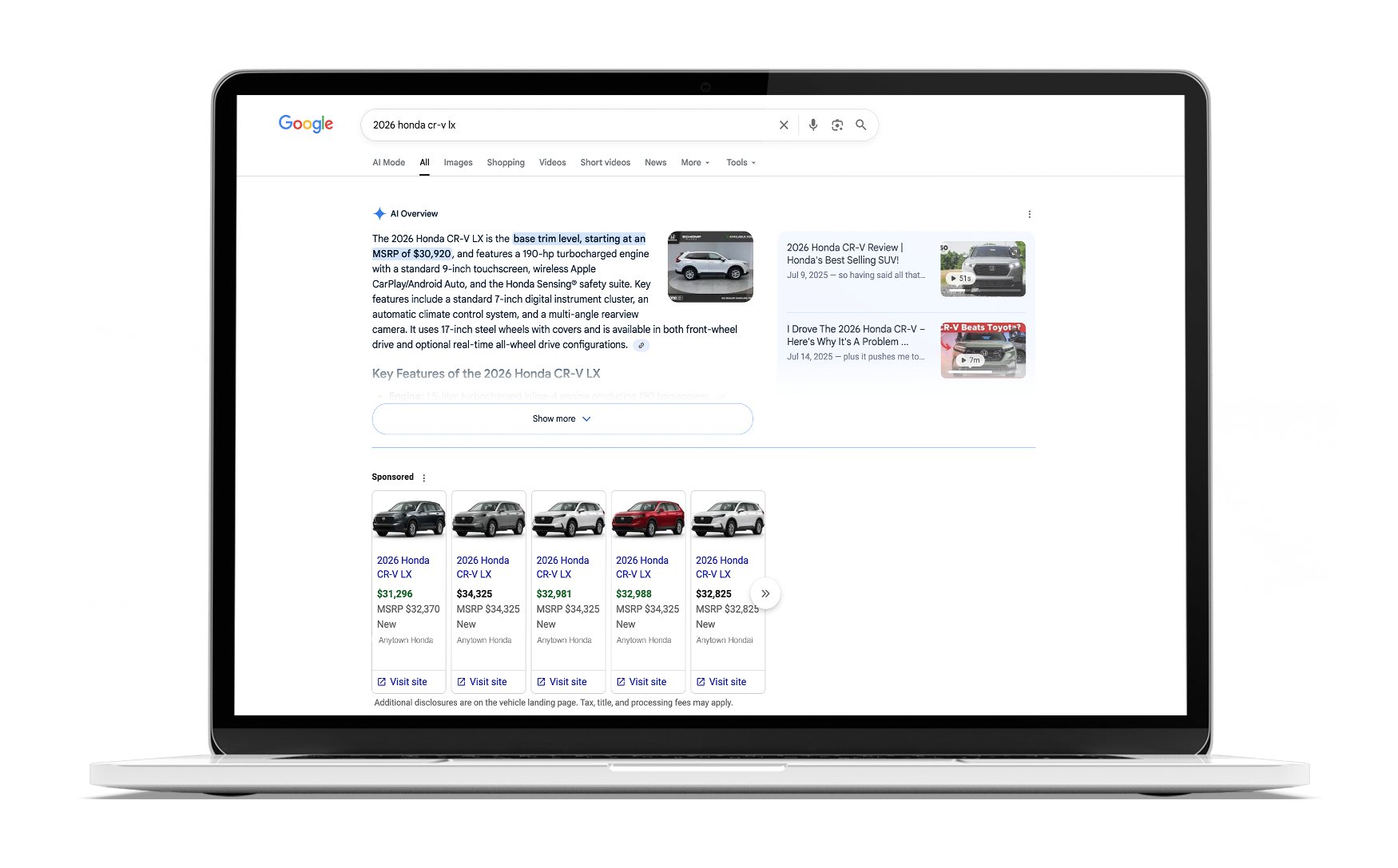

In today’s digital car-buying journey, finance and credit tools play a critical role in moving shoppers from interest to intent. These solutions streamline what has traditionally been one of the most complex parts of purchasing a vehicle — securing financing. When properly integrated, finance and credit platforms help customers pre-qualify or get pre-approved online, explore real-time, personalized financing options, and complete much of the process before ever setting foot in a dealership.

The Role of Finance & Credit in Modern Car Buying

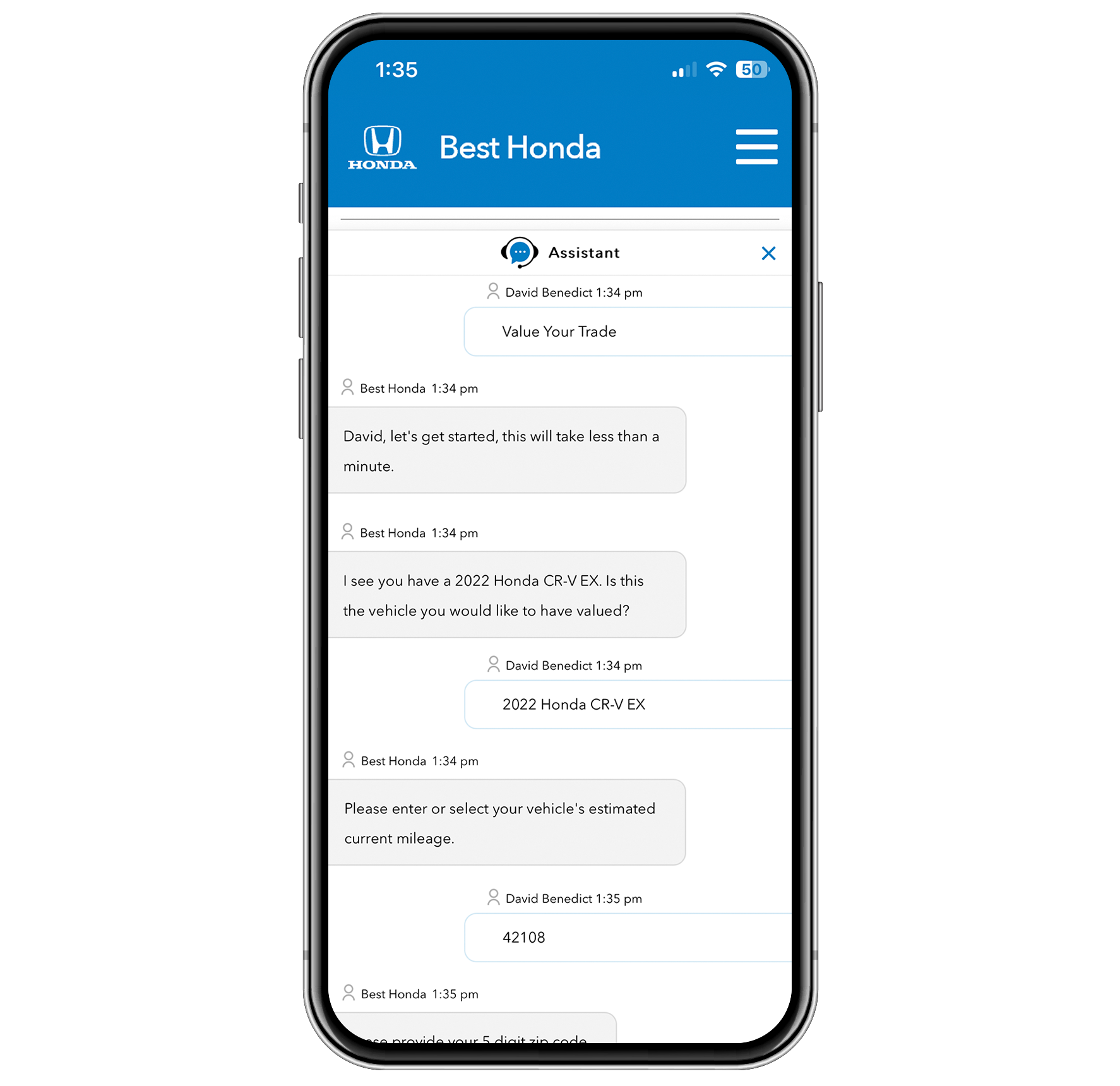

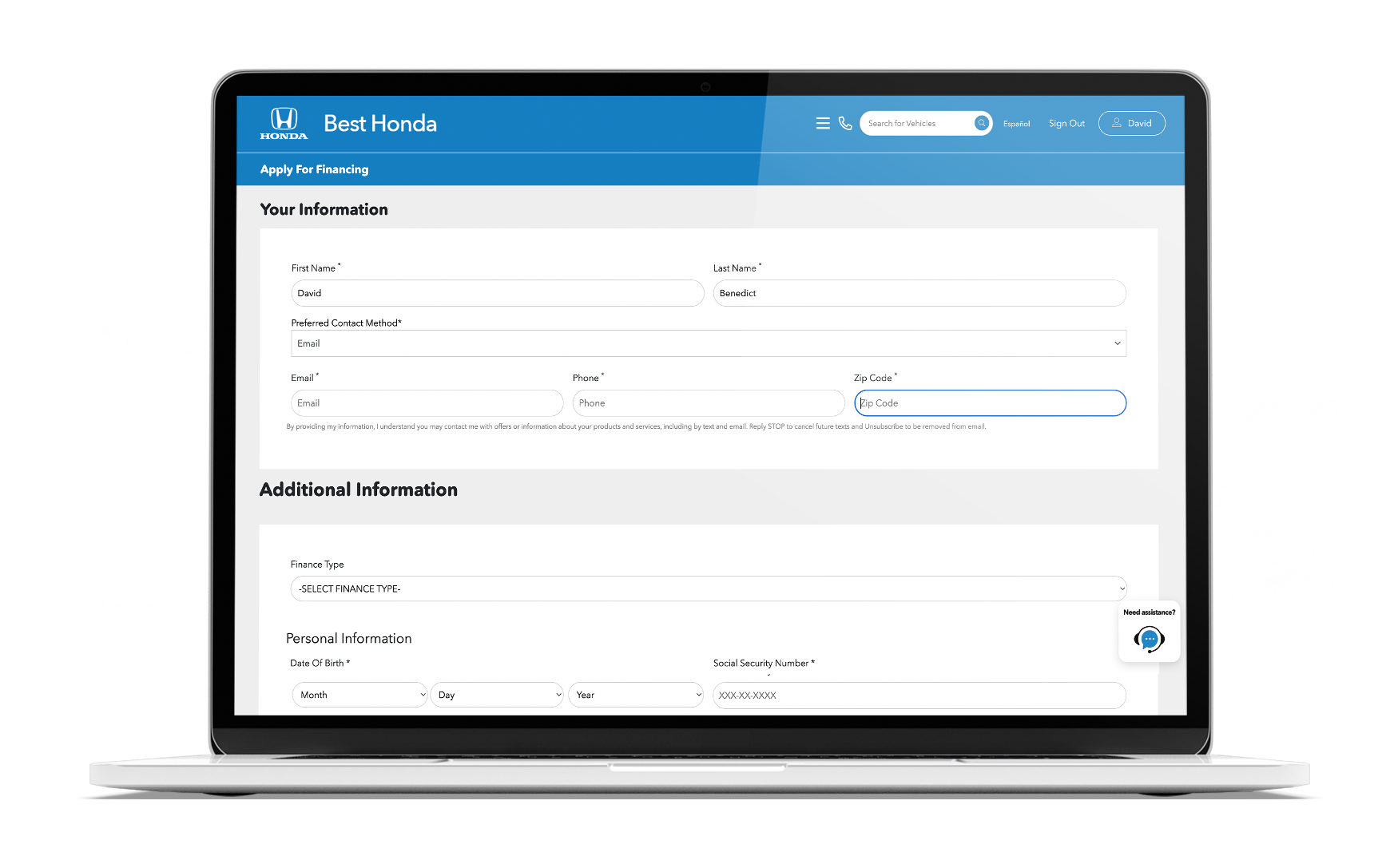

Finance and credit integrations allow customers to understand their true buying power early in the journey. Through soft or hard credit pulls, they can pre-qualify for loans, view accurate payment options based on factors like trade-in value and equity, and even complete the majority of financing steps from the comfort of home.

This transparency creates trust — shoppers know what they can afford before they meet with a salesperson, which means fewer surprises and faster, more confident decisions.

Common Limitations of Finance Tools

While finance tools have transformed how customers start the buying process, many still face key limitations that create friction for both shoppers and dealers.

Fragmentation

Too often, finance tools operate in isolation from core dealer systems like the CRM, DMS, or dealership website. This siloed approach leads to manual data entry, duplicate efforts, and inconsistent customer experiences.

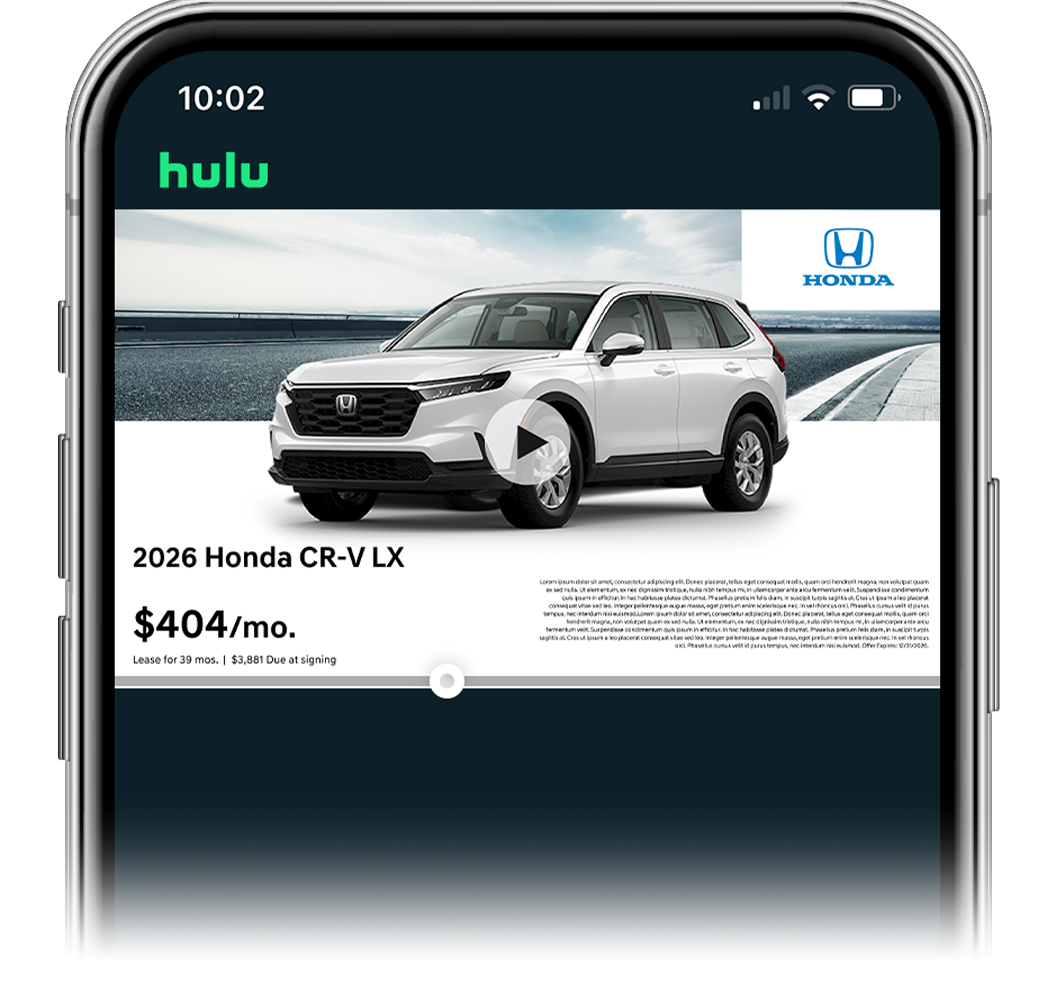

Poor Mobile Experience

With most consumers browsing and applying on mobile, many pre-qualification forms still aren’t optimized for smaller screens. This results in incomplete submissions, higher abandonment rates, and lost leads.

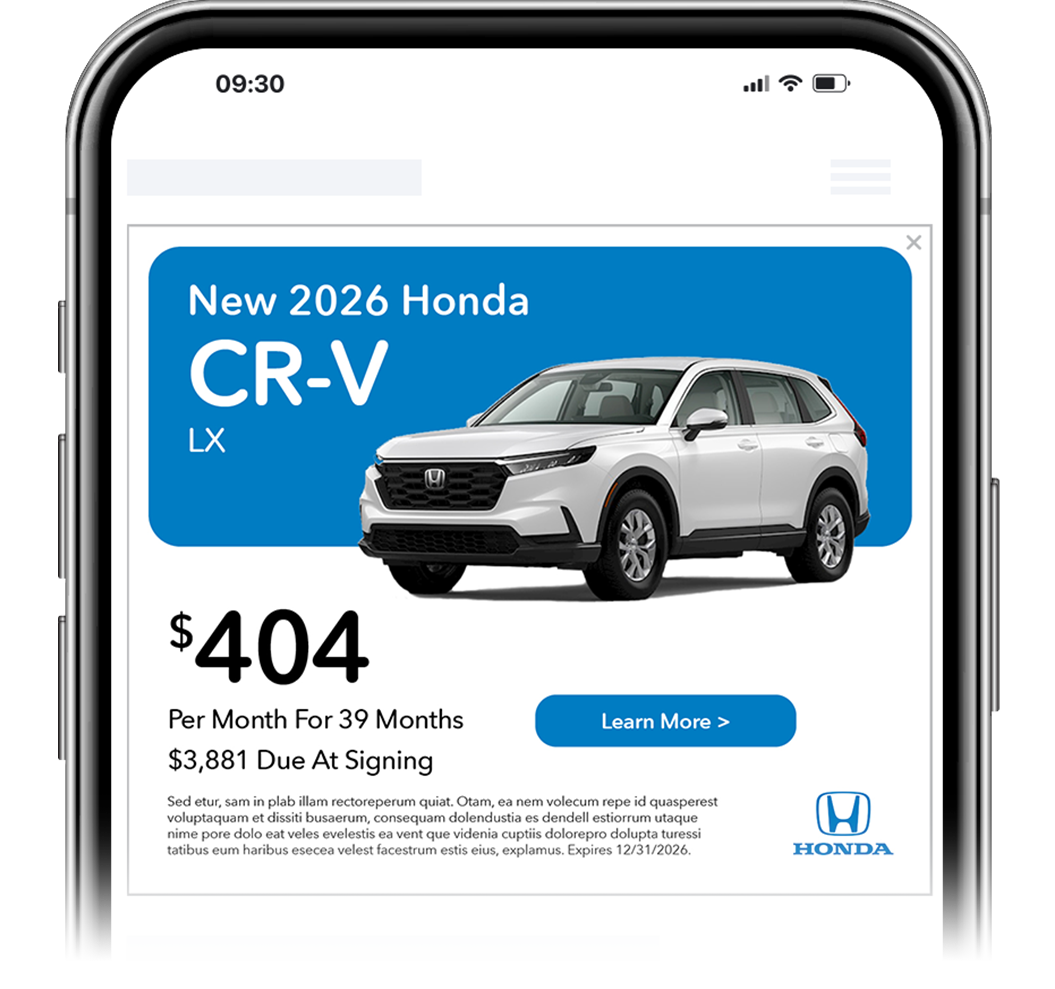

Lack of Personalization

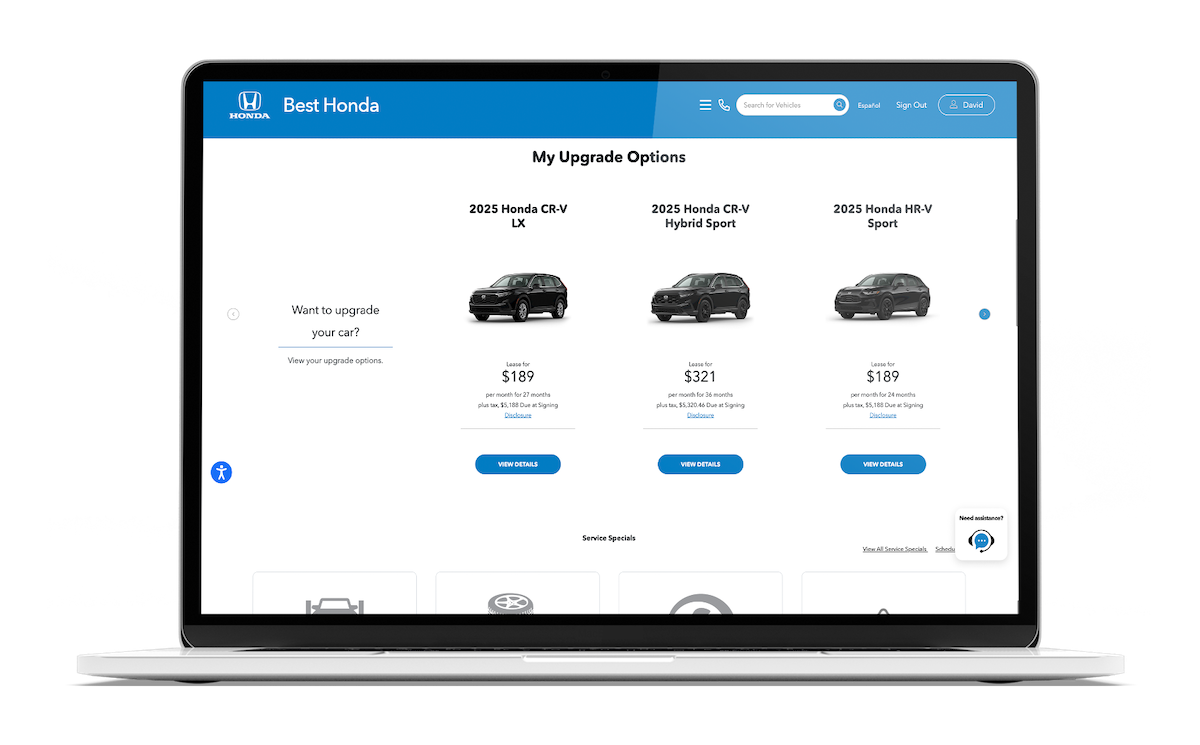

Generic offers fail to reflect a shopper’s individual circumstances or behavior, leaving potential customers feeling disconnected from the buying experience.

Inconsistent Data Flow

When finance tools aren’t connected across the ecosystem, dealers lose access to critical insights. This limits follow-up opportunities and prevents intelligent, finance-based marketing campaigns that convert.

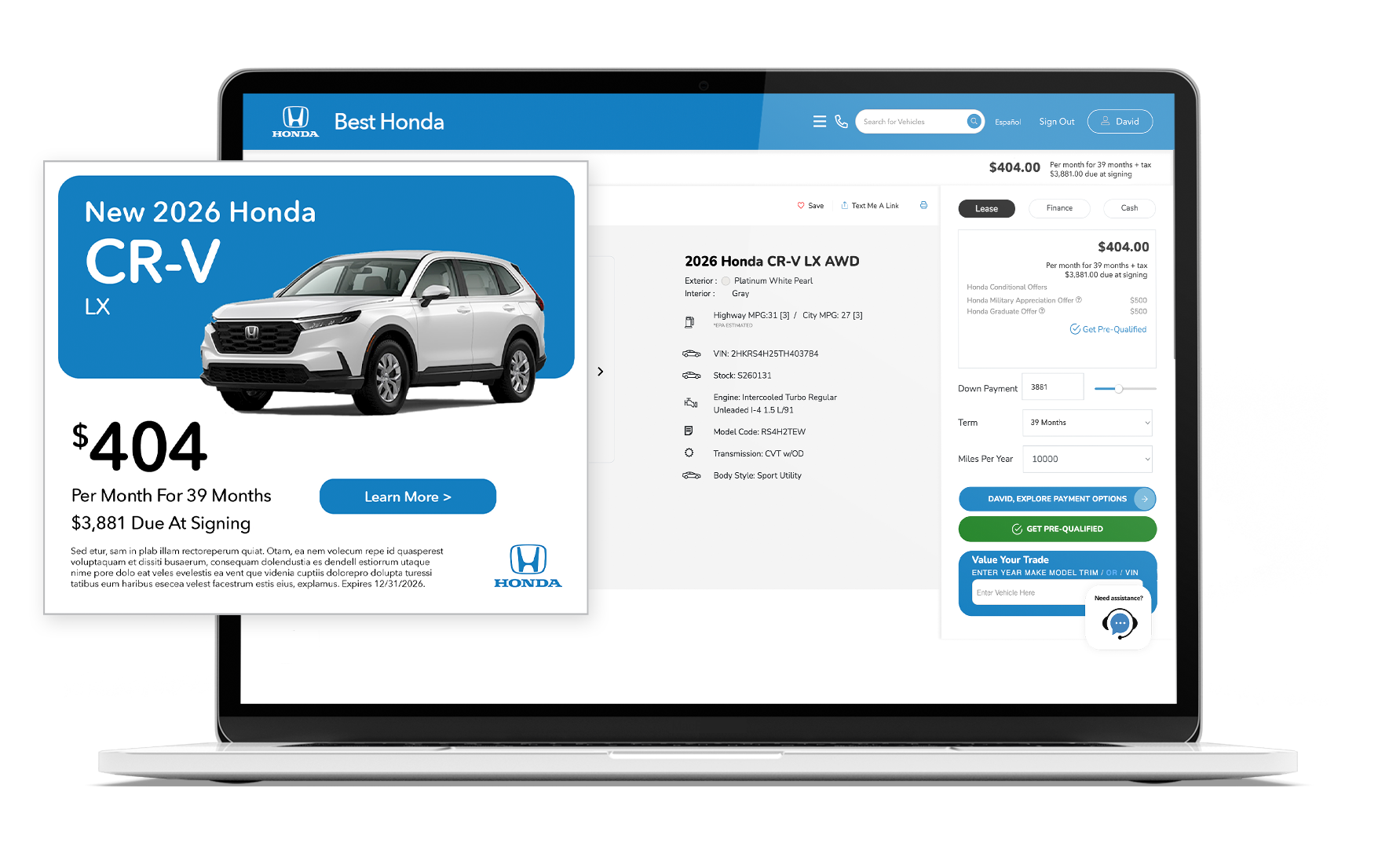

What True Integration Looks Like

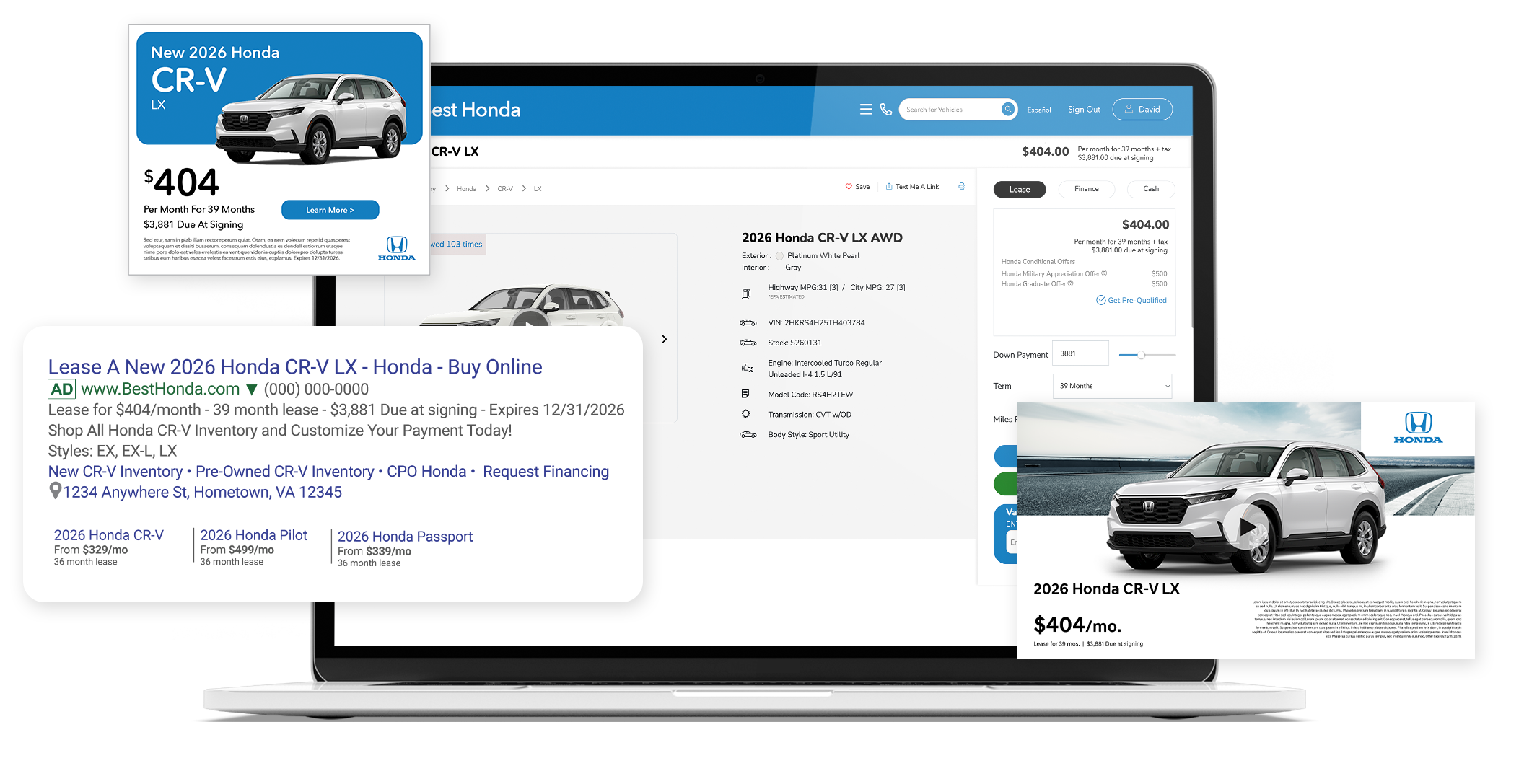

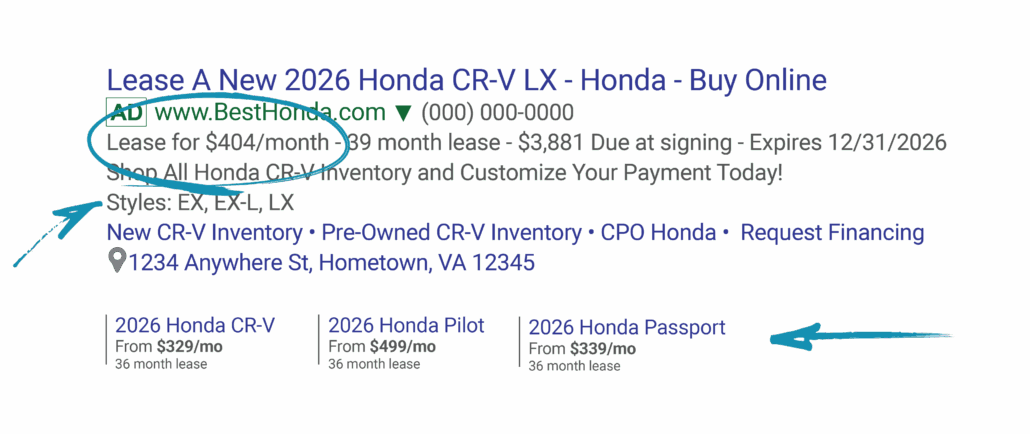

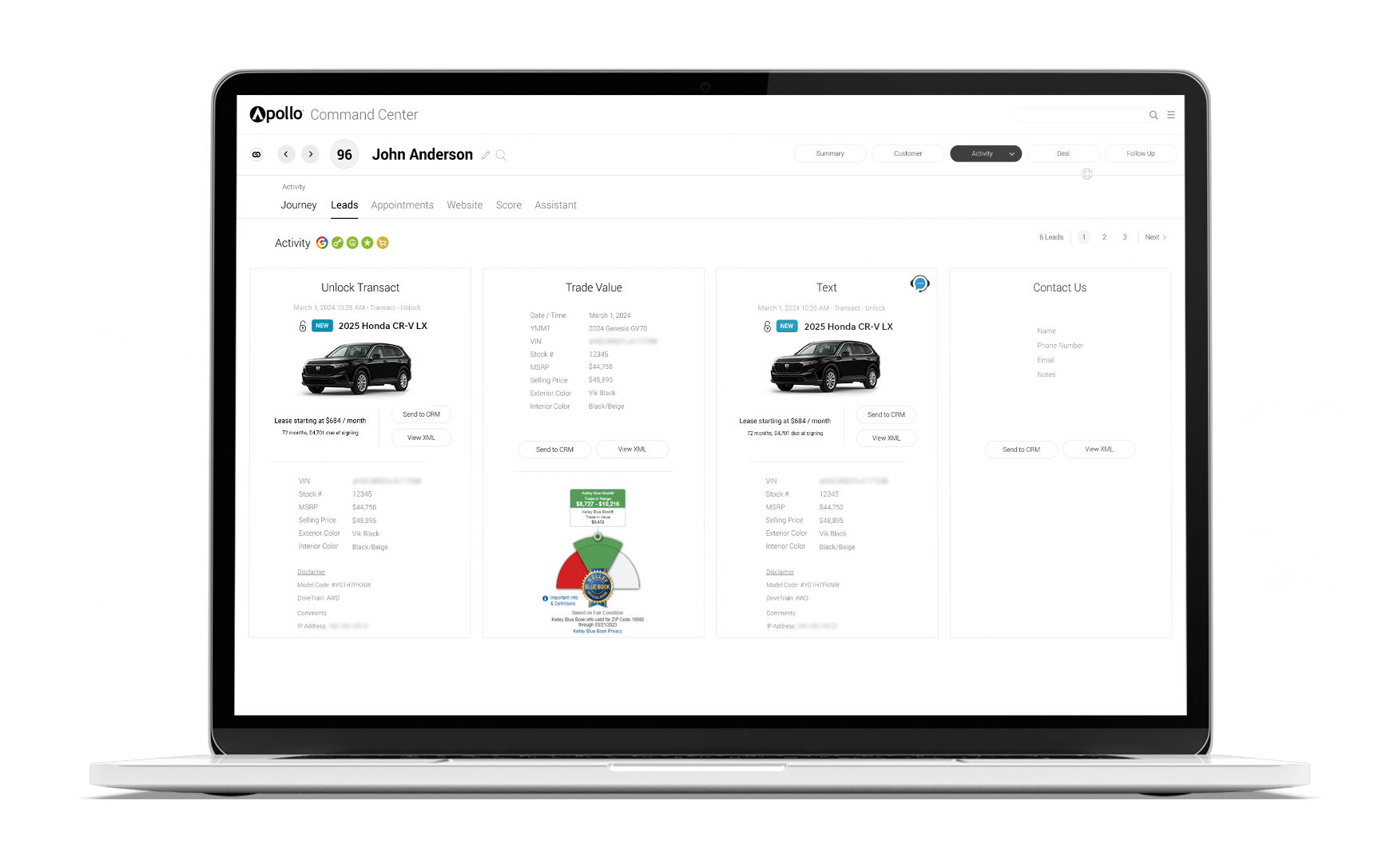

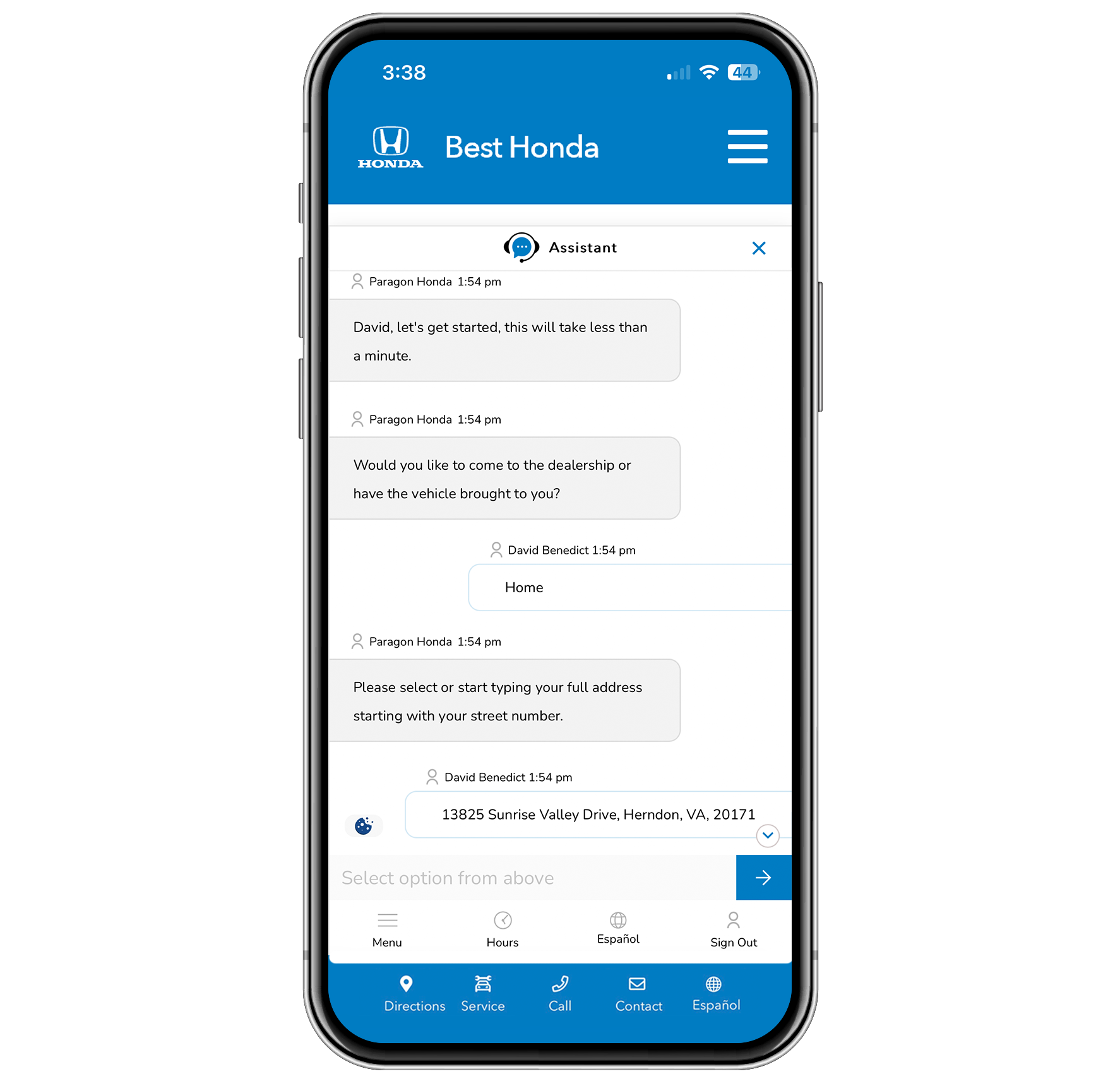

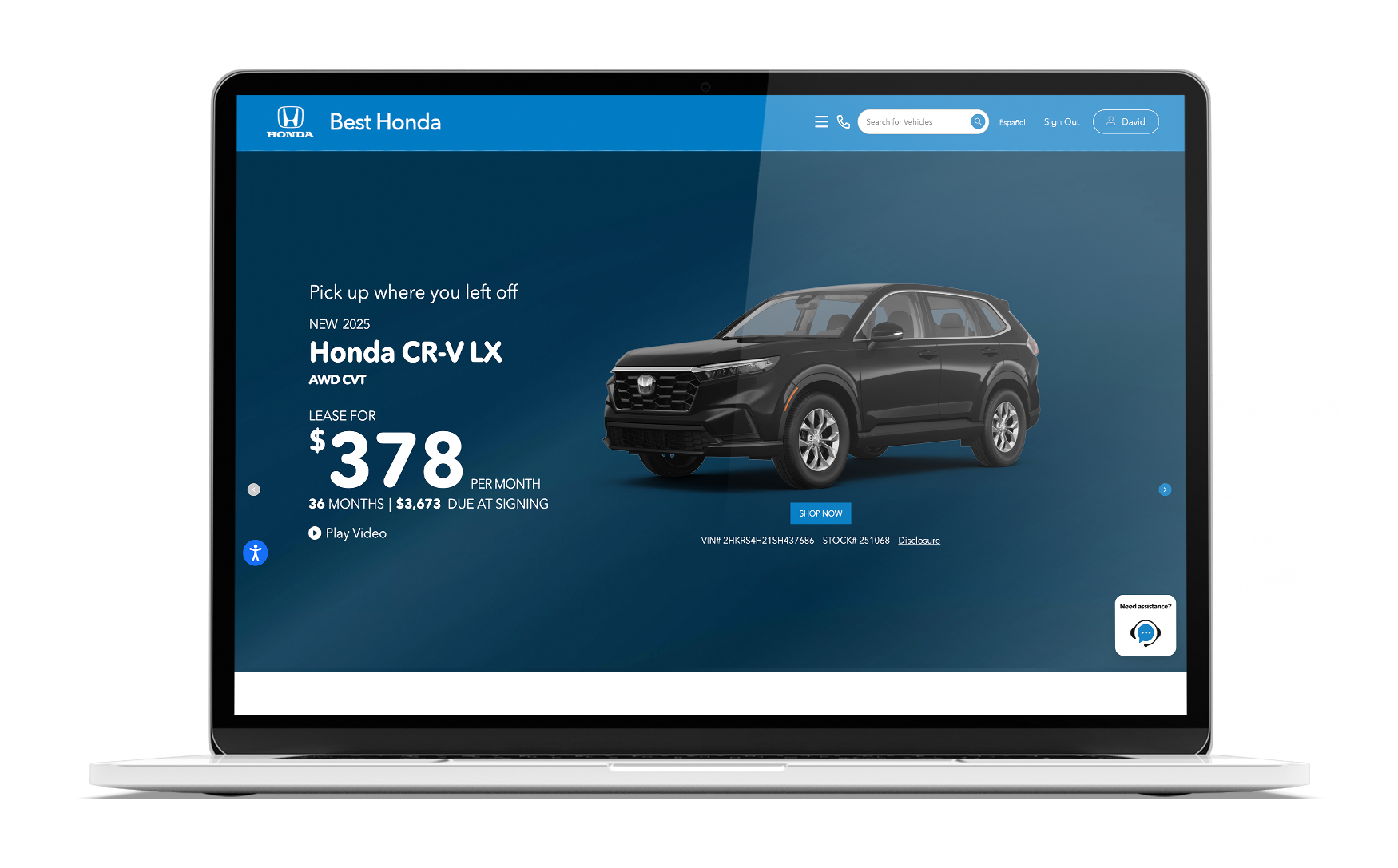

True integration transforms financing from a friction point into a seamless, data-driven exchange. With native connections between platforms, every piece of data — from pre-qualification to payment offers — syncs automatically across DMS, CRM, and digital retailing tools.

- End-to-End Data Flow: No manual entry, no silos, and no lost opportunities.

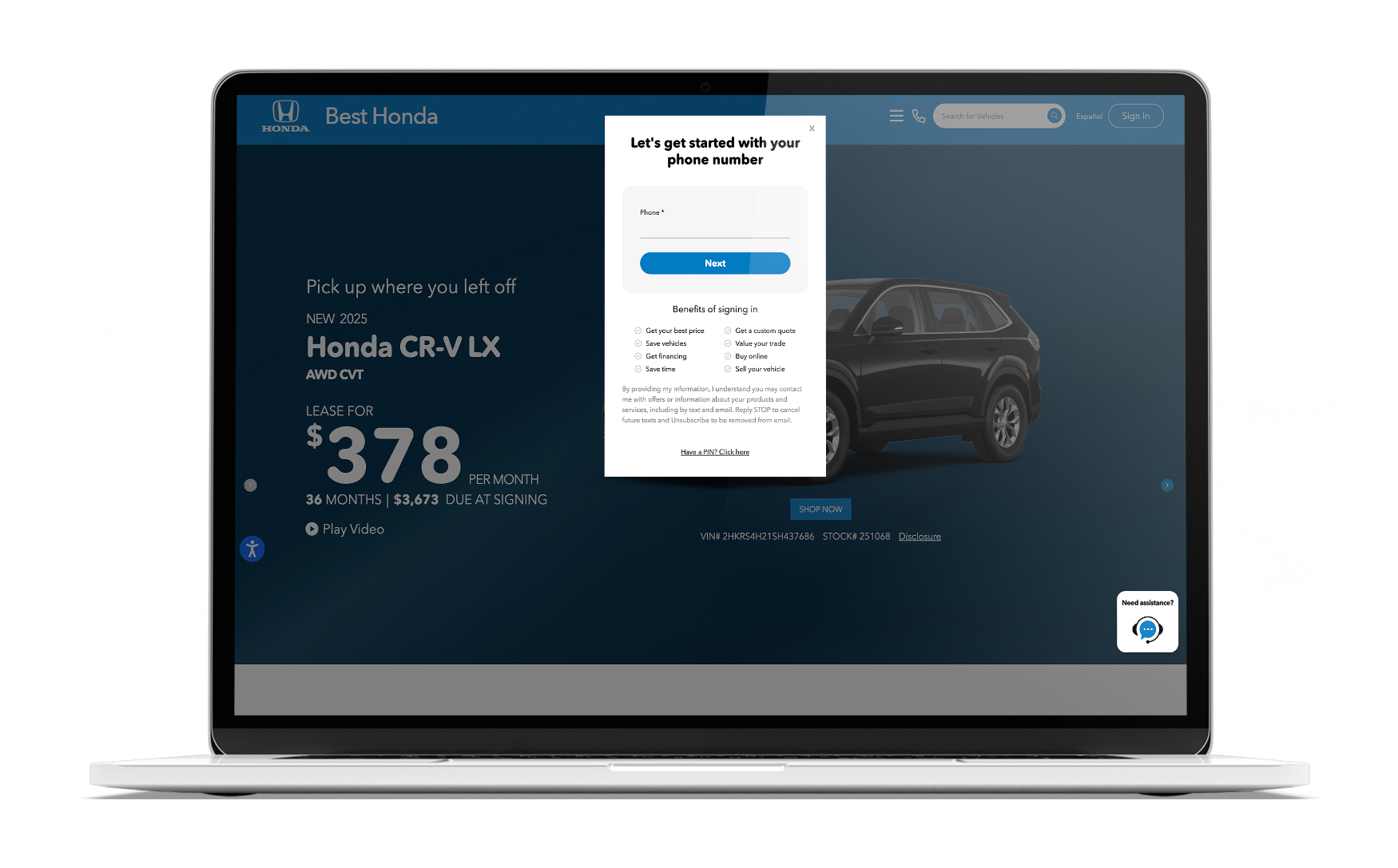

- From Pre-Qualification to Personalization: Soft credit pulls and pre-qualification tools deliver real-time, customized payment offers before a hard lead is submitted.

- Seamless Online-to-In-Store Experience: The same information a customer sees online is exactly what the dealer sees in-store — consistent, transparent, and confidence-building.

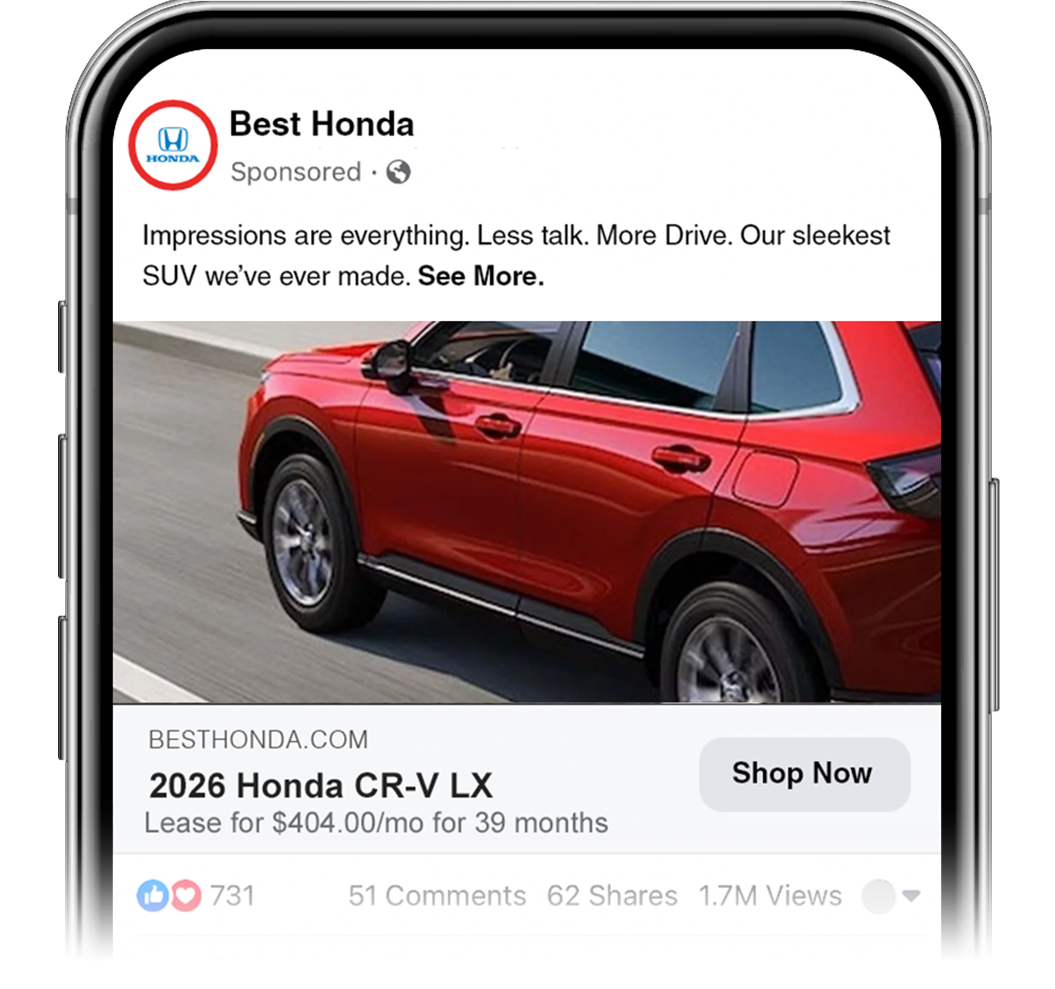

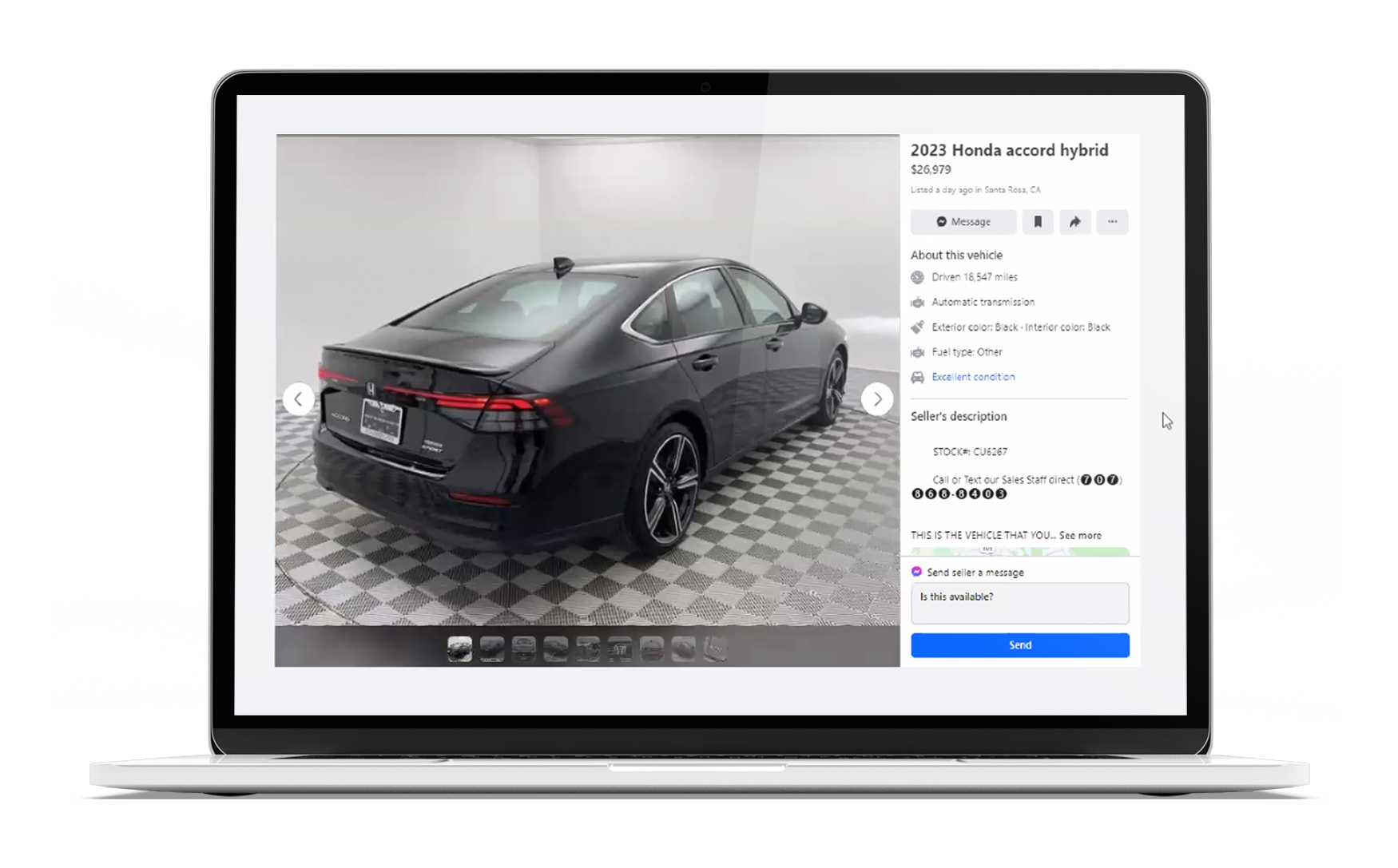

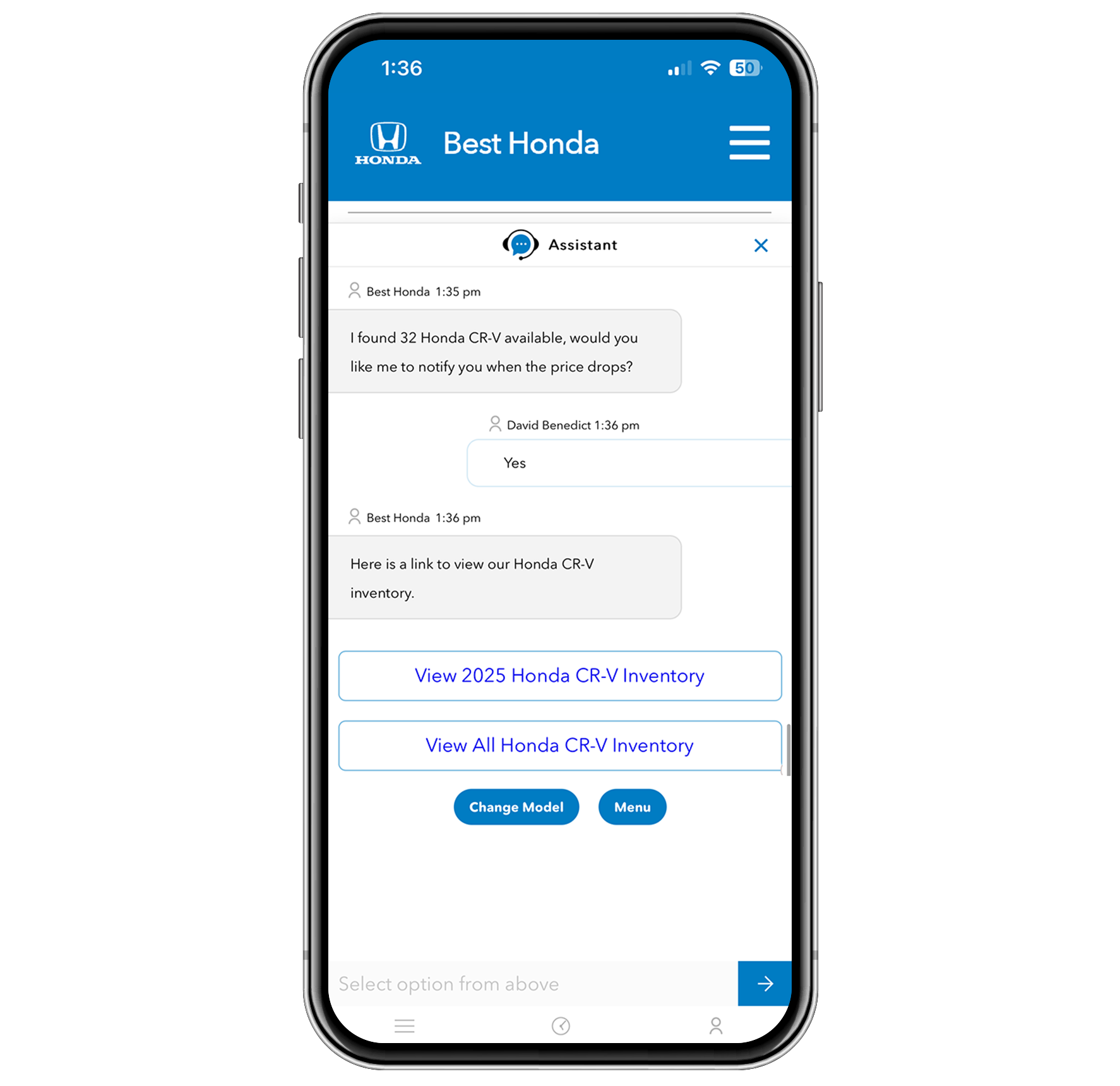

- Automated Follow-Up: Integrated data allows dealers to run intelligent, finance-driven campaigns that reach shoppers at every stage.

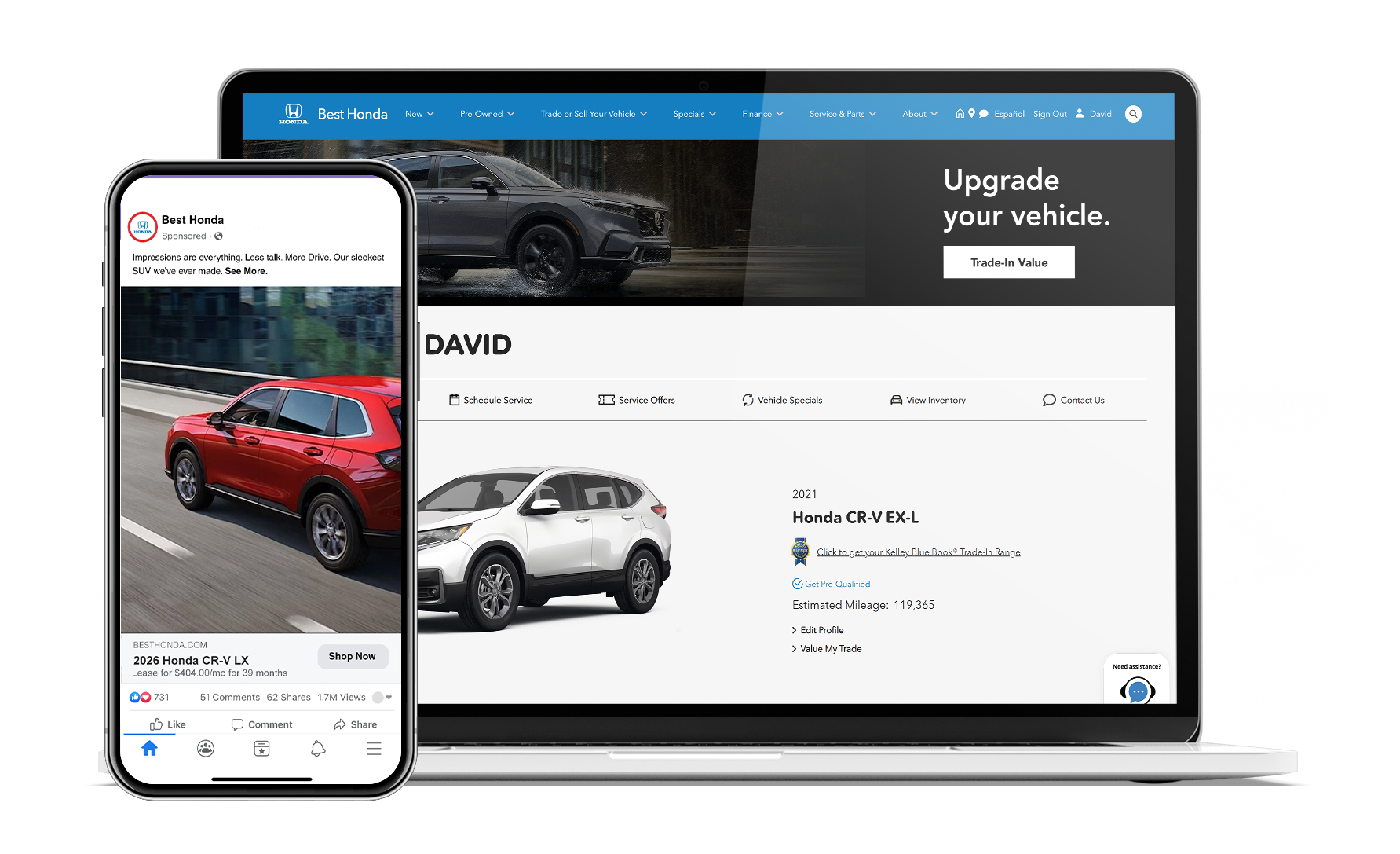

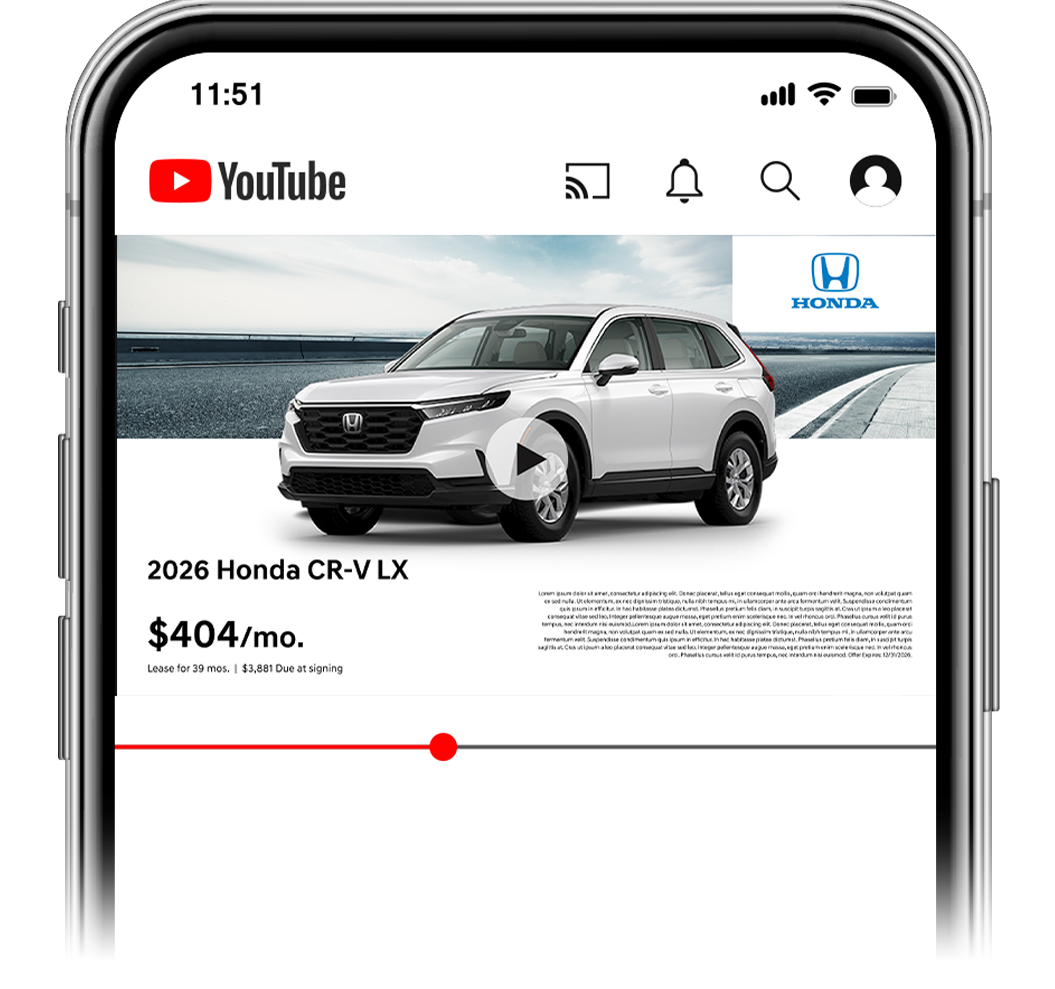

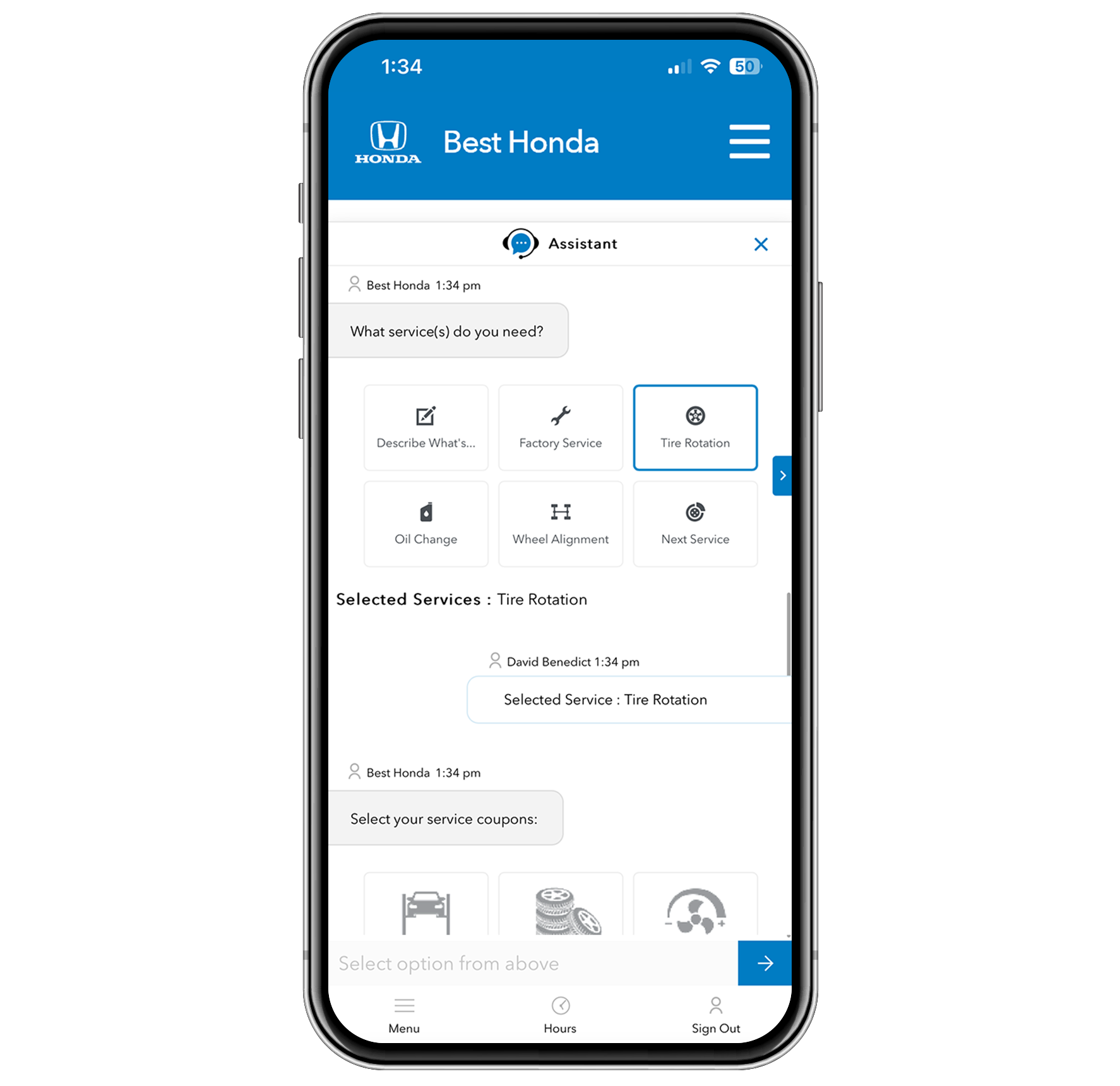

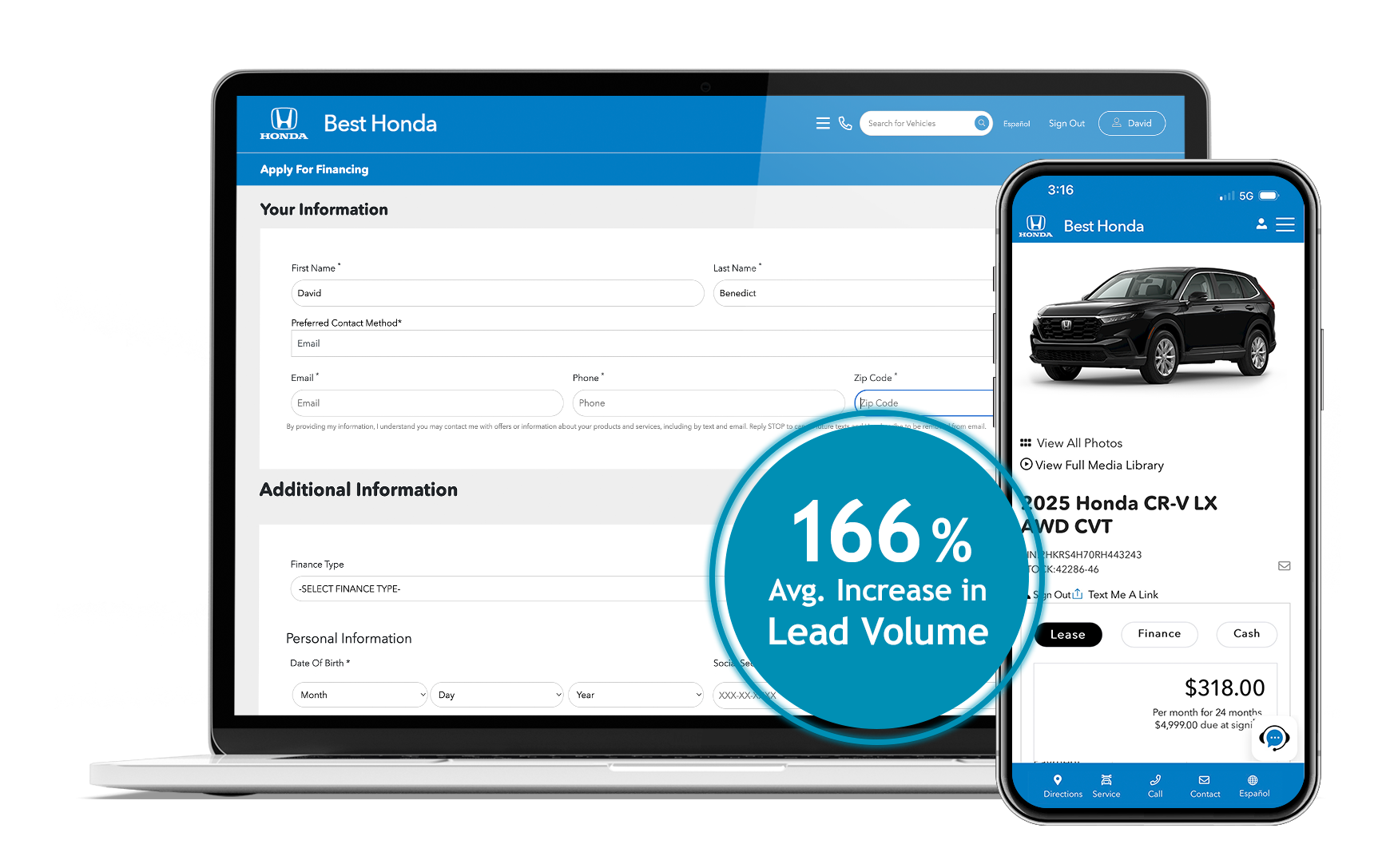

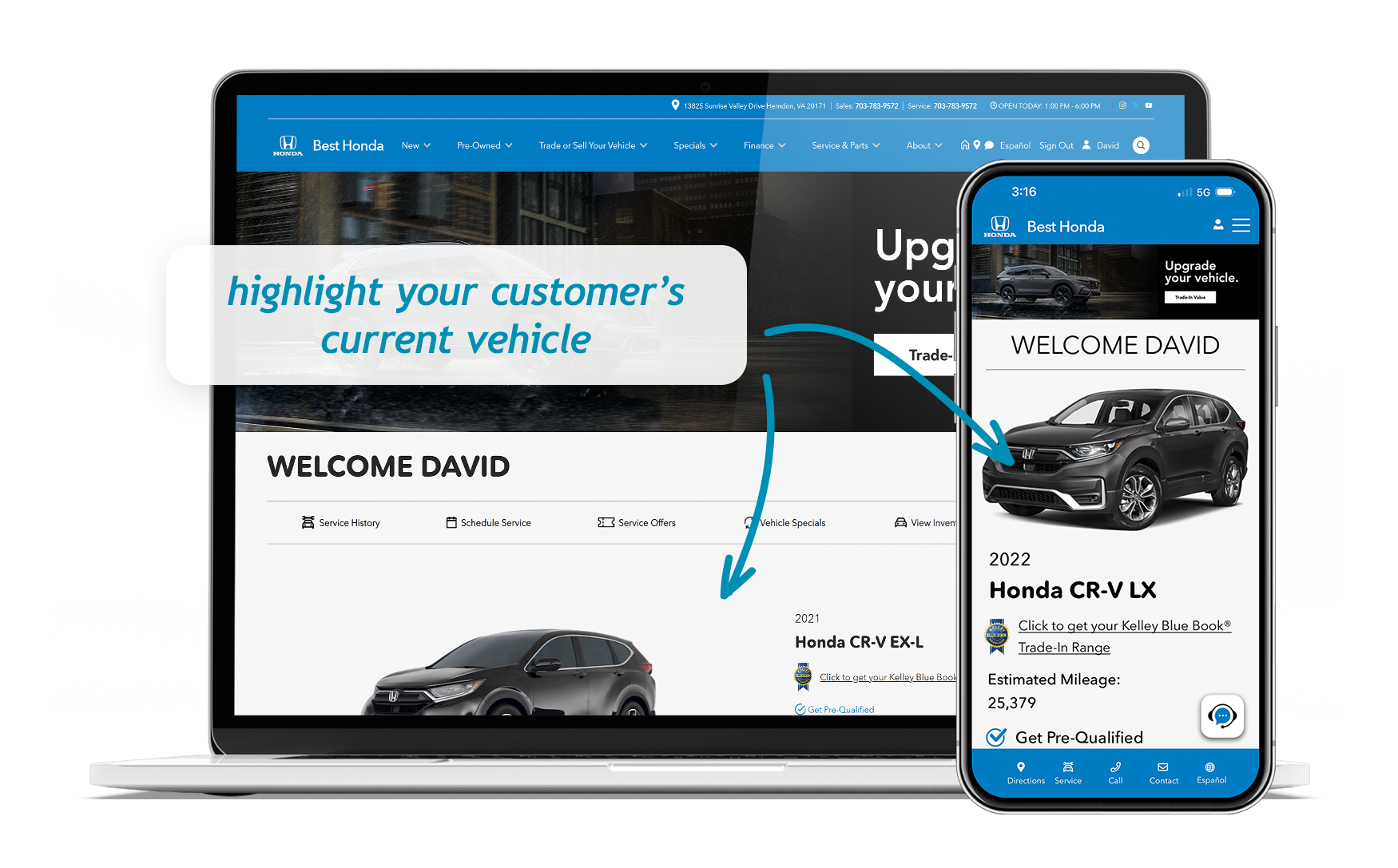

- Mobile Friendly: Whether on desktop, tablet, or smartphone, customers enjoy the same easy, frictionless experience.

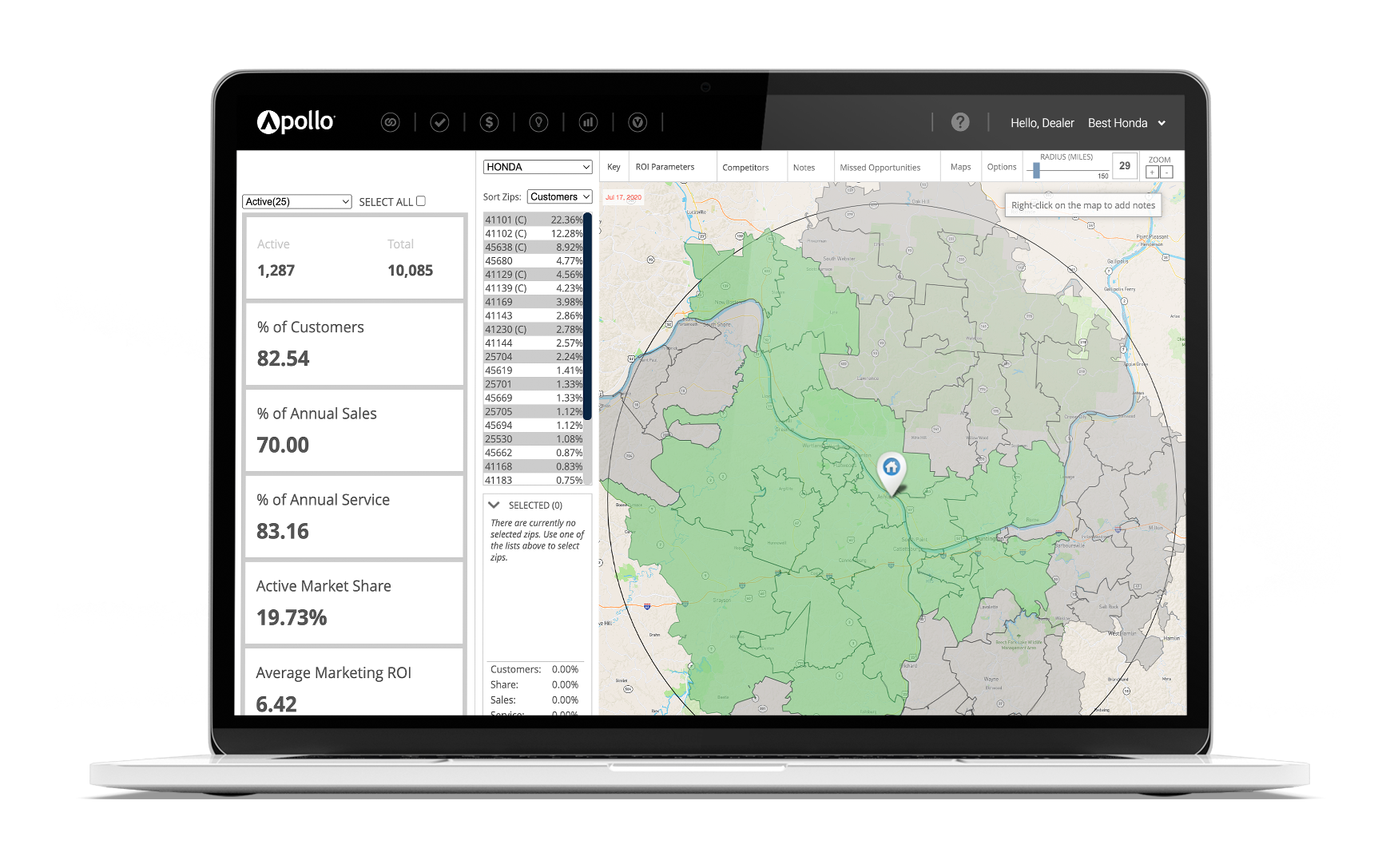

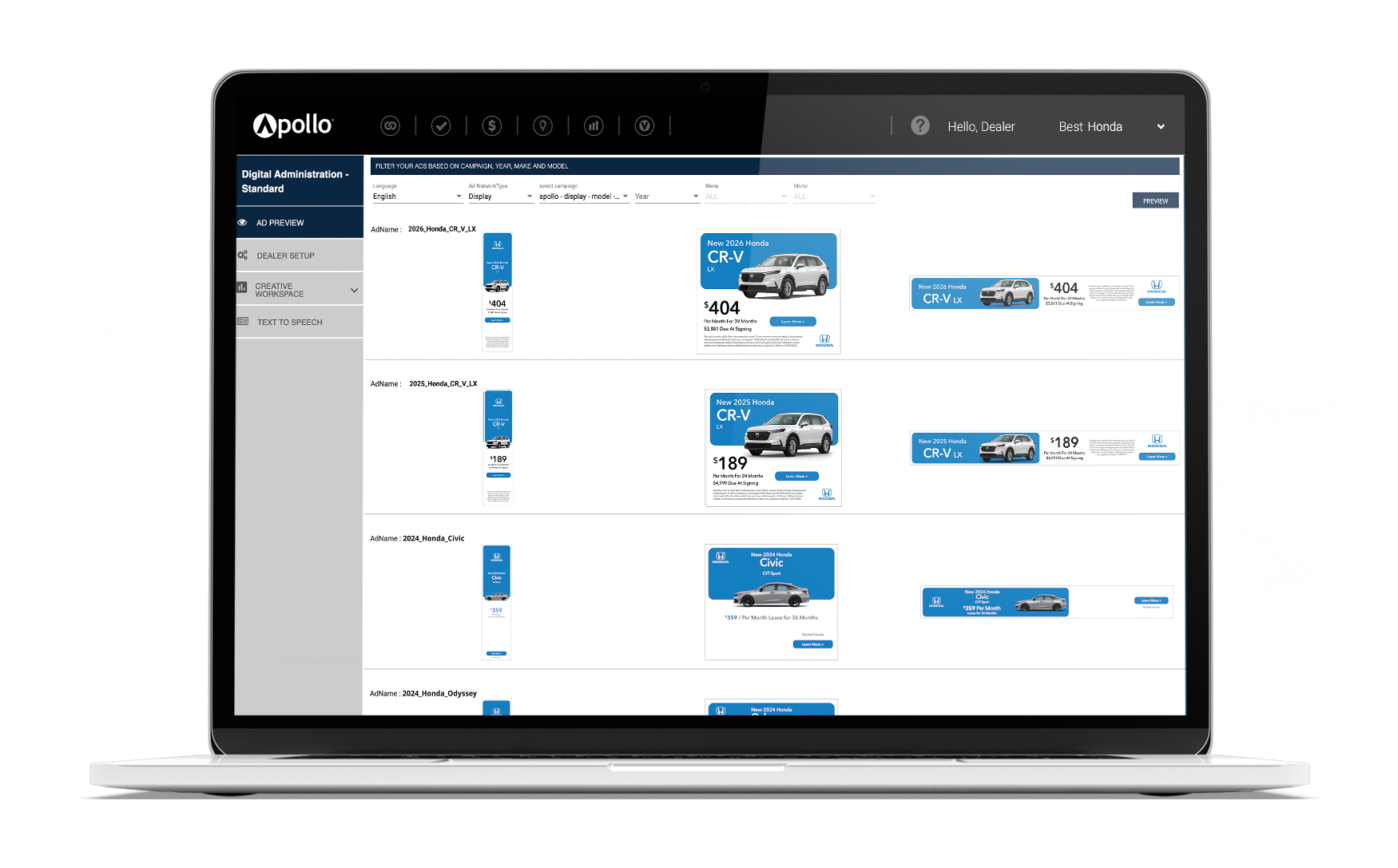

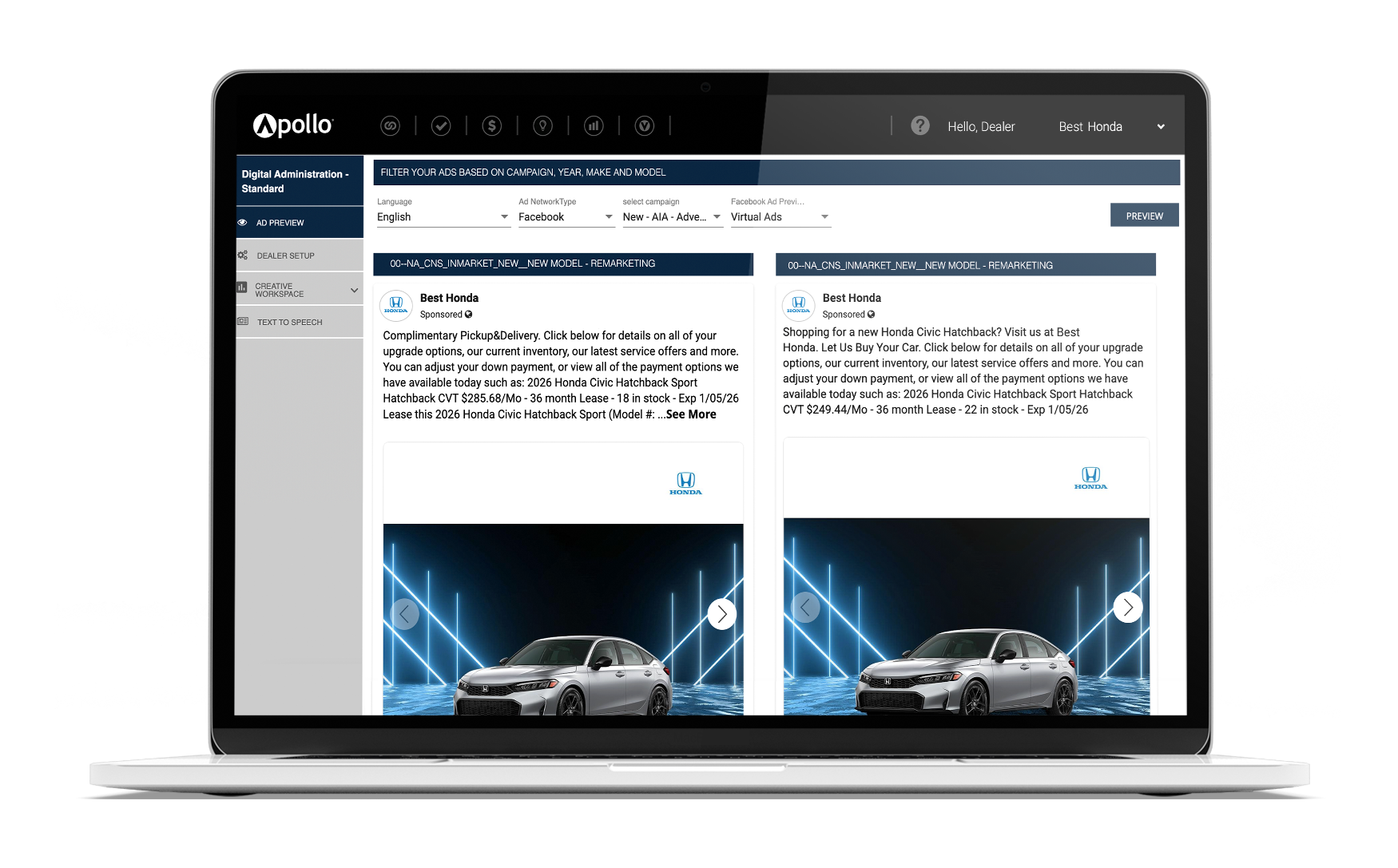

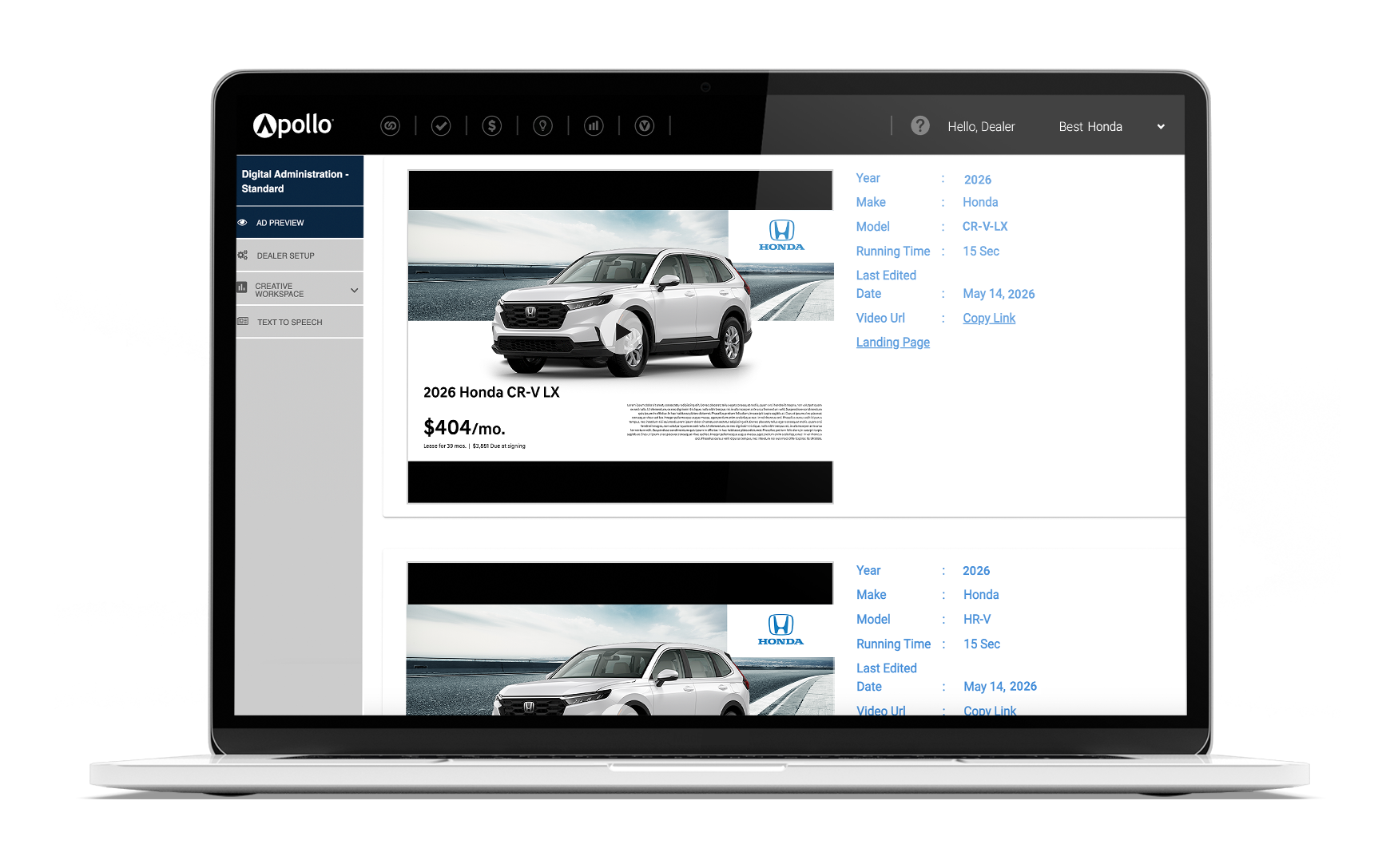

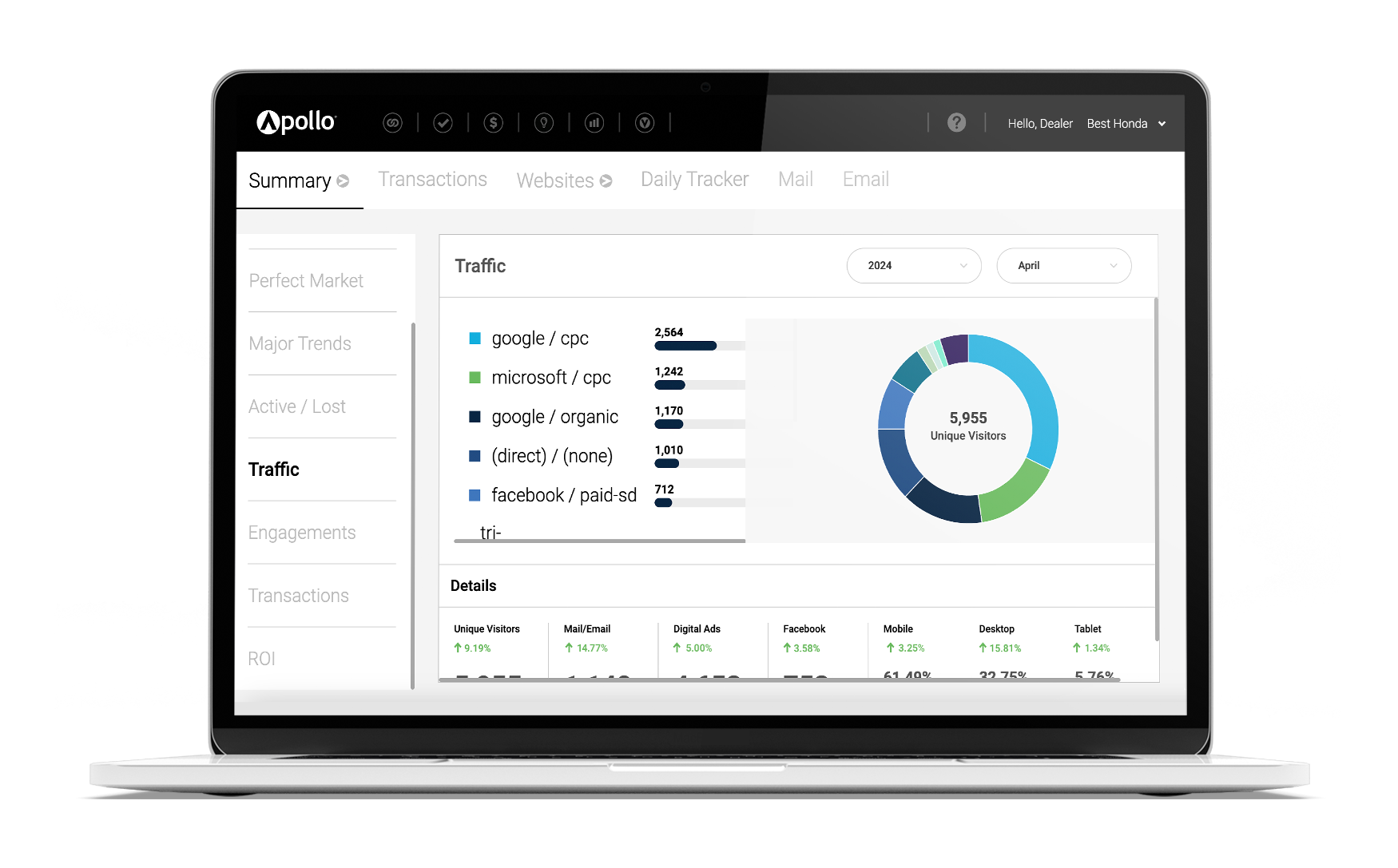

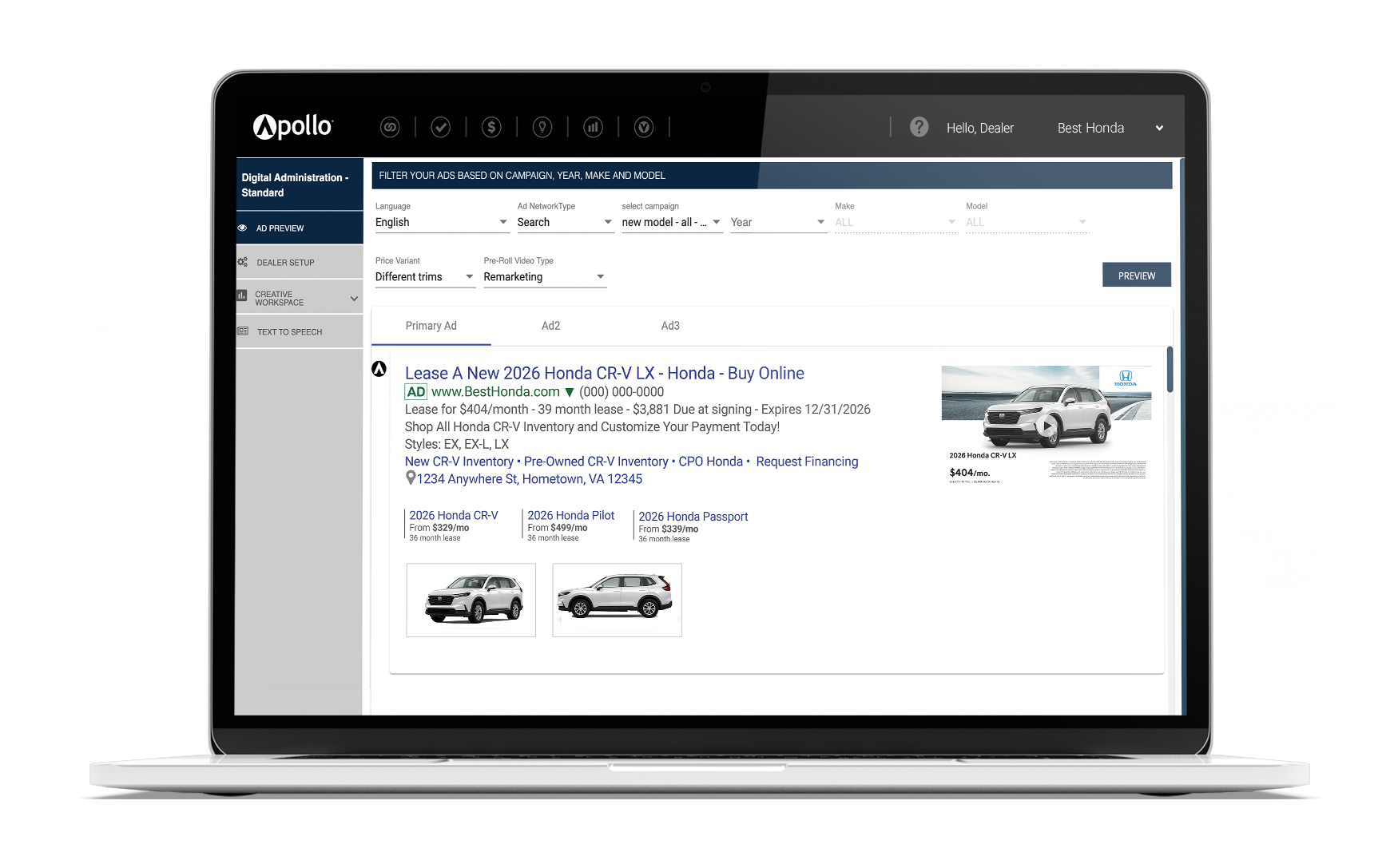

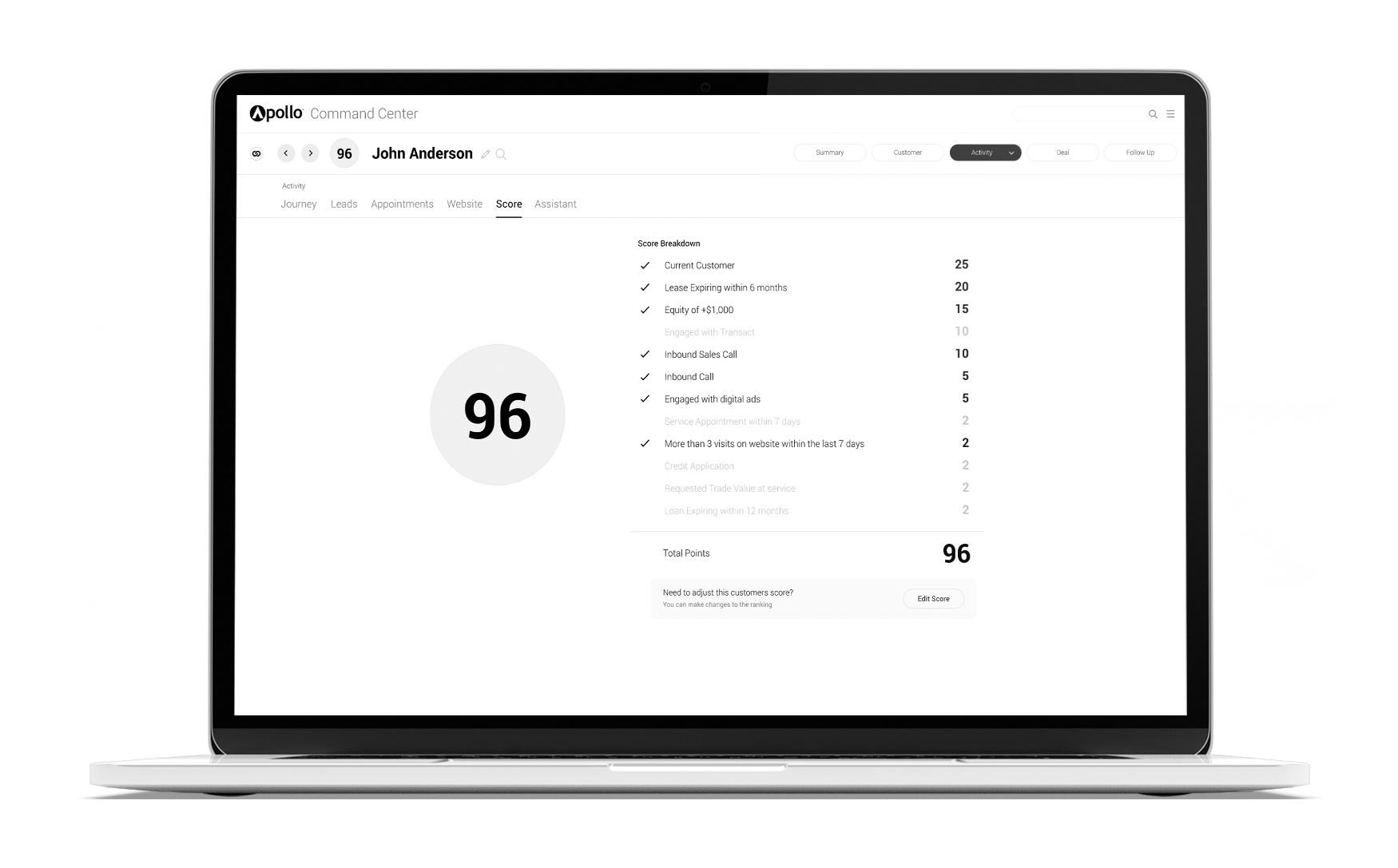

How Apollo Supercharges Your Finance & Credit Tech

Apollo’s ecosystem is designed to unify the full retail experience, and that includes finance and credit.

Credit Pre-Qualification

Built directly into Apollo Sites, pre-qualification tools let customers explore financing early in the journey. Dealers receive deal alerts tied to pre-qual activity, helping them identify shoppers who are most ready to buy.

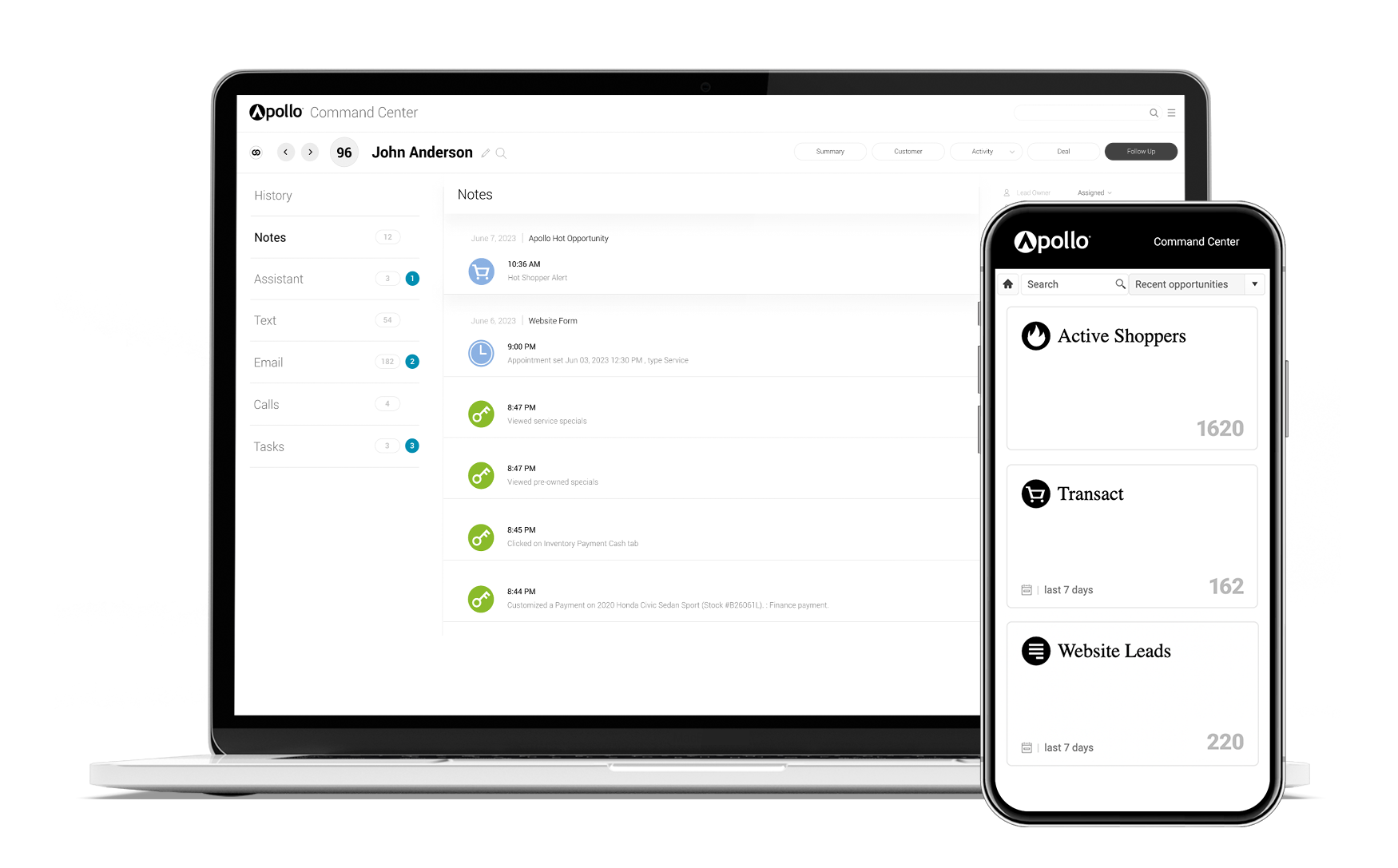

Integration with CRM and DMS

Because Apollo connects directly with CRM and DMS systems, personalized finance offers automatically carry through every customer touchpoint — from digital ads to in-store discussions.

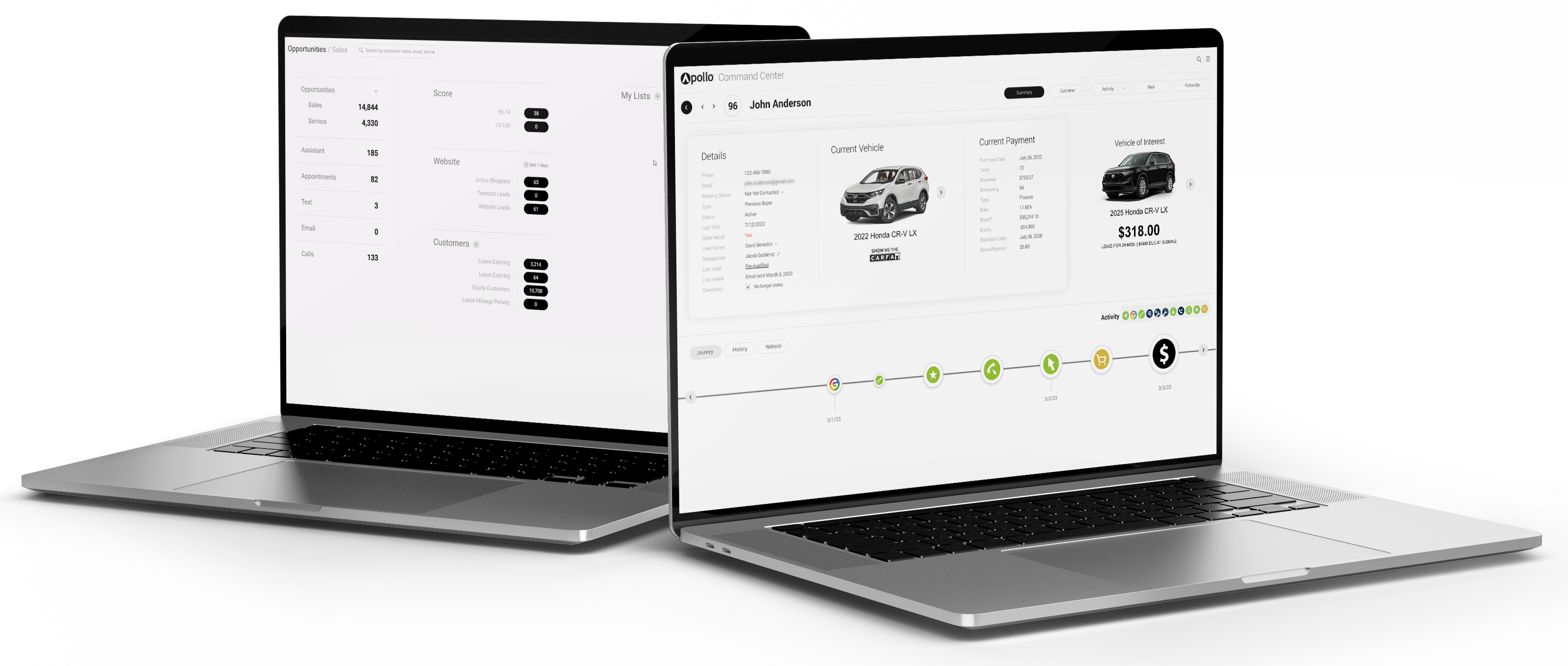

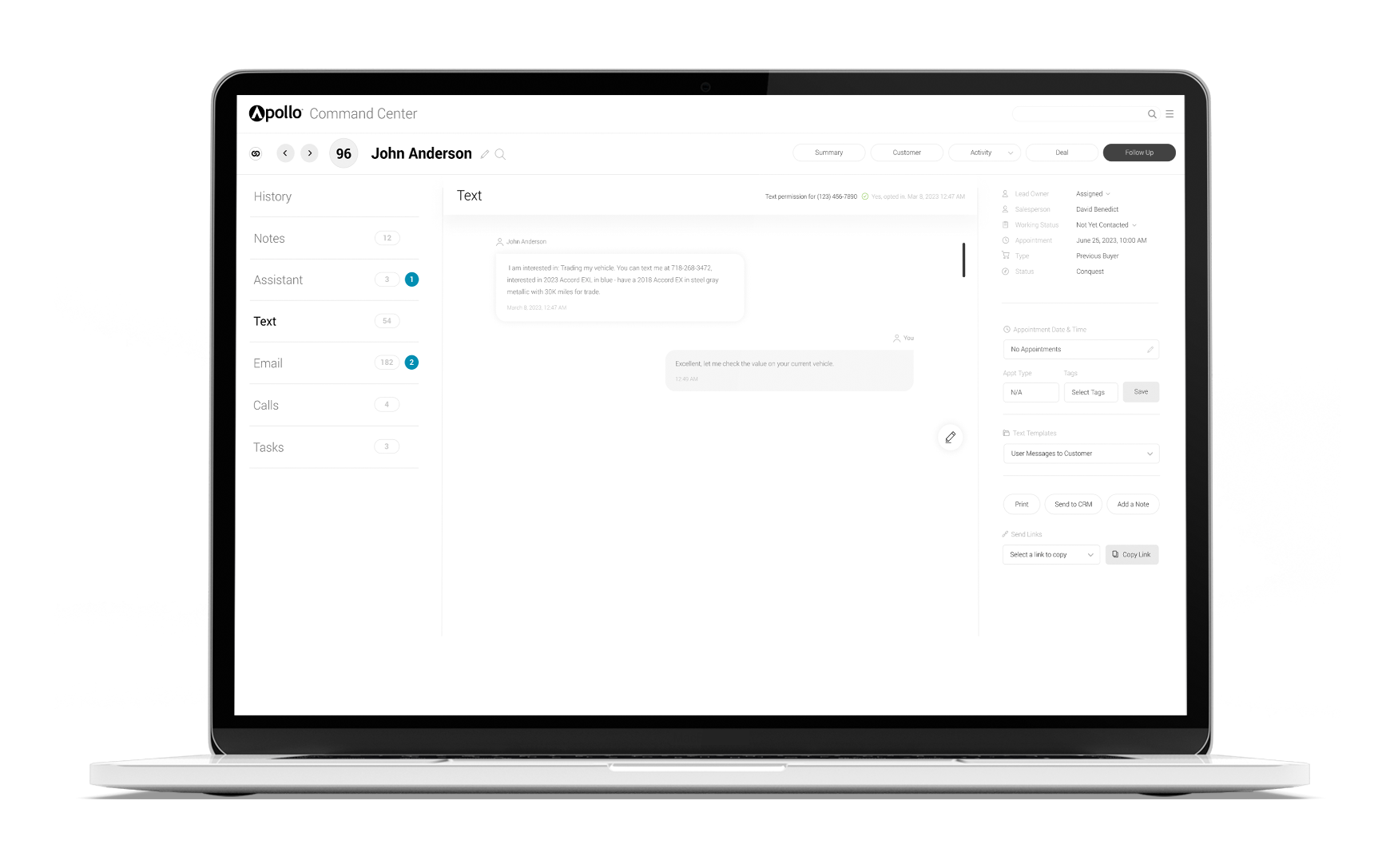

Command Center Connection

Command Center bridges the online-to-in-store gap, ensuring consistent pricing and financing details no matter where the customer interacts.

Real-World Impact

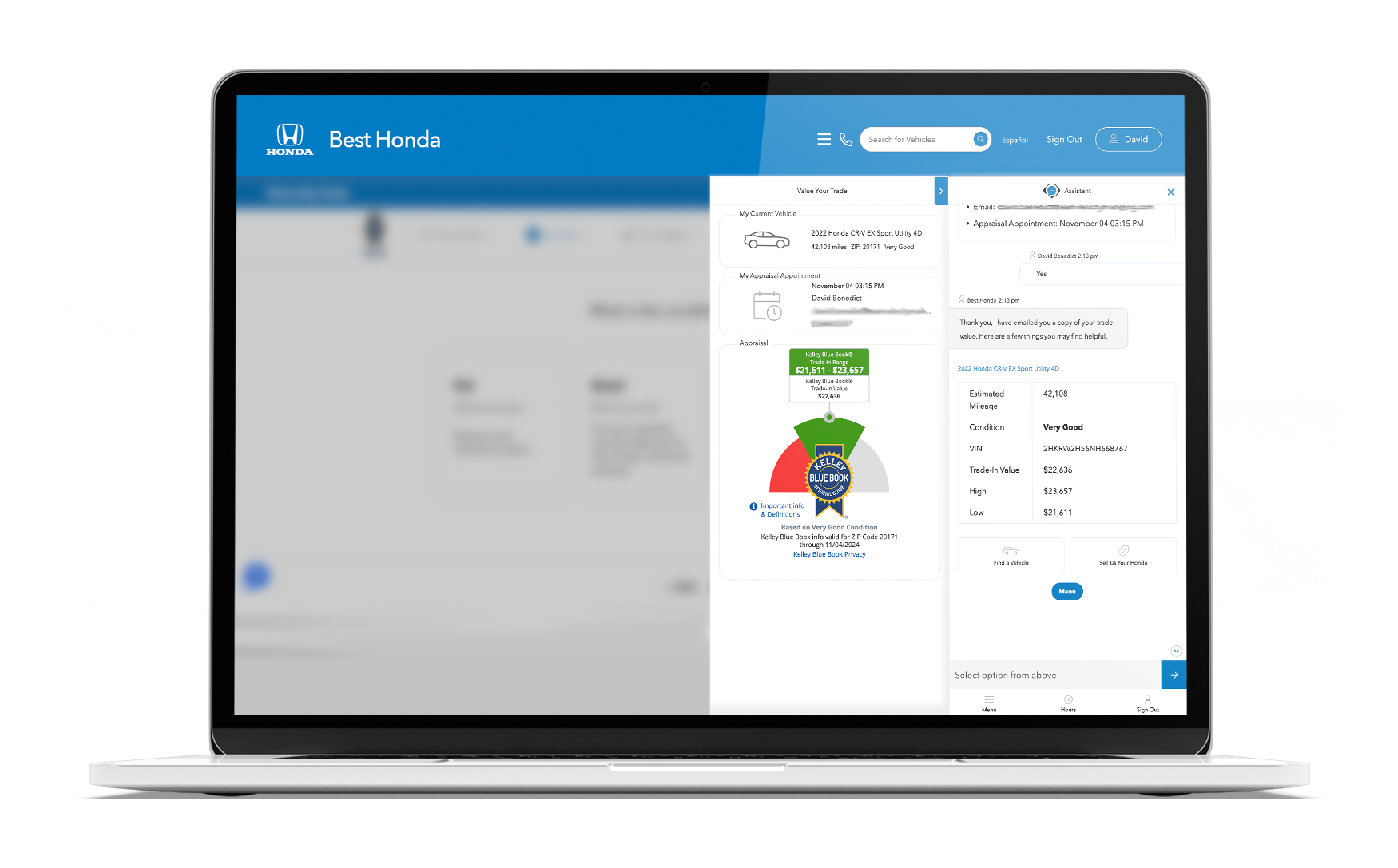

Imagine a customer completing a soft credit pull online through Apollo. Their data syncs instantly to the dealership’s CRM, updating both their lead profile and in-store experience. When they arrive, the salesperson already knows the customer’s approved range and preferred payment structure — cutting out the back-and-forth and allowing the deal to close faster and with greater confidence.

Finance & Credit Partners

- Dealertrack: Connects directly to Apollo, pulling customer info into lender tools to shorten funding times, reduce errors, and increase buyer confidence.

- RouteOne: Receives structured deal data from Apollo for real-time approvals — no waiting, no uncertainty.

- Equifax: Built-in soft pulls display true buying power instantly, helping both customers and dealers move forward faster.

- eLEND Solutions: Integrates credit-driven payment data, improving confidence and reducing renegotiations.

- Credit Bureau Connection (CBC): Embedded pre-qual tools turn browsers into credit-qualified leads within seconds.

- OfferLogix: Powers real-time, VIN-specific payments across Apollo’s ecosystem — keeping every offer accurate, compliant, and automatically updated.

Bringing Confidence and Clarity to Every Deal

Finance and credit are no longer back-office functions — they’re essential parts of the customer experience. True integration eliminates silos, accelerates funding, enhances personalization, and builds trust through transparency.

With Apollo and its network of partners, dealers can finally offer a financing process that’s as seamless, data-driven, and customer-focused as the rest of the modern retail experience.

Interested in learning more? Connect with us today.