AutoSuccess Cover Story: Brian Benstock (Paragon Direct)

The future can be a frightening place, especially for those not able — or willing — to adapt to changing realities and market conditions. While the auto sales industry has enjoyed several years of growth, change is on the horizon. Those dealerships locked into past models and old methods of thinking might not find that future to be a hospitable — or survivable — space.

Brian Benstock, vice president and general manager of Paragon Honda and Paragon Acura of New York City, has spent time and effort trying to determine what that future has to offer, and one word sums up his findings: disruption.

The ways of the past

“The current dealer model is not a dying breed,” Benstock said. “It’s dead. It’s absolutely dead.”

The reason for his startling prediction is due in part to changing customer expectations of not only automotive shopping but the very act of shopping itself. Benstock believes that the convenience, growing acceptance, and ultimate expectation of online transactions — along with the transparency those transactions demand — run counter to the classic dealership model.

“The most successful businesses are the ones that best meet the needs of the customer,” Benstock said. “For years, the dealers have relied on antiquated business models — the franchised dealer agreements — to protect themselves. The second the customers are given an opportunity to go away from the standard business model of automobile dealers, they will. More and more, we’re seeing that they’re being given many different options by some of the largest retailers in the world.”

Several of the companies responsible for this disruption of the automotive industry are not even in automotive sales. “We’ve got companies like Amazon and Apple that are approaching a trillion dollars in valuation,” Benstock said. “They have incredible resources to take over and change any industry that they so choose.”

Current realities and potential opportunities

The reality of Benstock’s Paragon dealerships is one of the reasons he’s made it a point to anticipate future market conditions. Located in Queens, just outside of Manhattan, the Paragon dealerships are the No. 1 new and used car dealerships in the country. Because of their location, however, the dealerships have always had to think differently about the way they do business. “Real estate is at a premium,” he said. “Compared to some other dealers in other markets that have acres of land, we have a patchwork of properties. Customer parking and customer display can be one of the challenges, but that also leads to some great opportunities.”

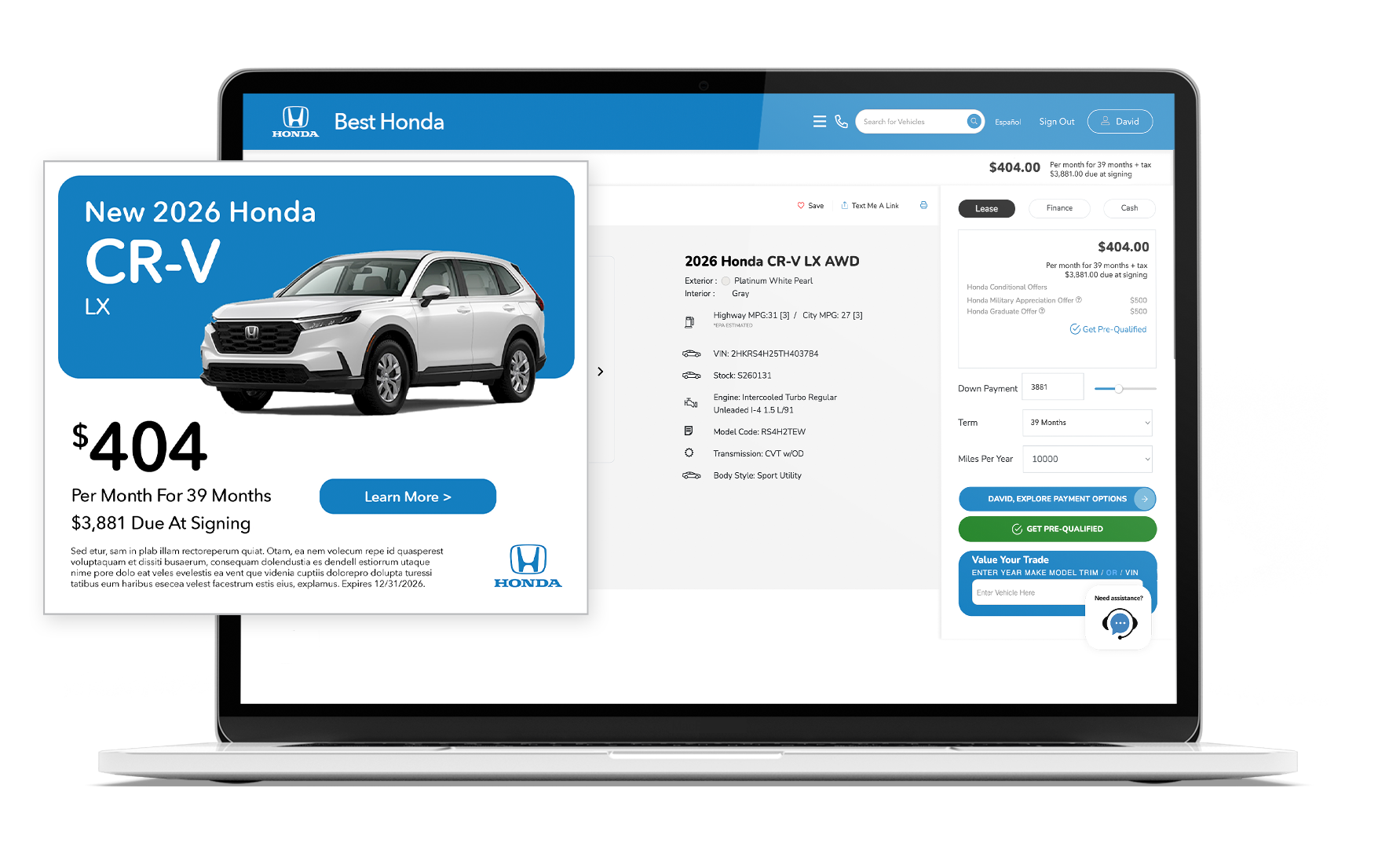

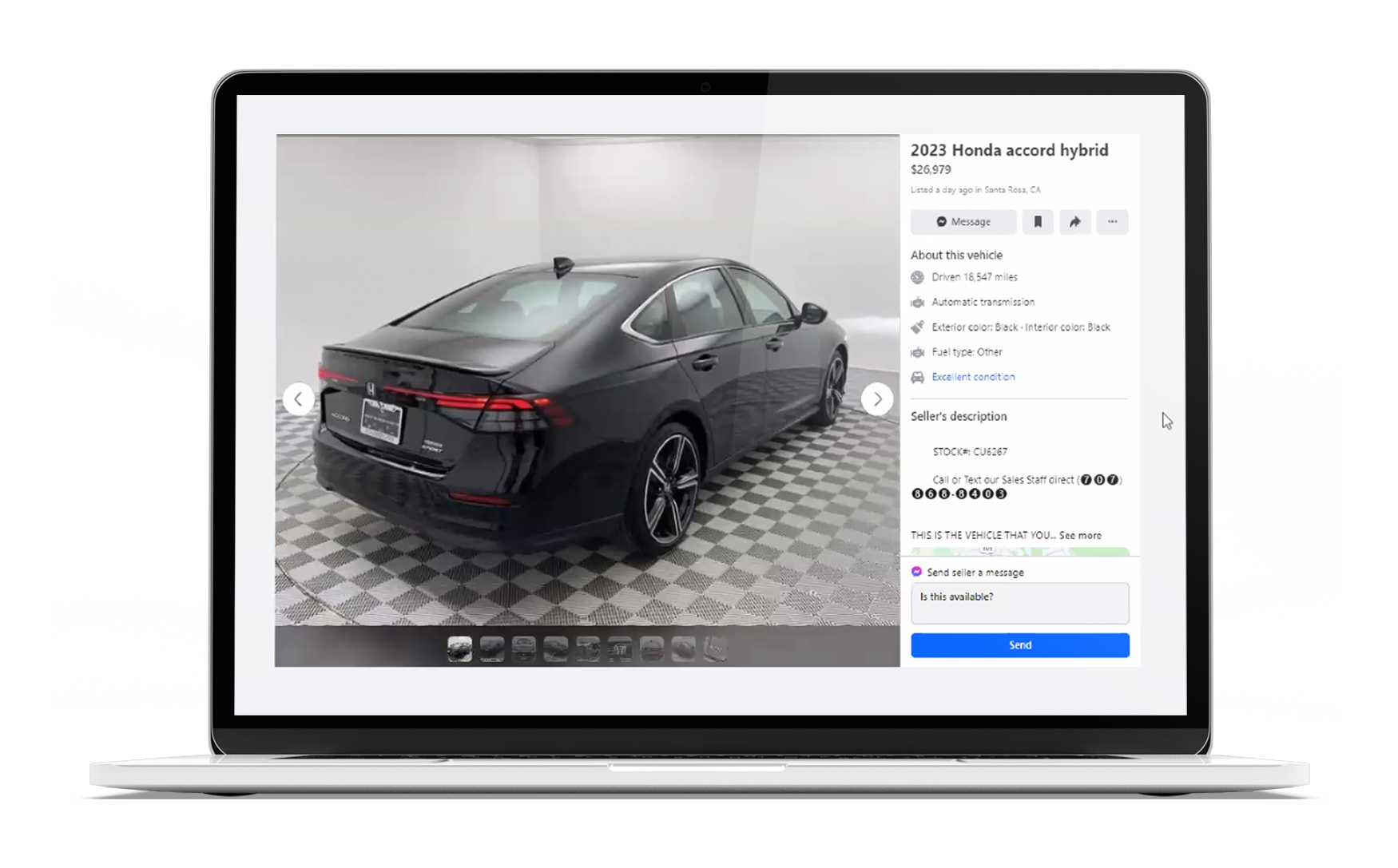

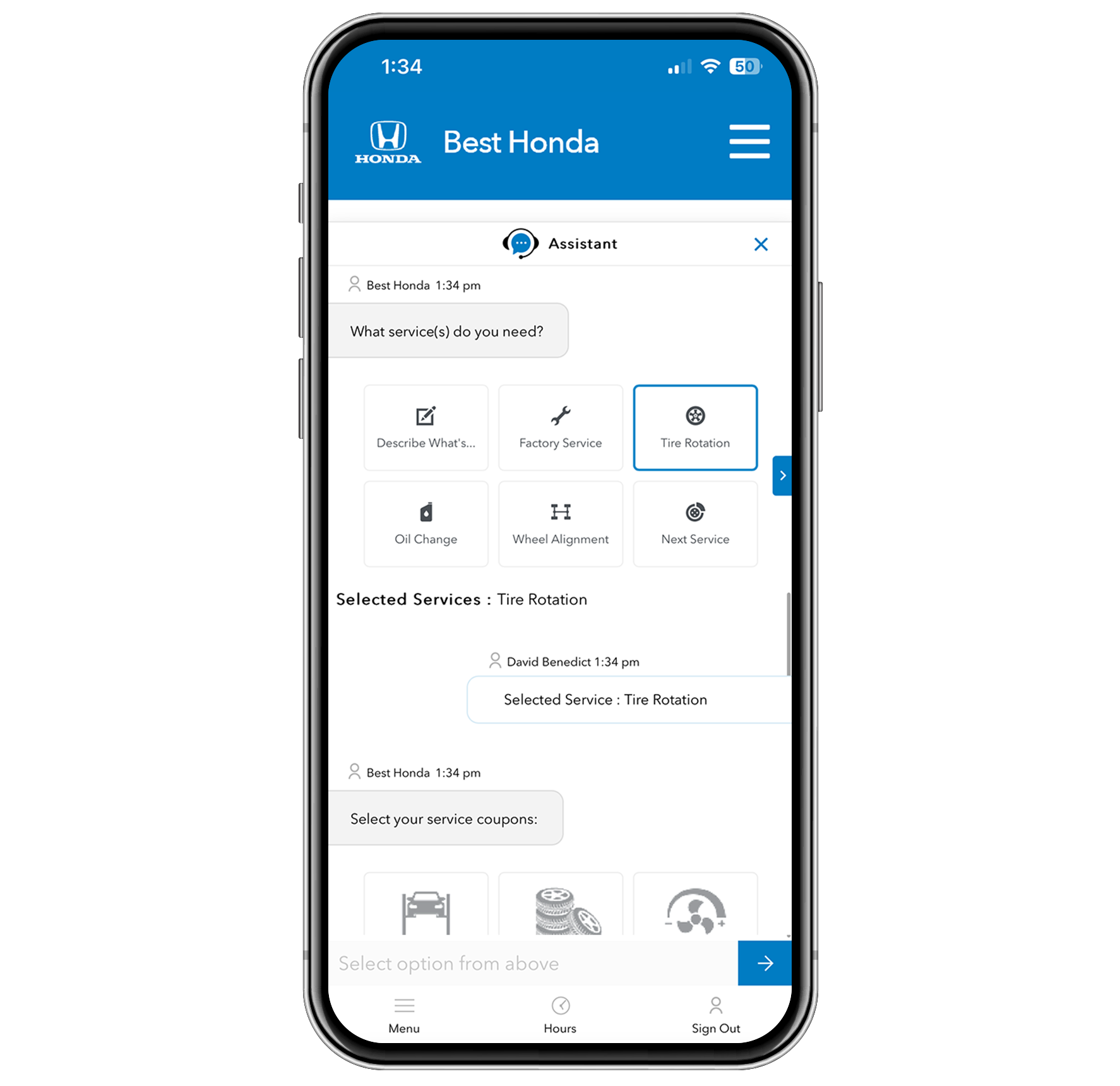

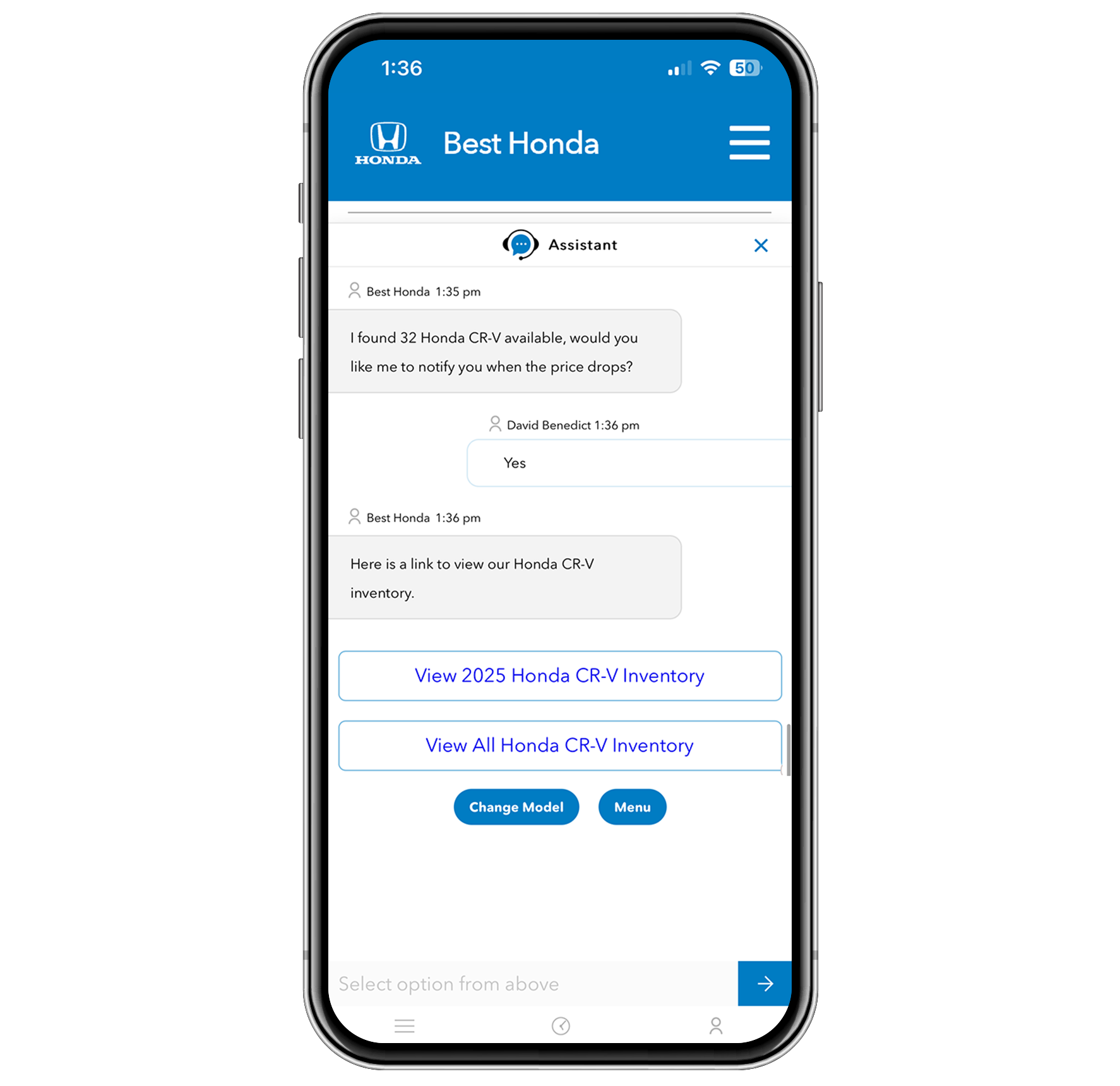

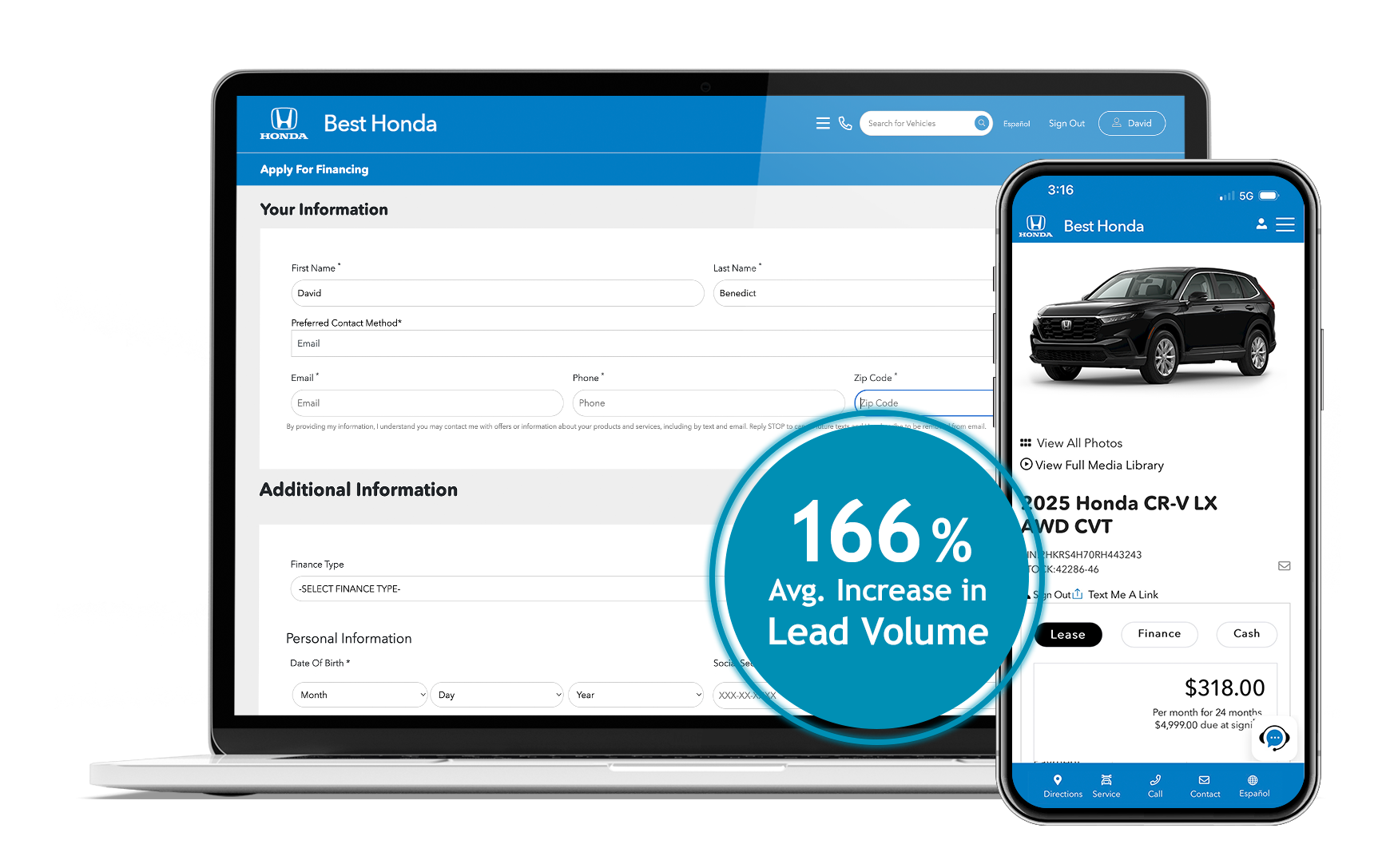

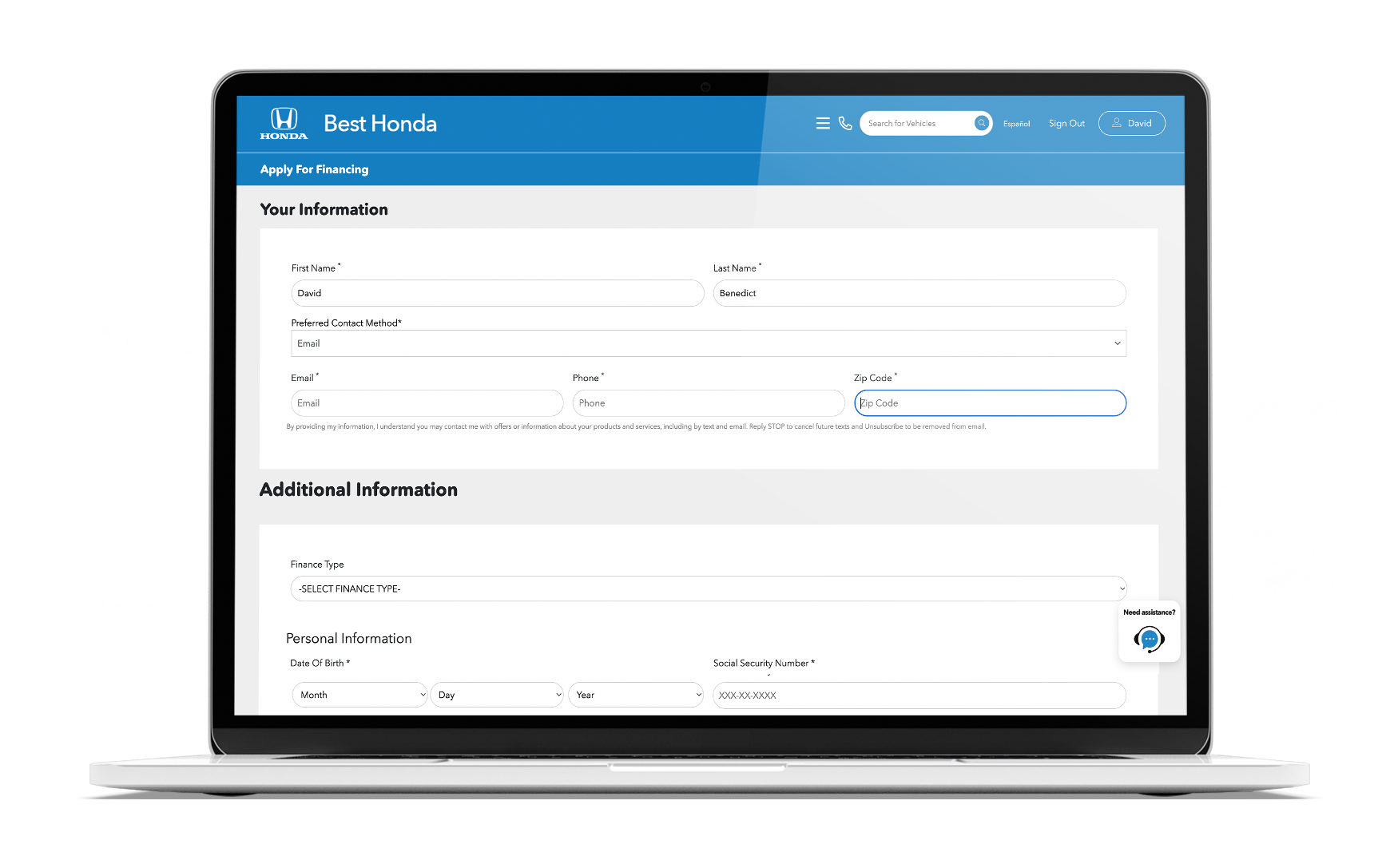

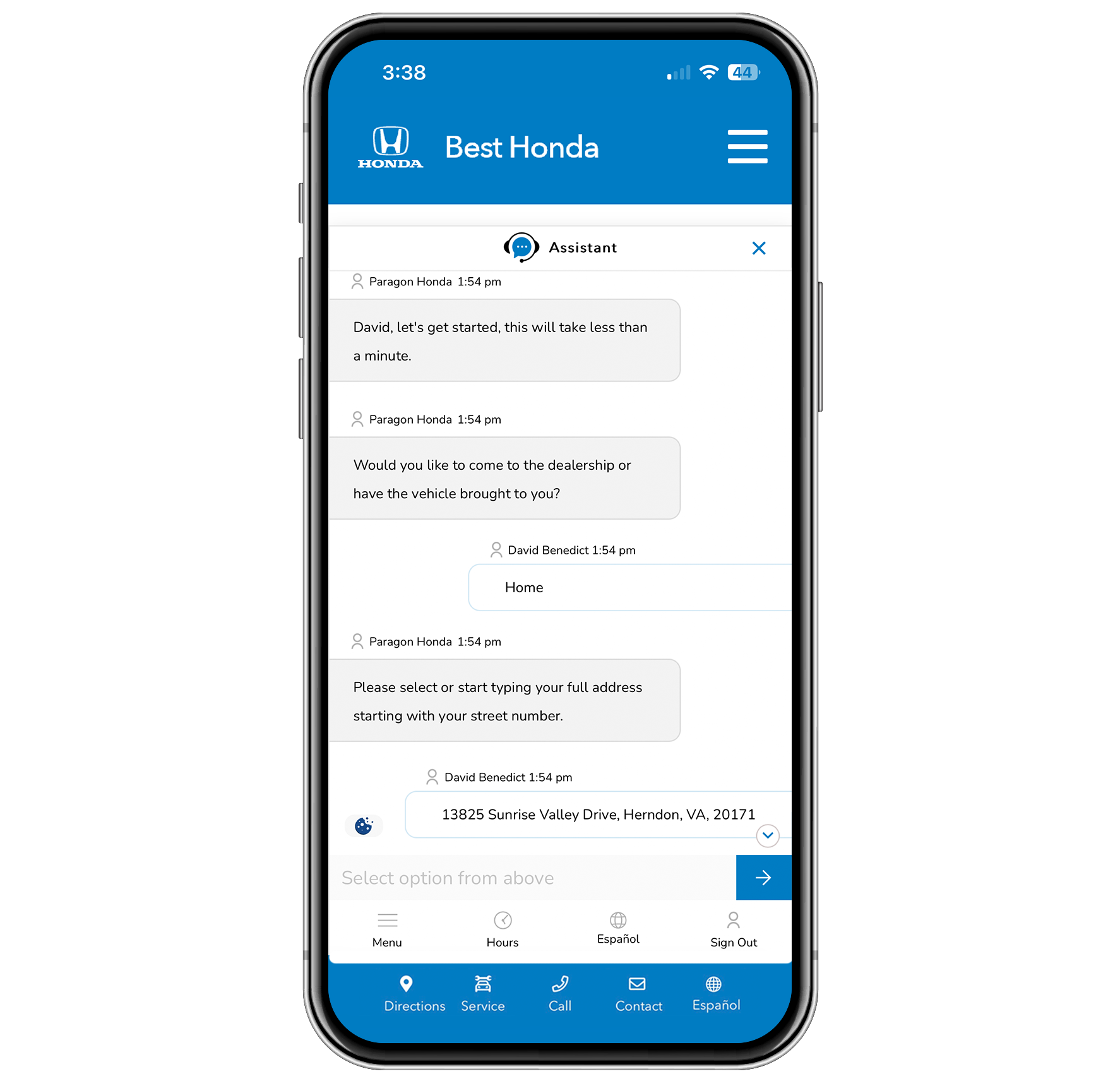

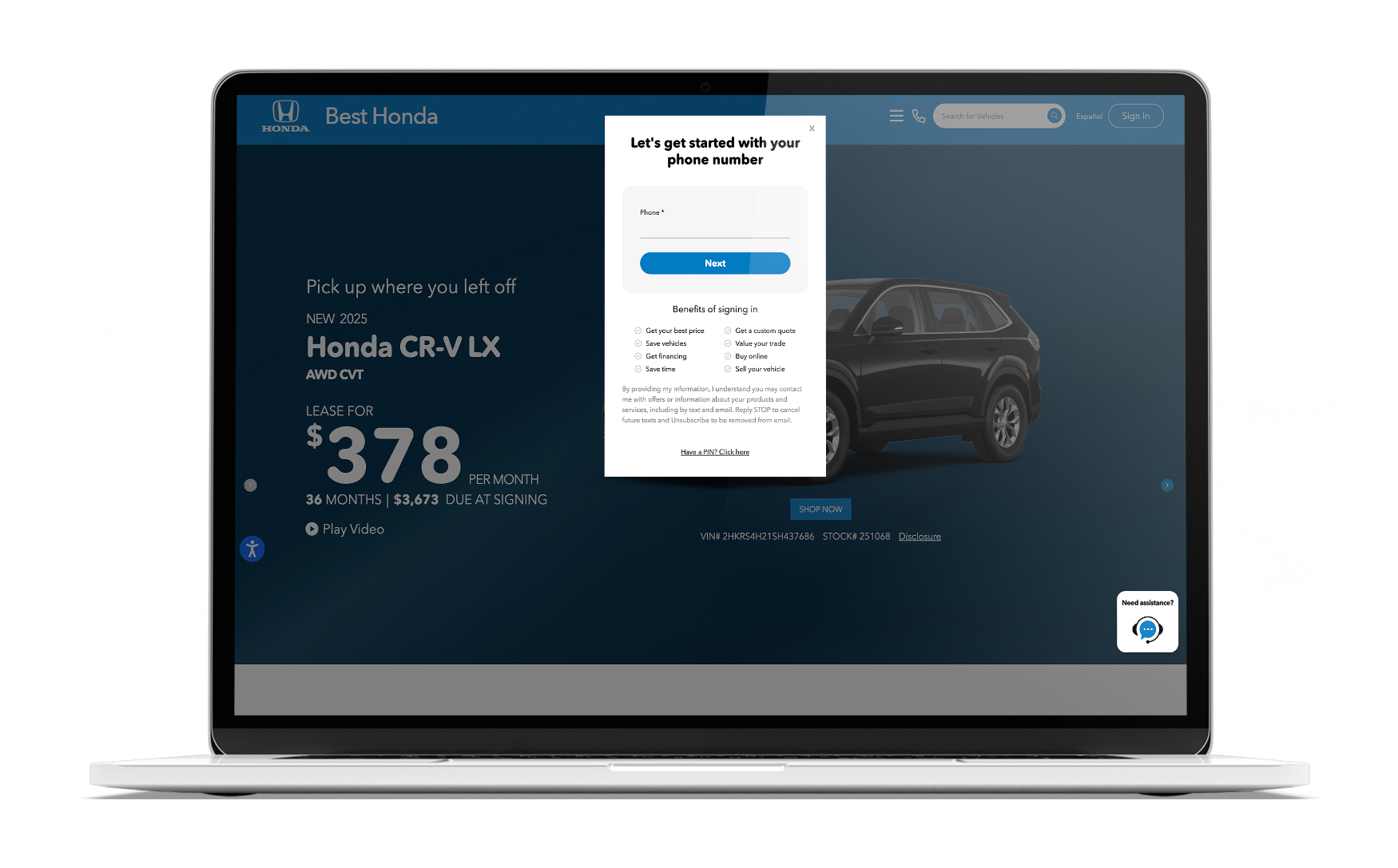

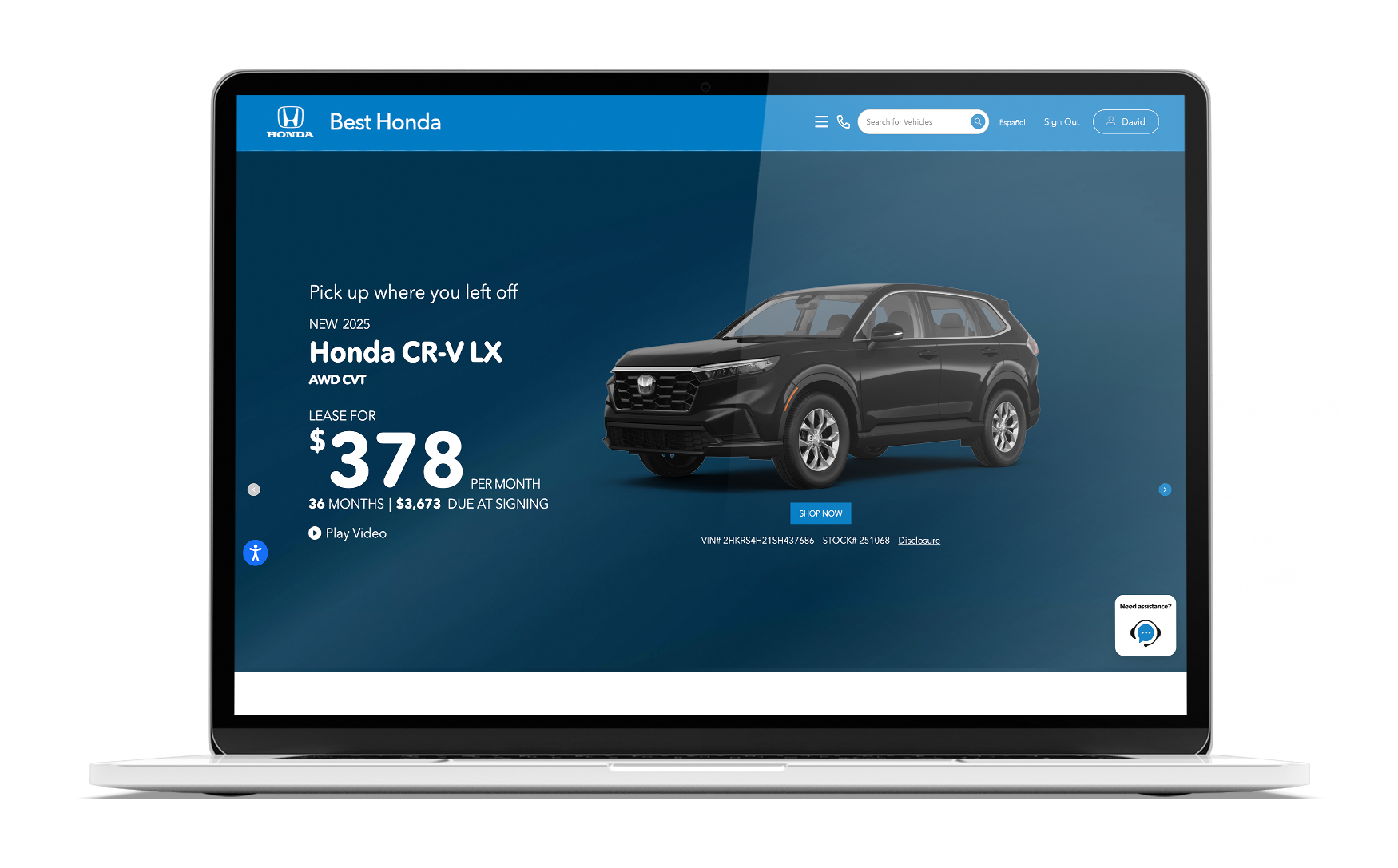

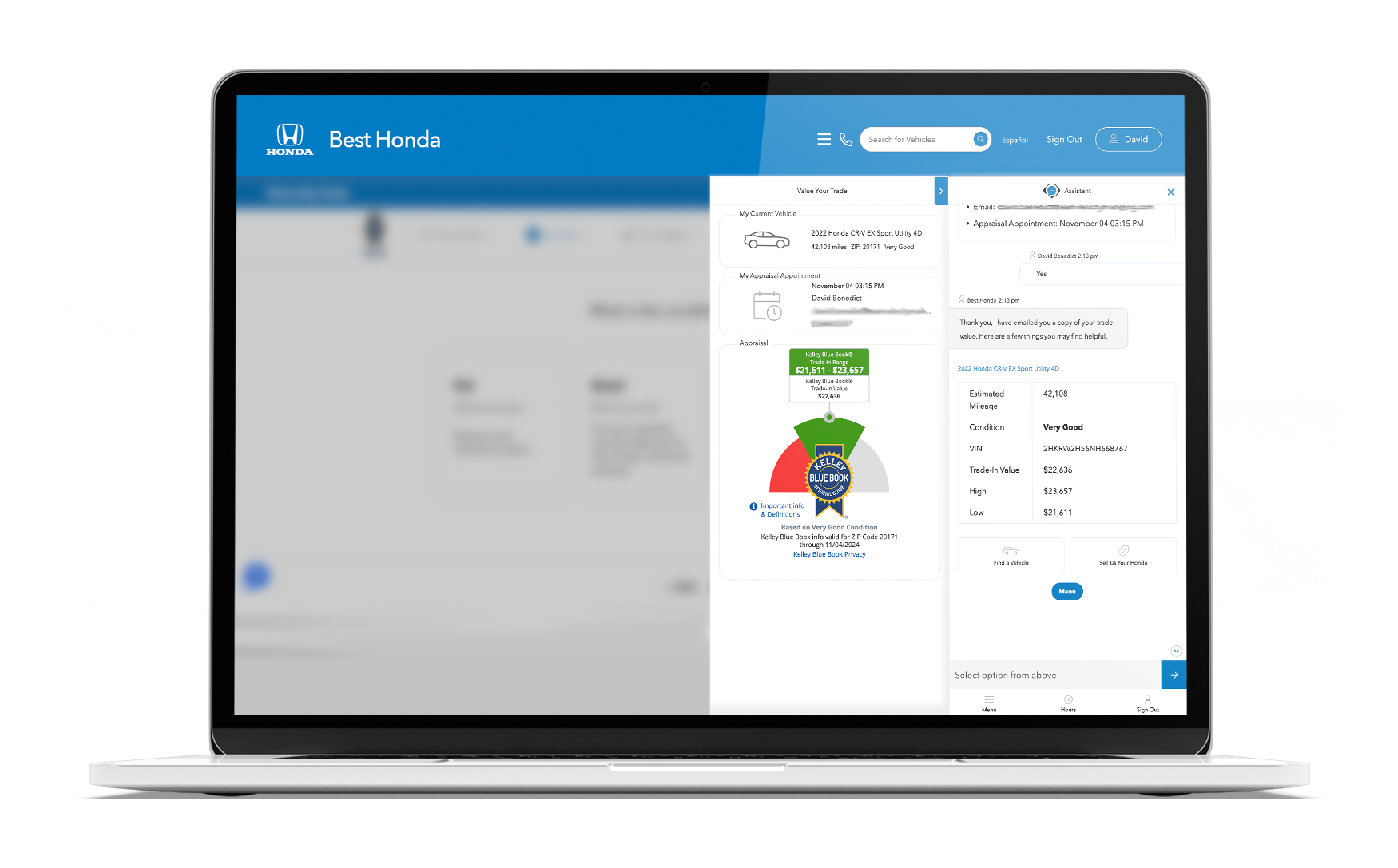

One of those opportunities is the ability to continually re-think how they do business. “Does it make sense anymore to bring the customers to the dealership?” Benstock asked. One of the answers to that question was the creation of Paragon Direct, a new online platform where customers can do everything from arrange a test drive to purchase a vehicle. Benstock refers to this method of doing business as a “frictionless consumer experience,” which is something consumers are increasingly demanding. “We’re in the New York market competing against some of the best Honda and Acura dealers in the country, and we’ve proven we can hold our own. We’ve taken a look at some of the disruptors and business models that are coming in, though, and those are causing customers to take a different look at things.”

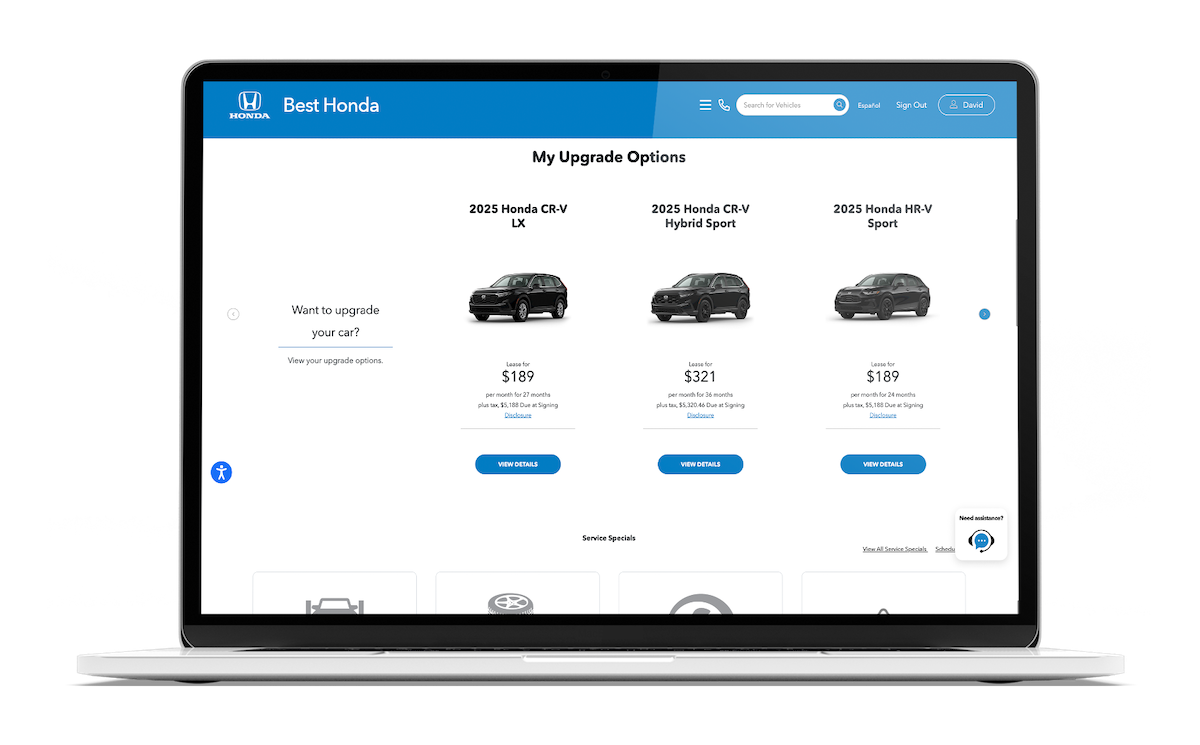

To meet this challenge head-on and serve consumers how they want to be served, Benstock and his team have taken a step back to see what sales methods would best meet their needs. “The customers basically want three things,” he said. “They want us to know them better, serve them faster, and ‘wow’ them everywhere. This is not special anymore. This is an expectation of today’s consumer.”

Marketing to today’s drivers

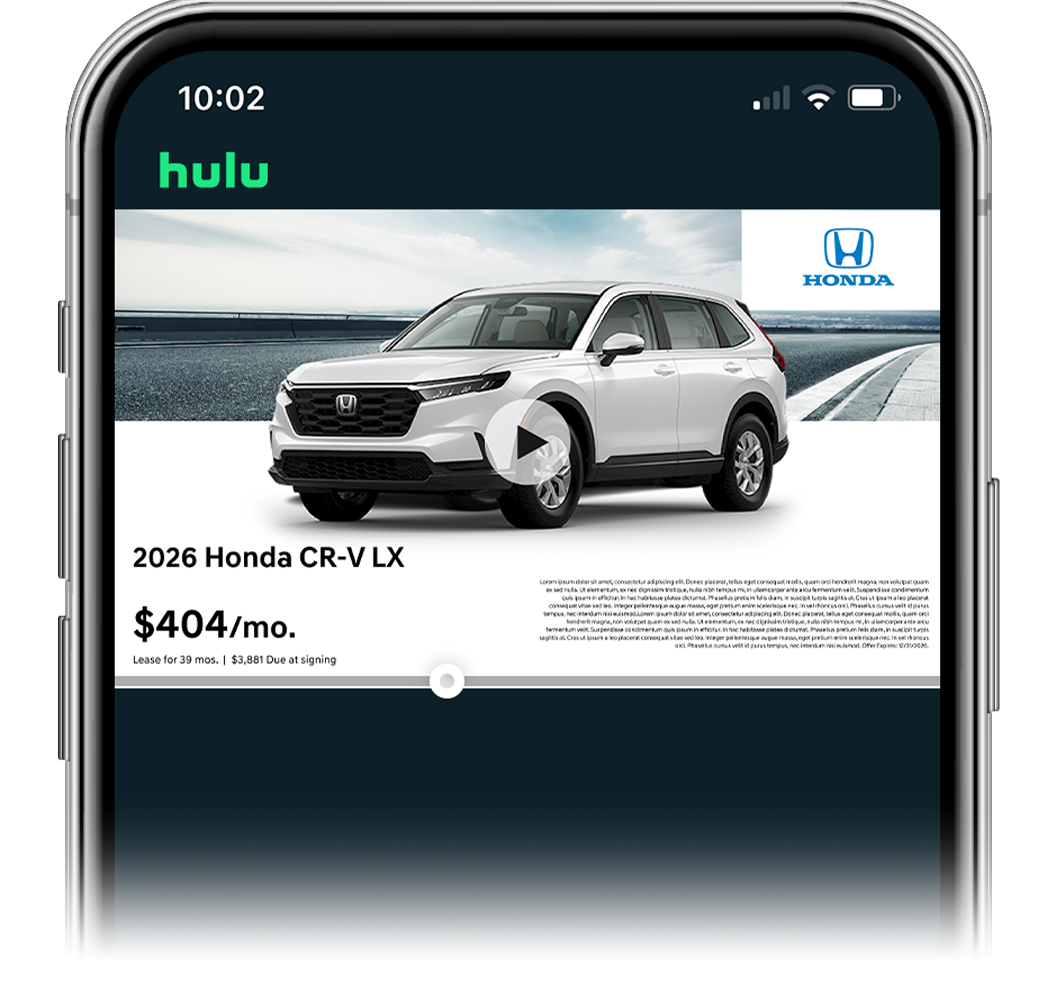

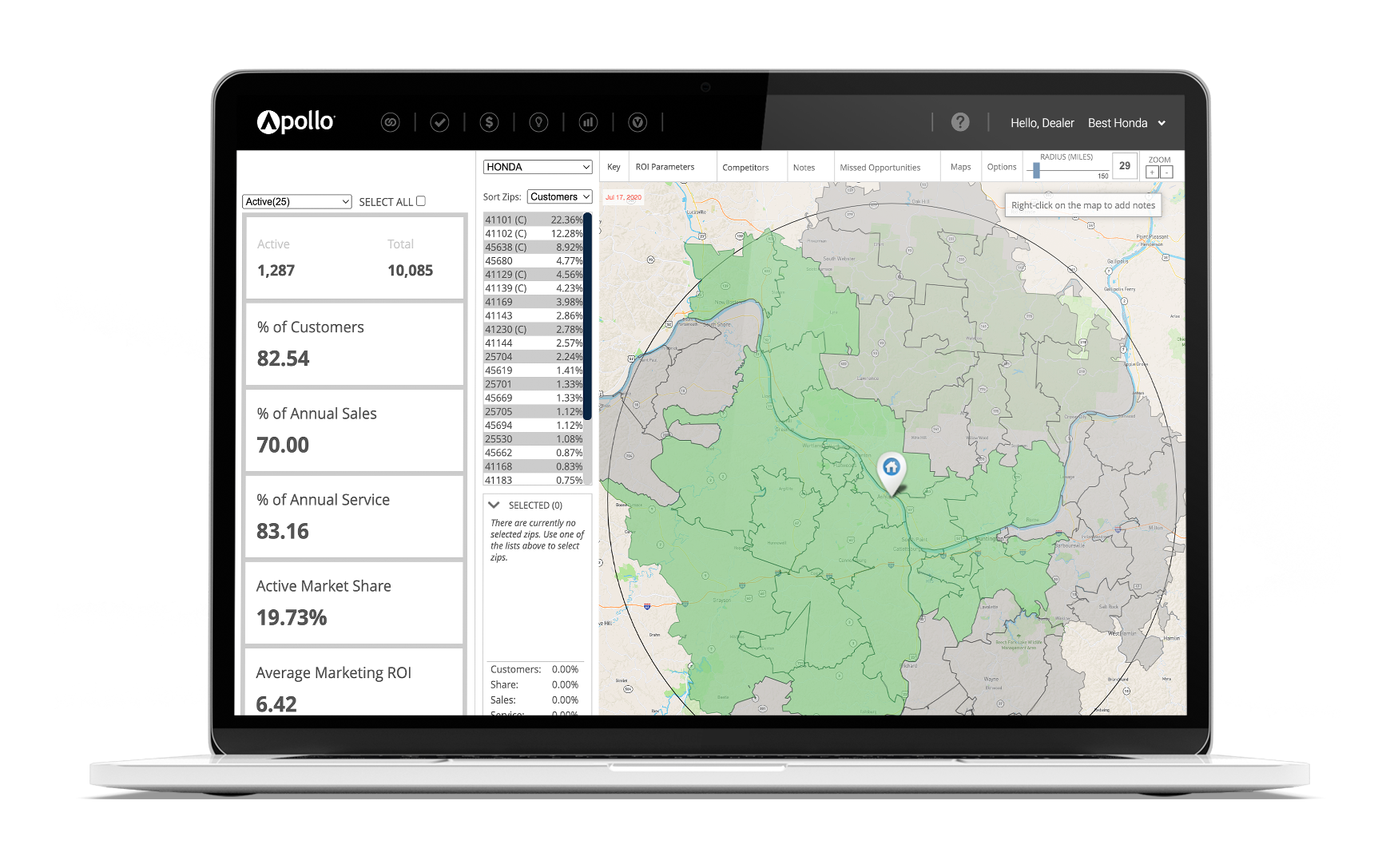

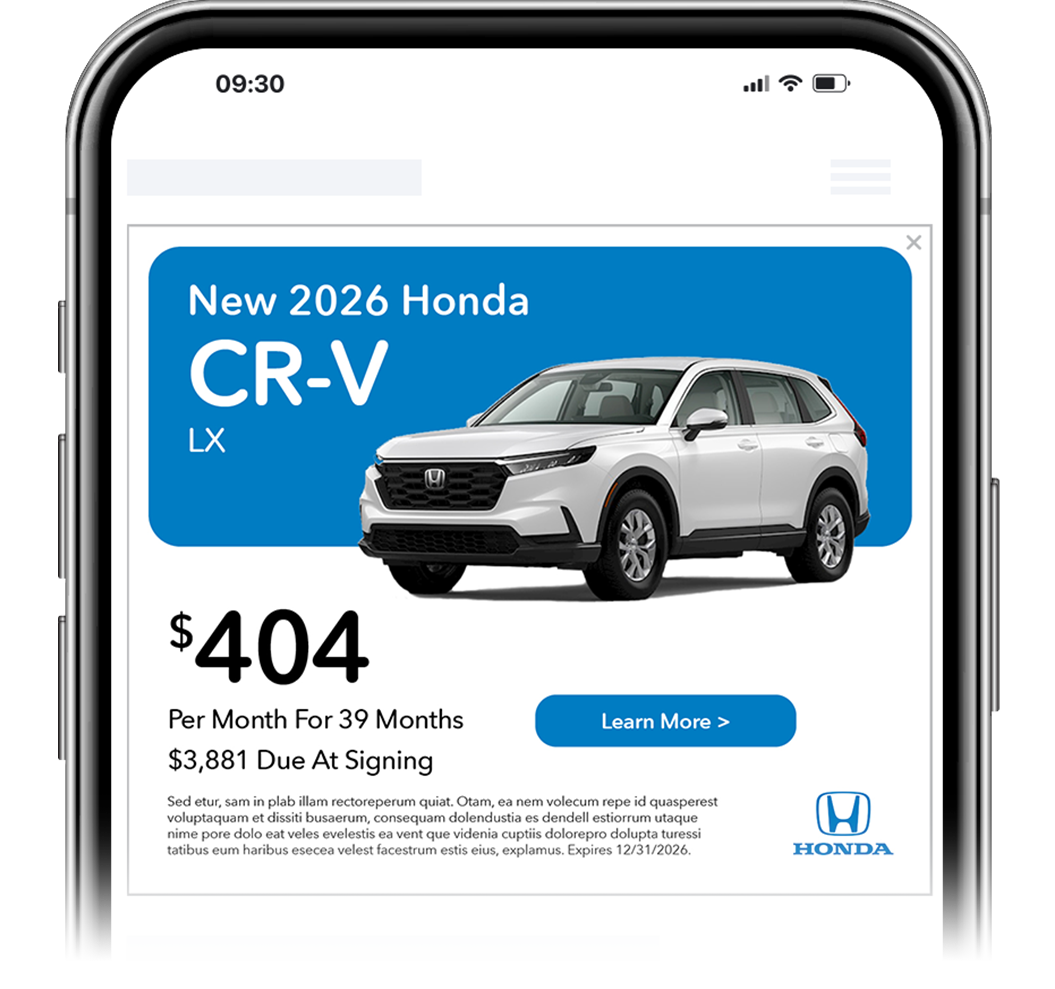

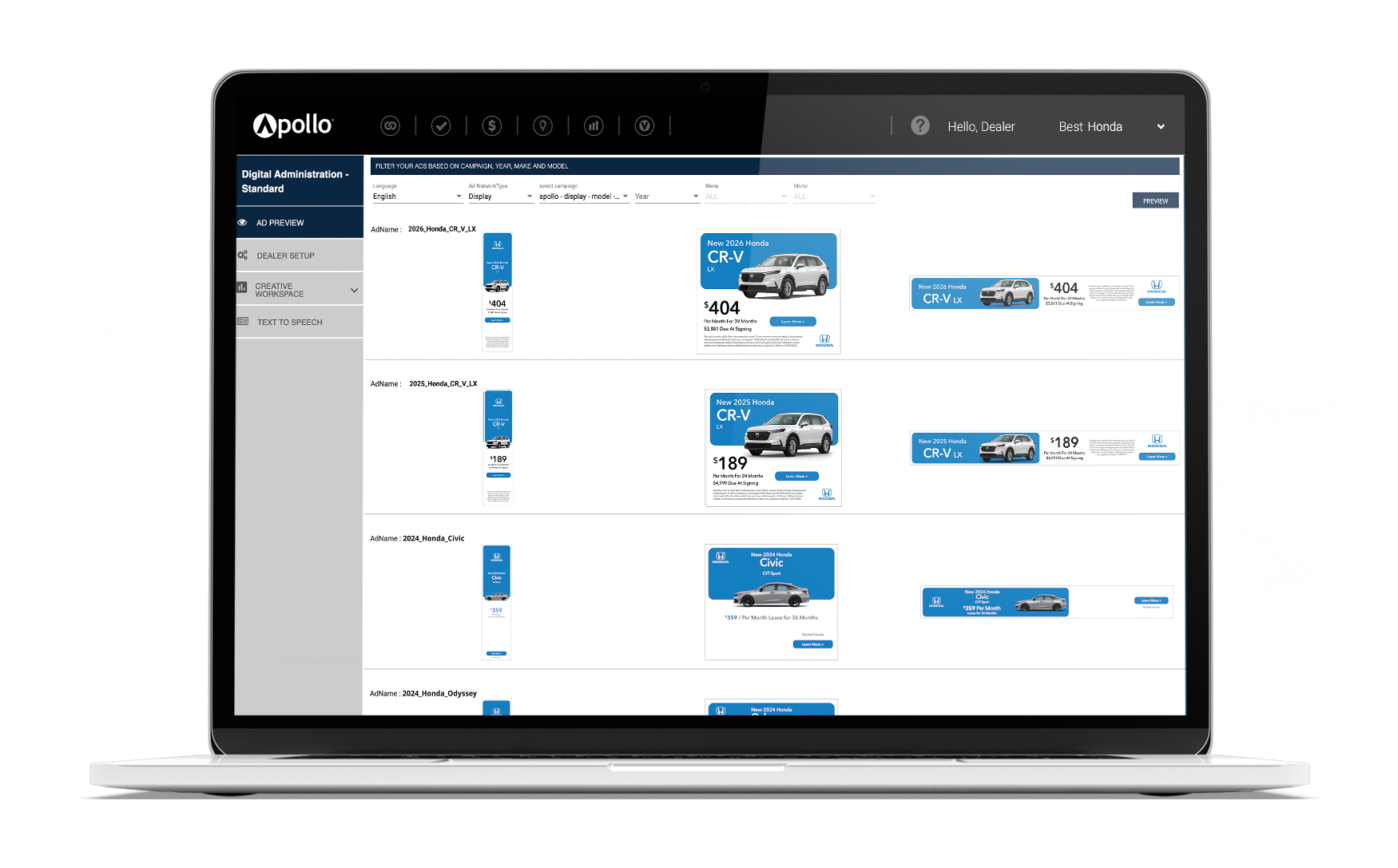

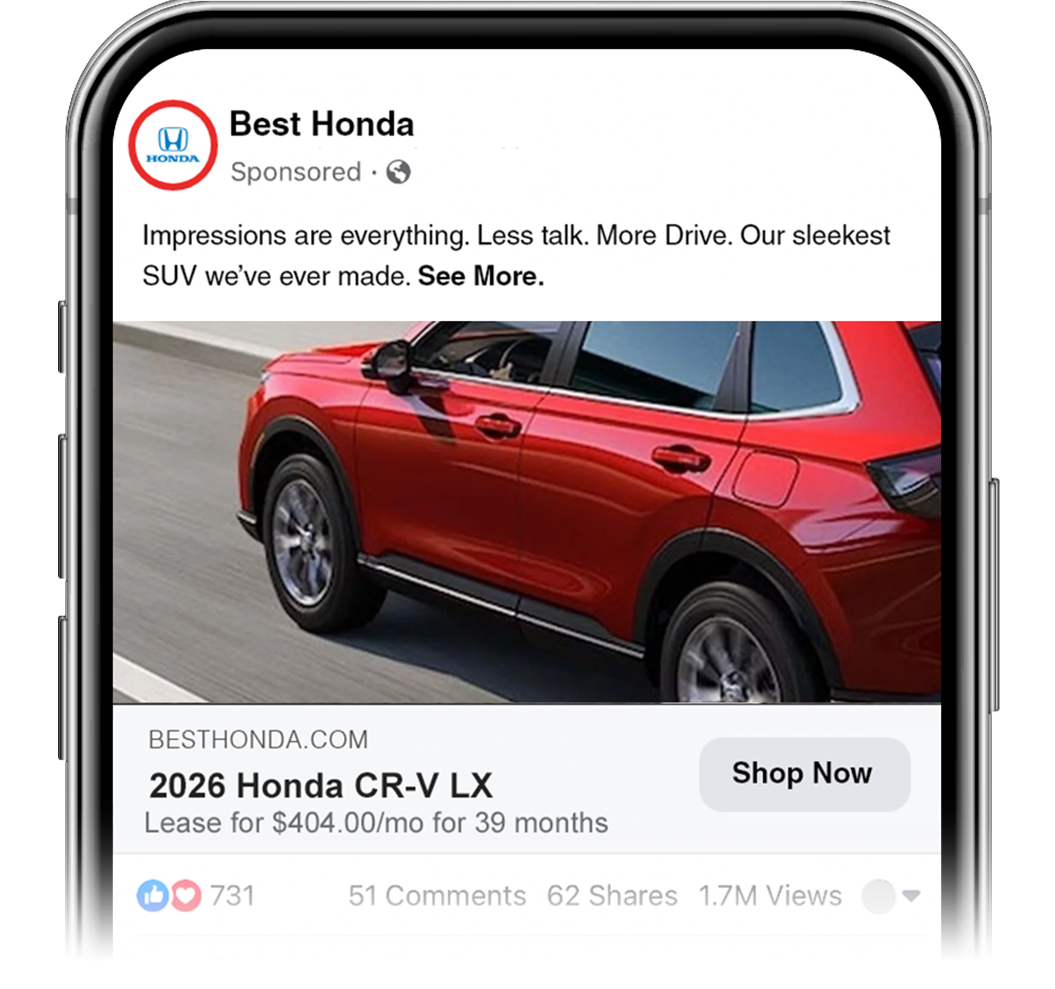

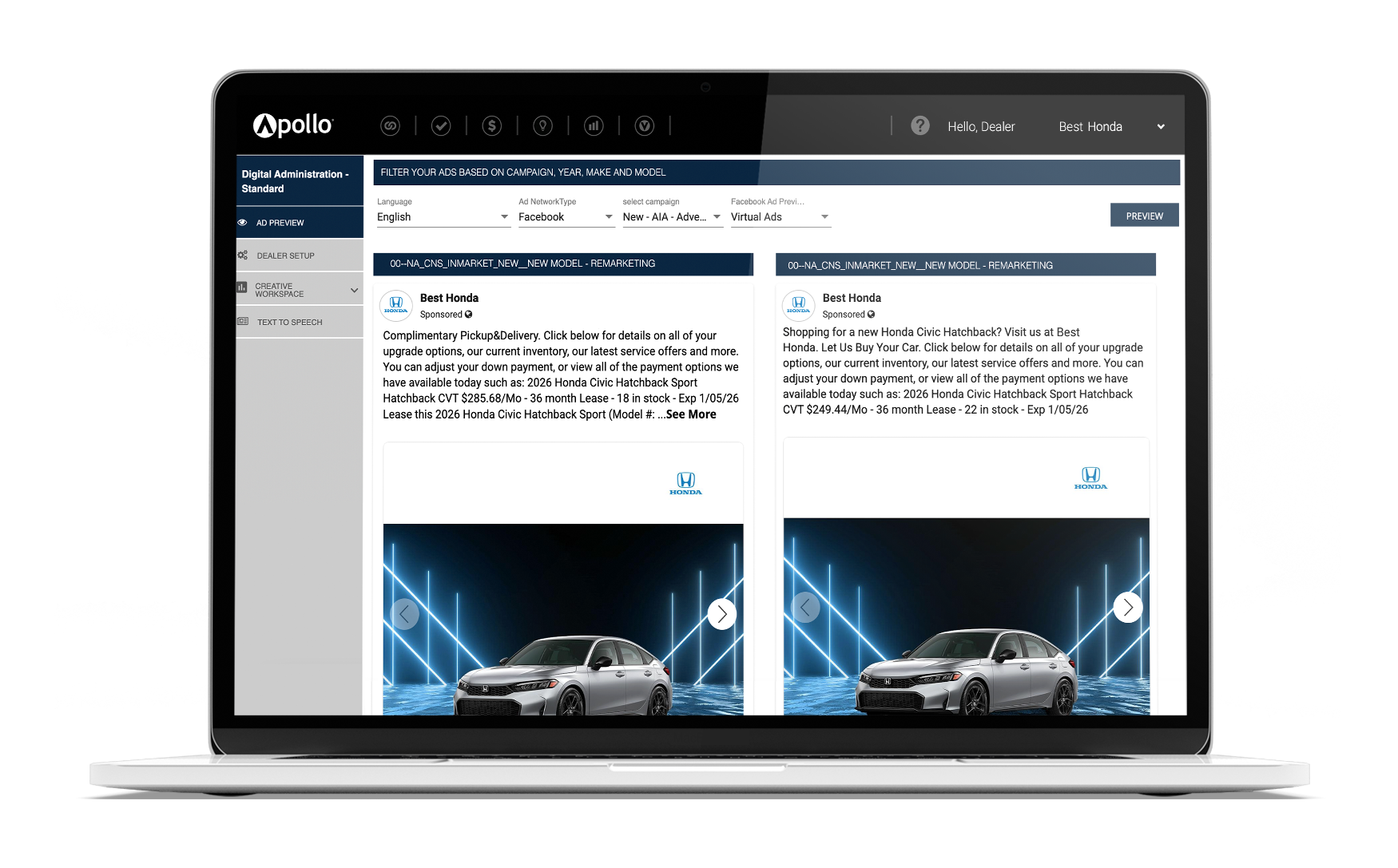

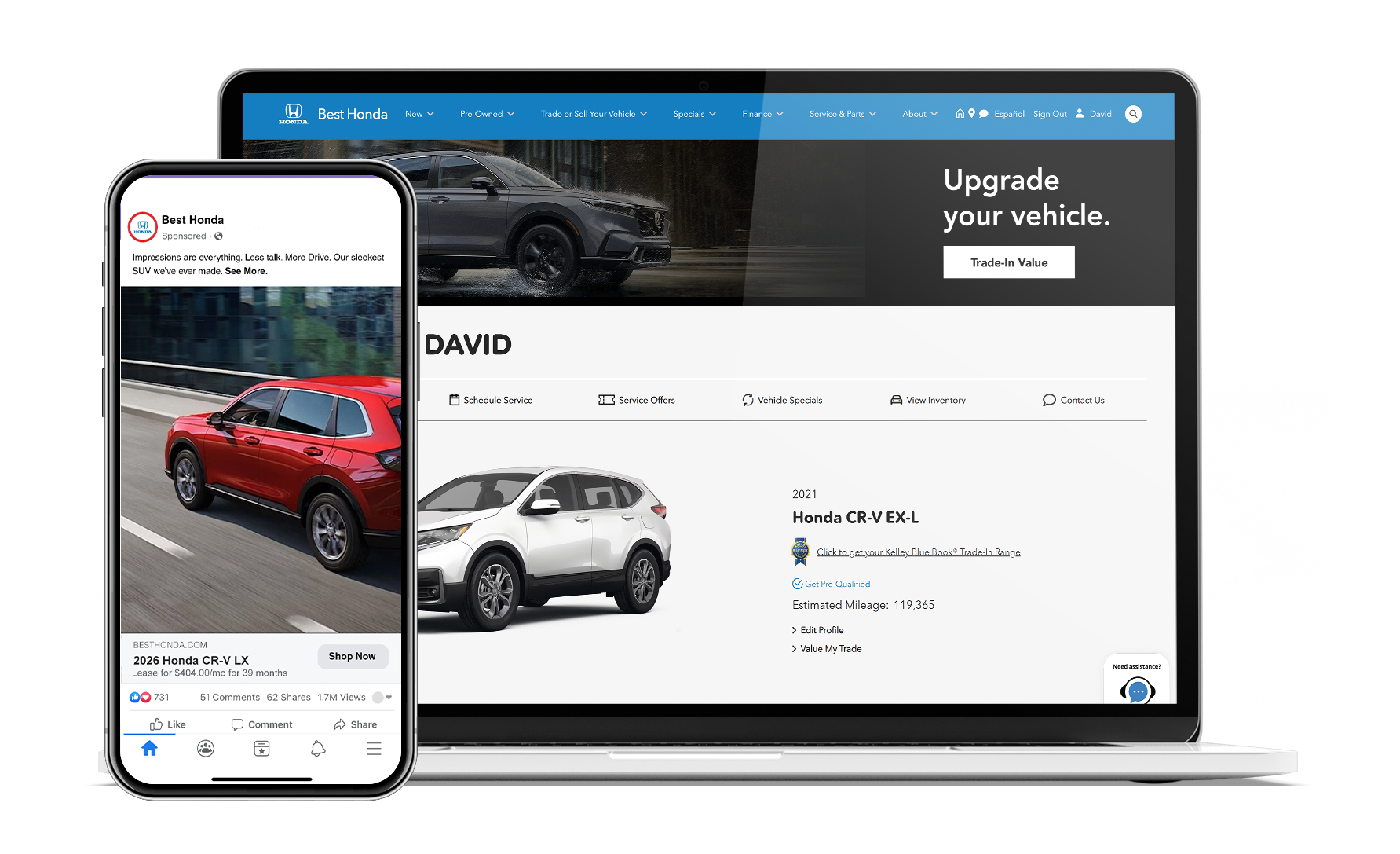

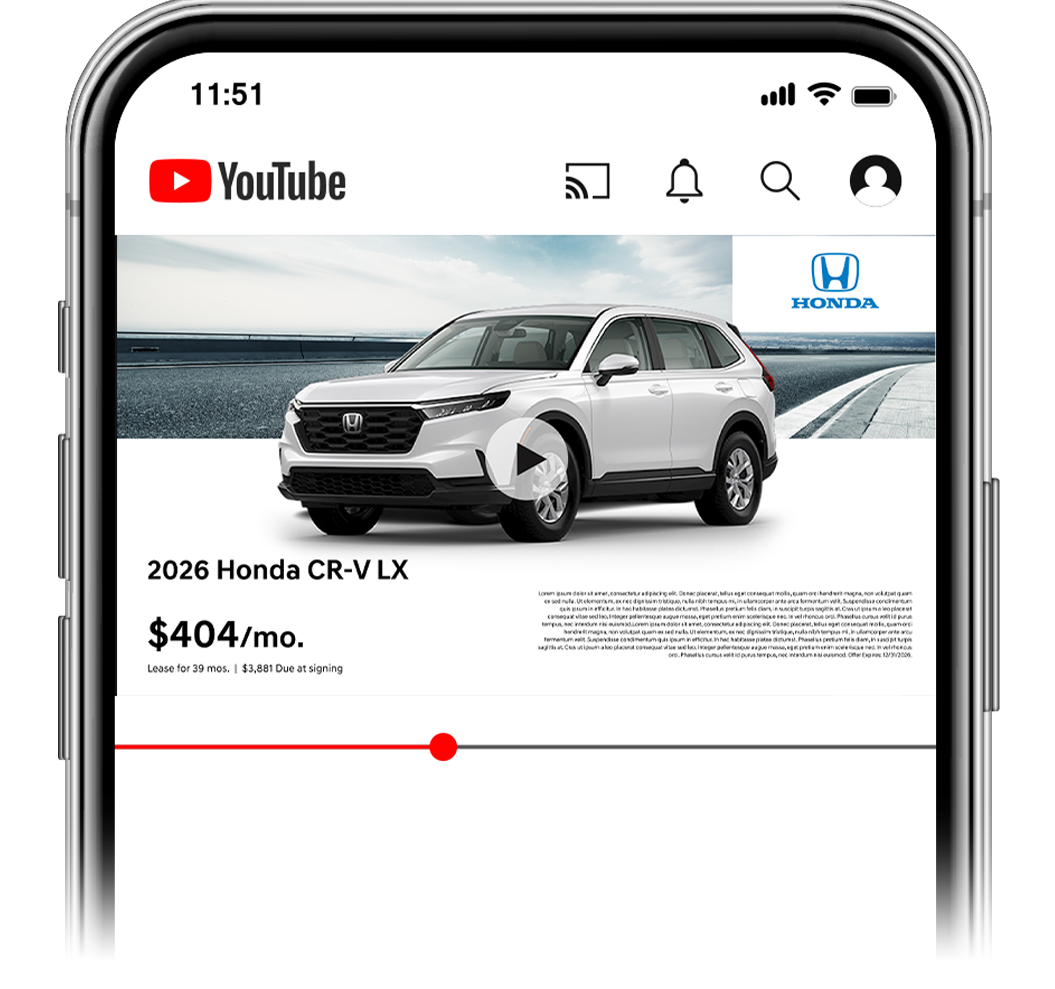

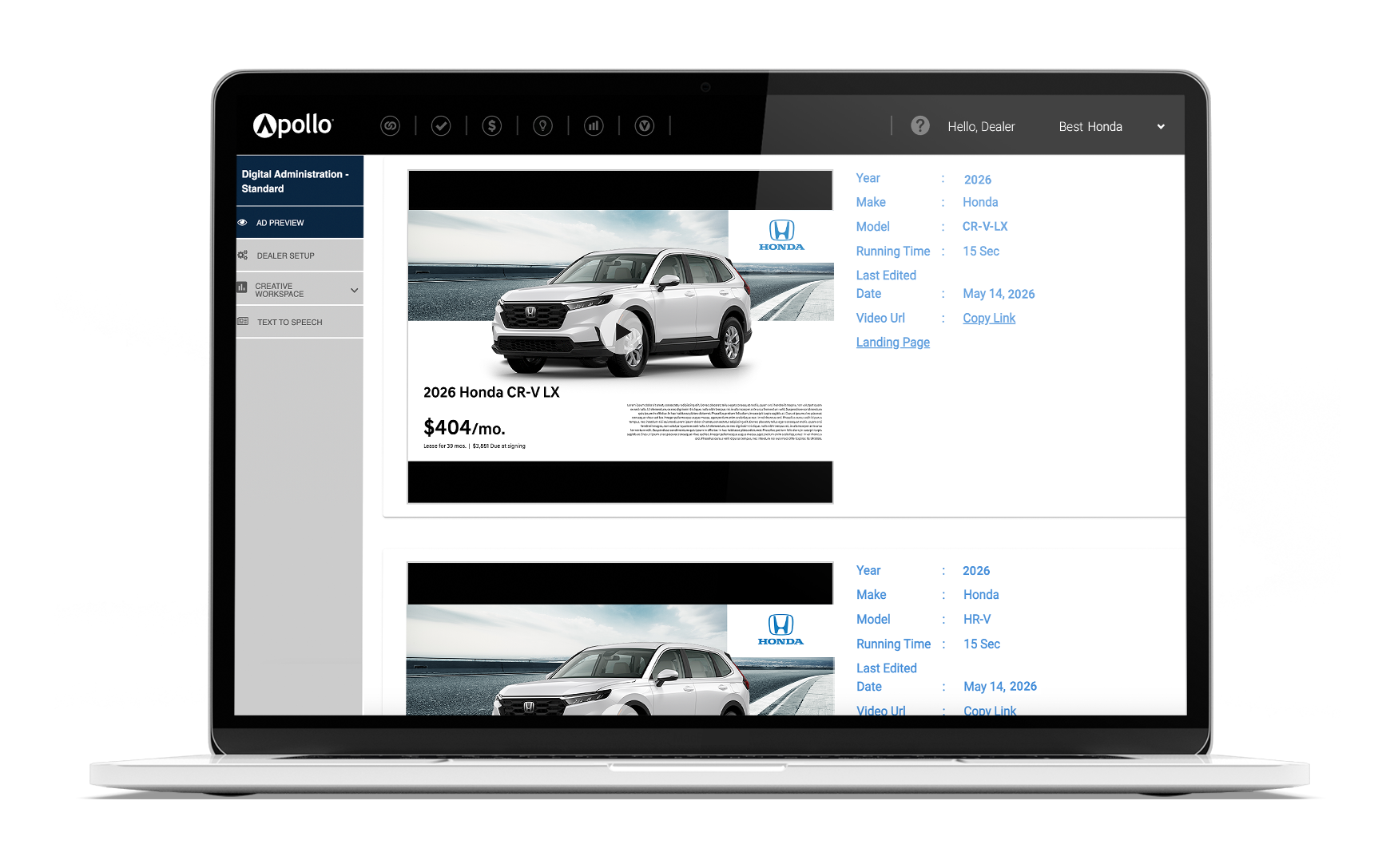

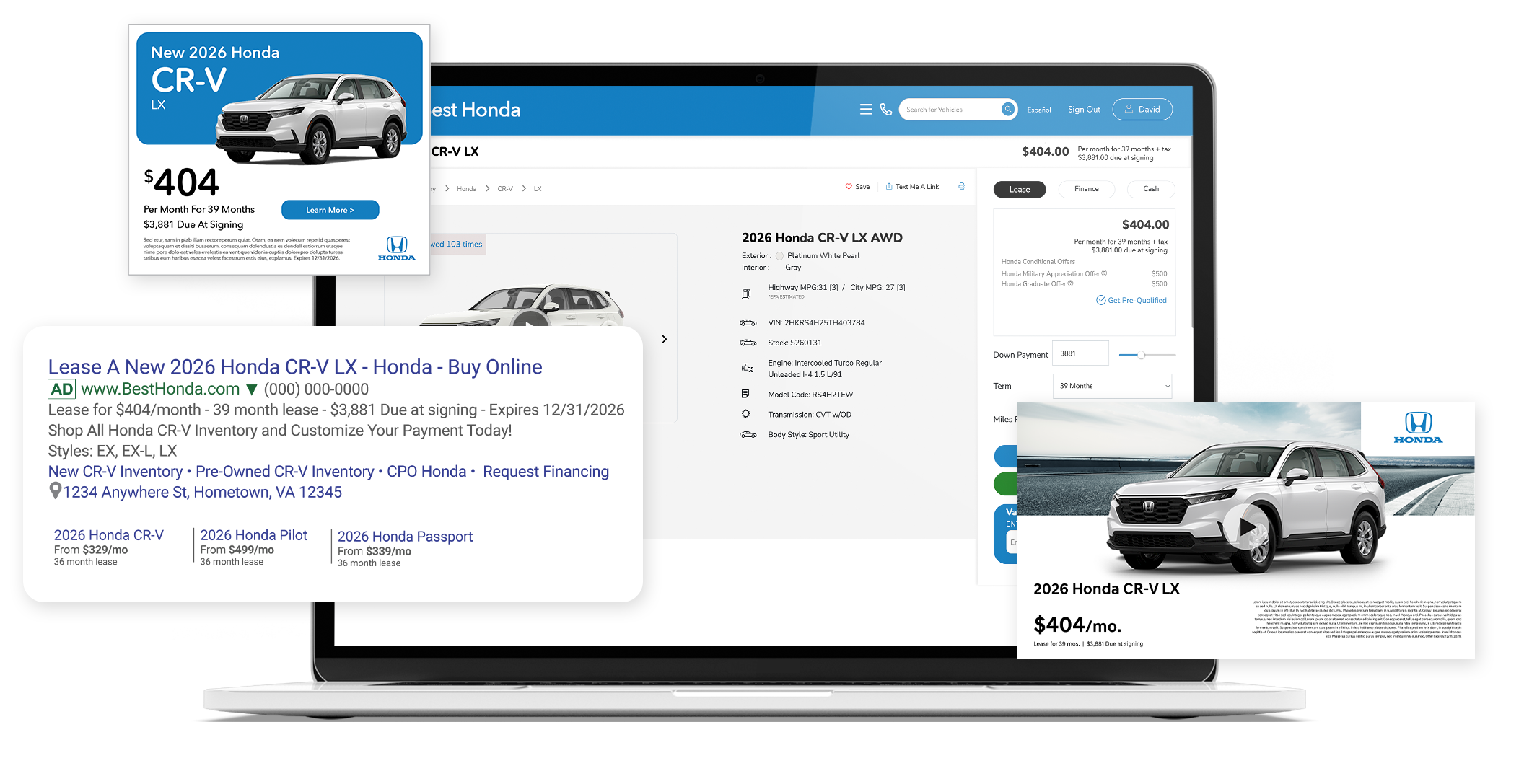

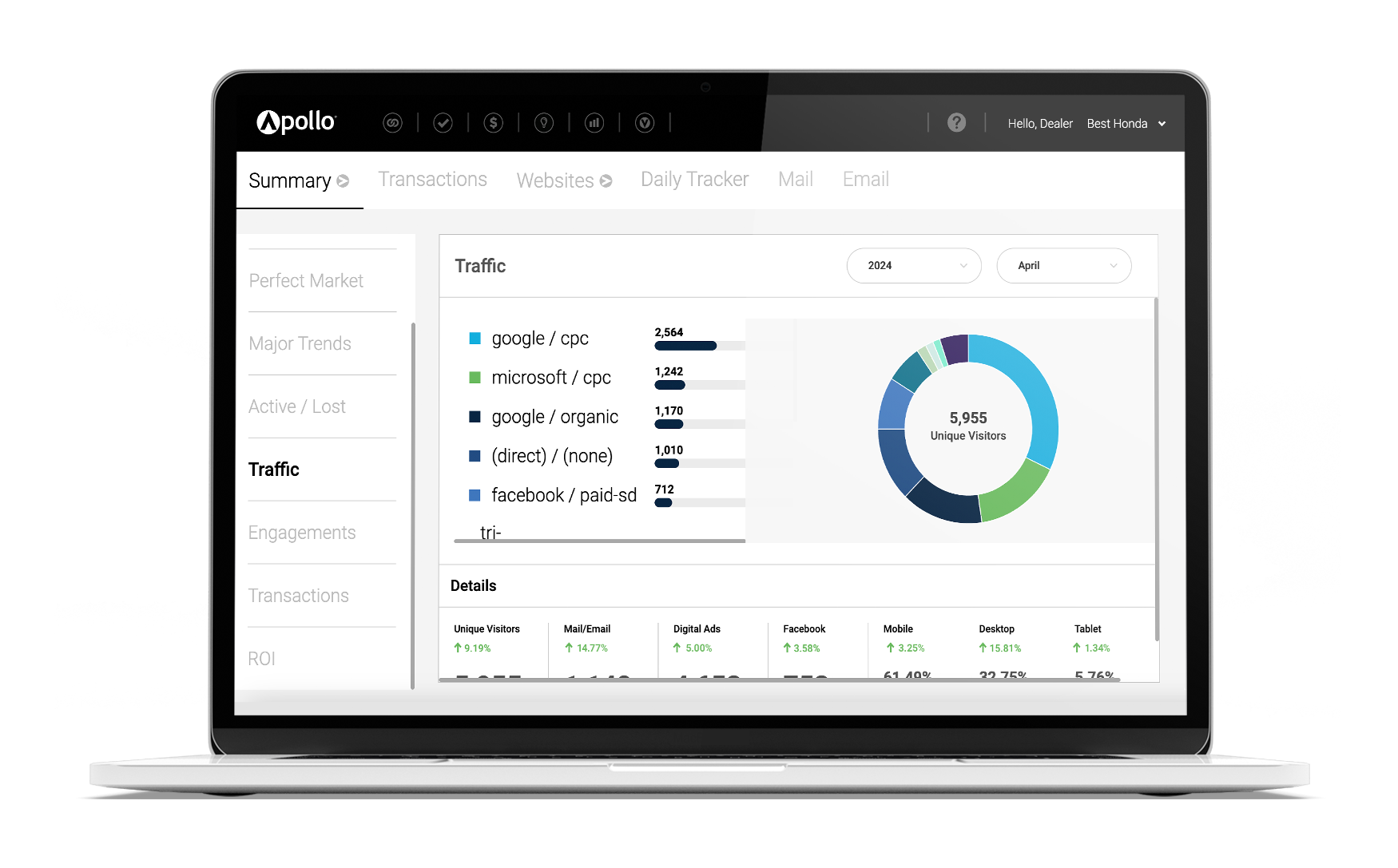

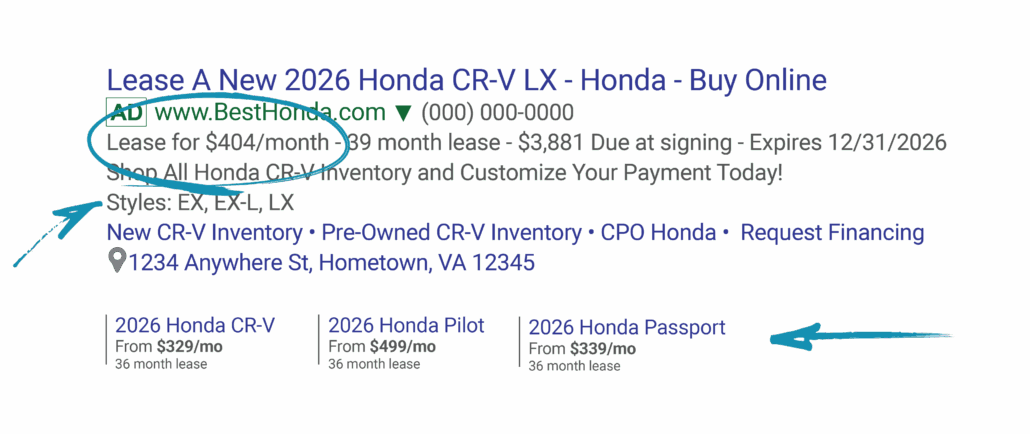

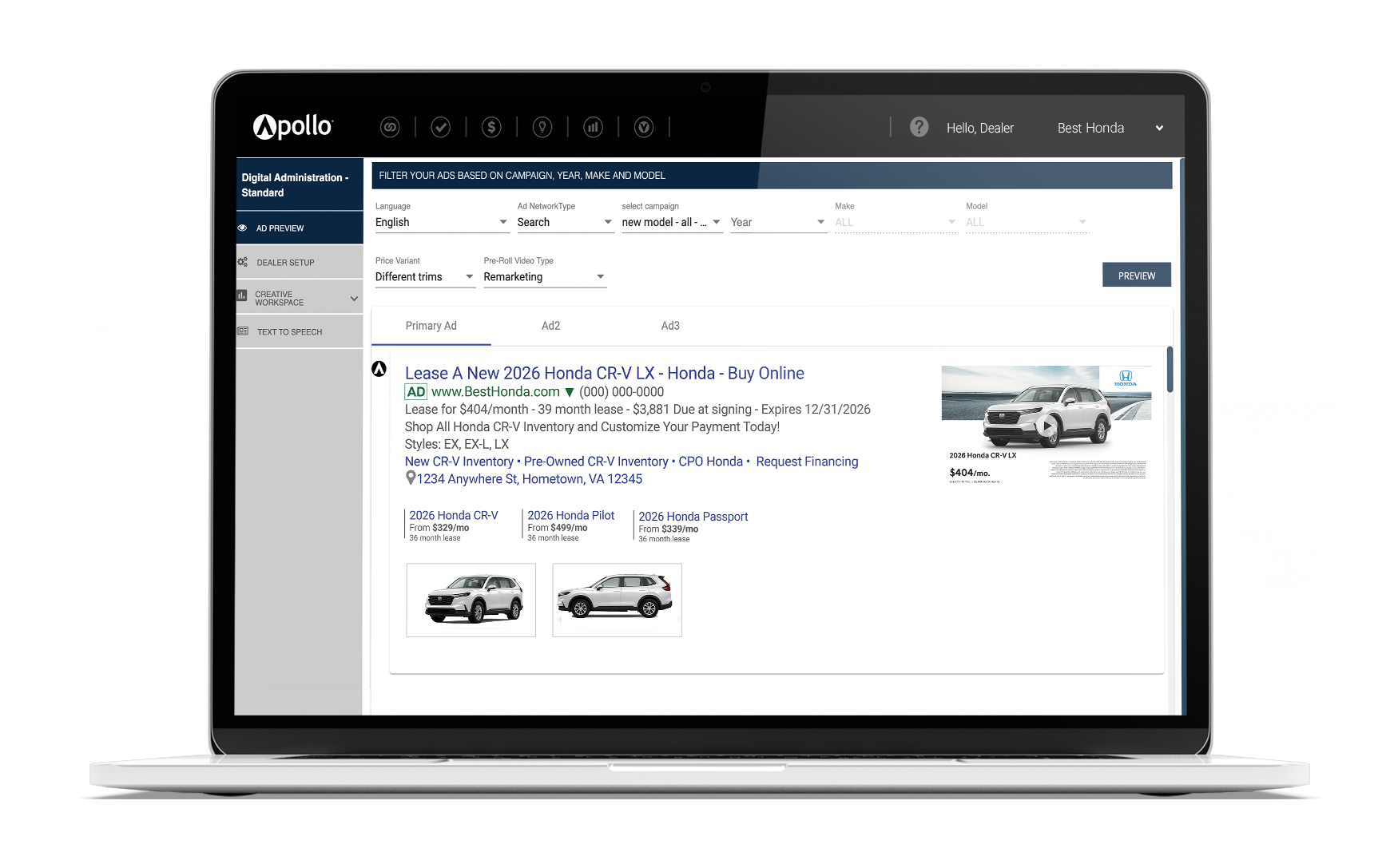

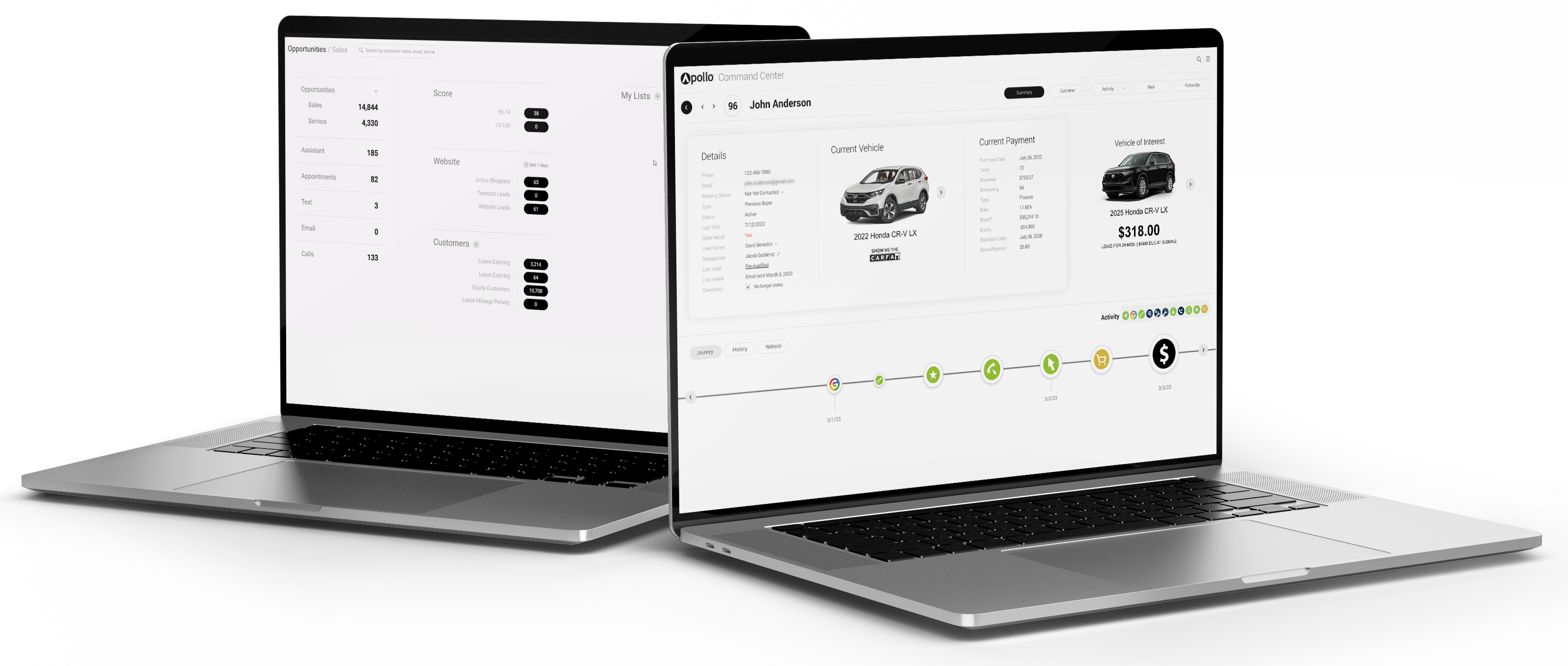

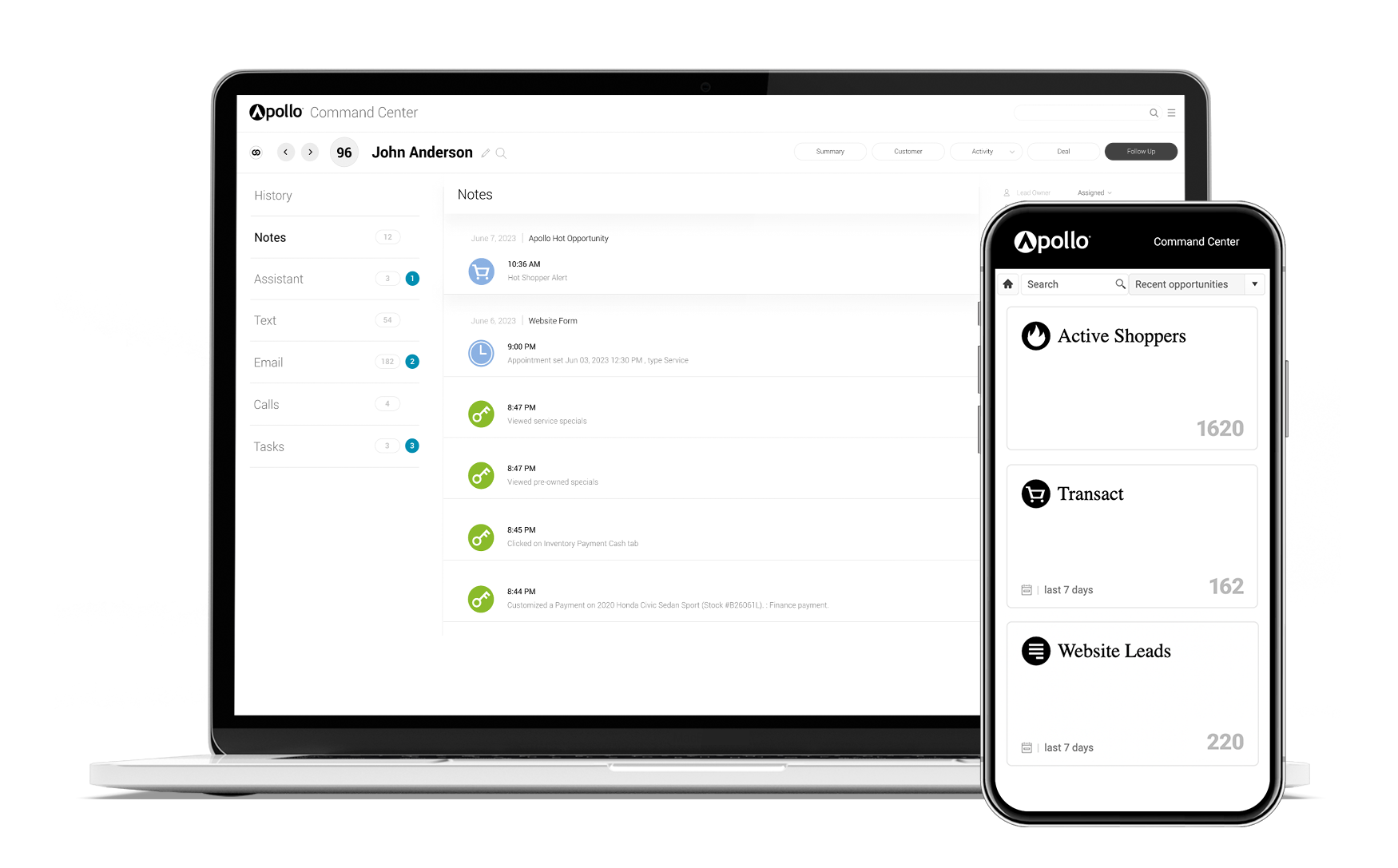

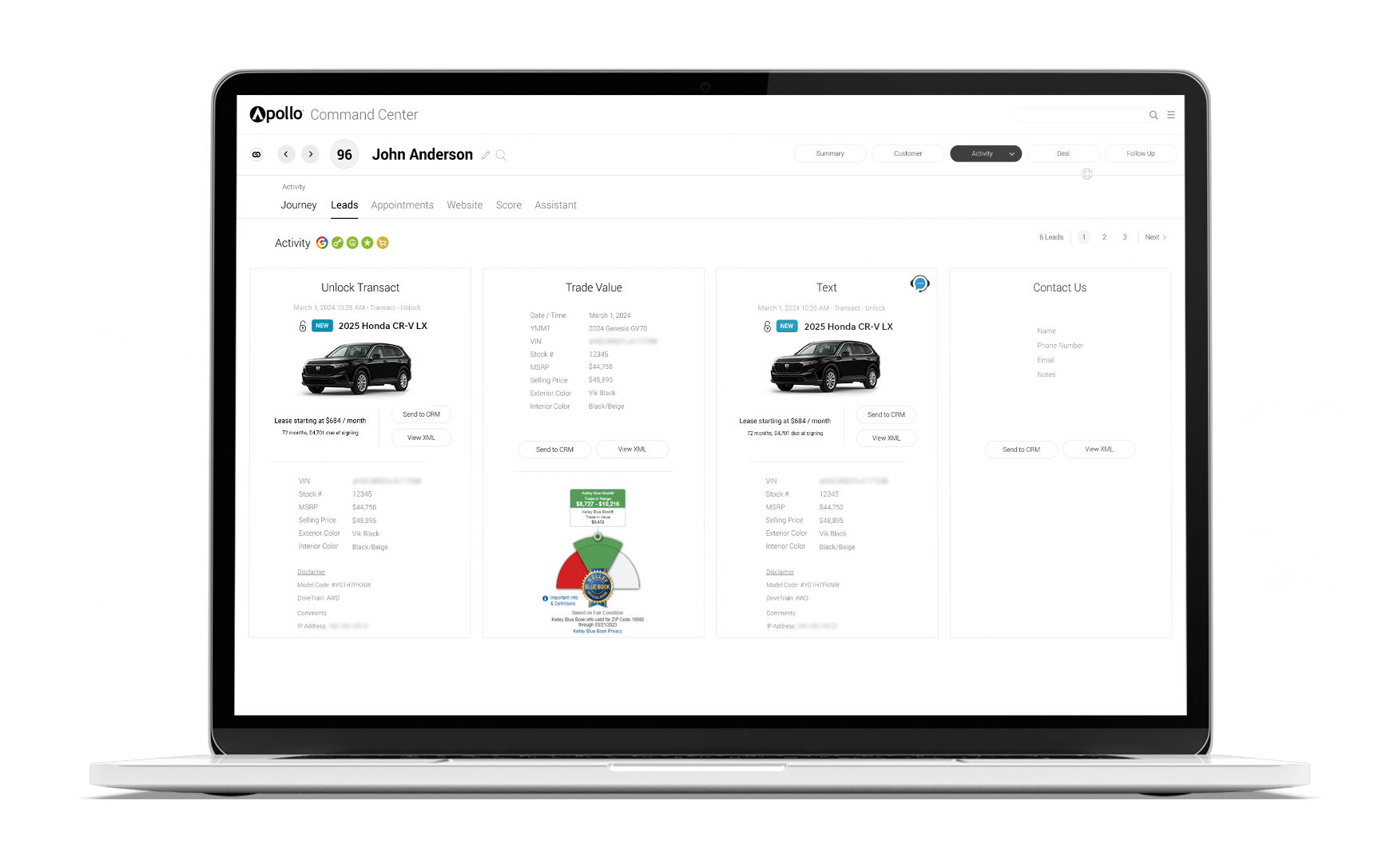

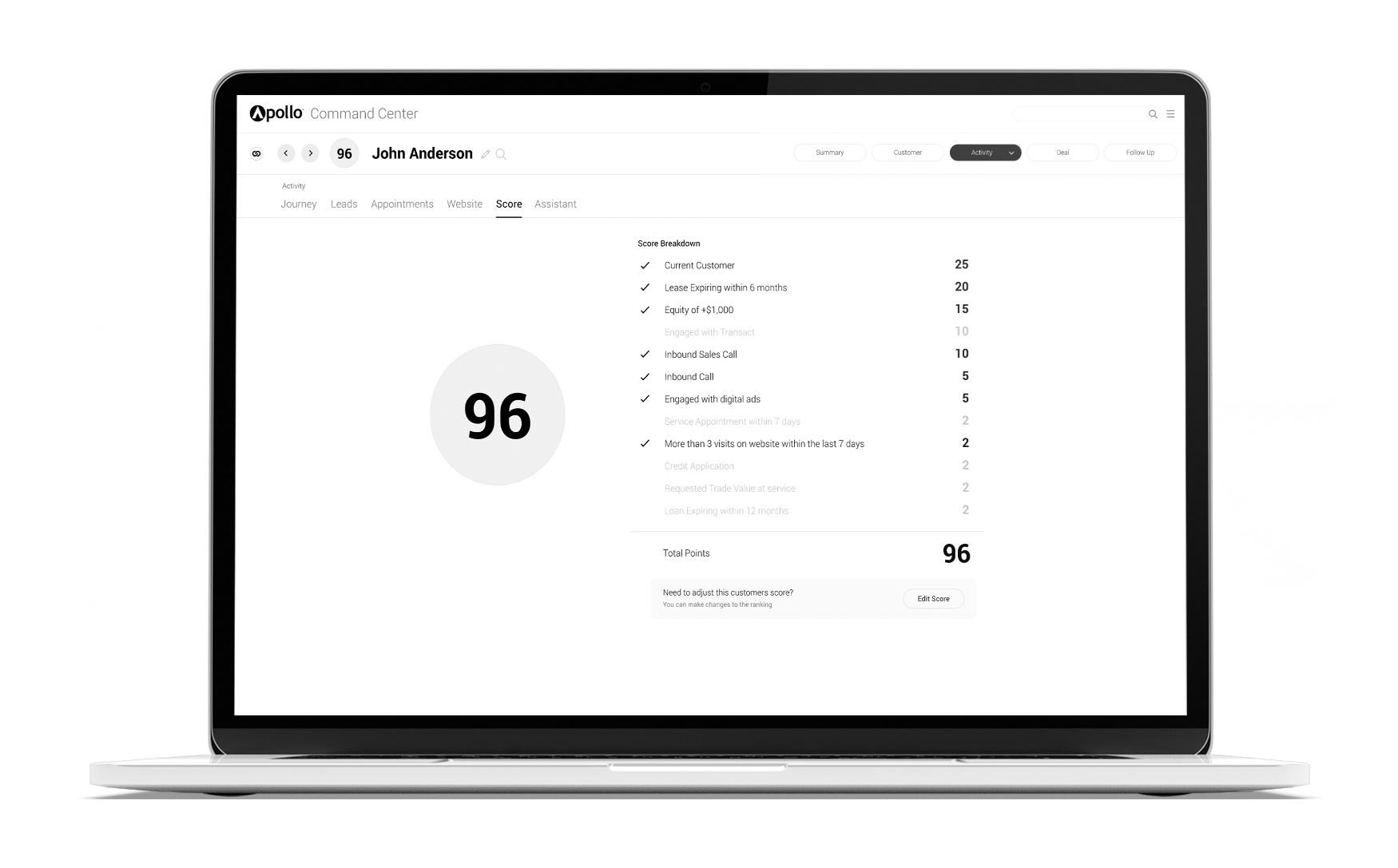

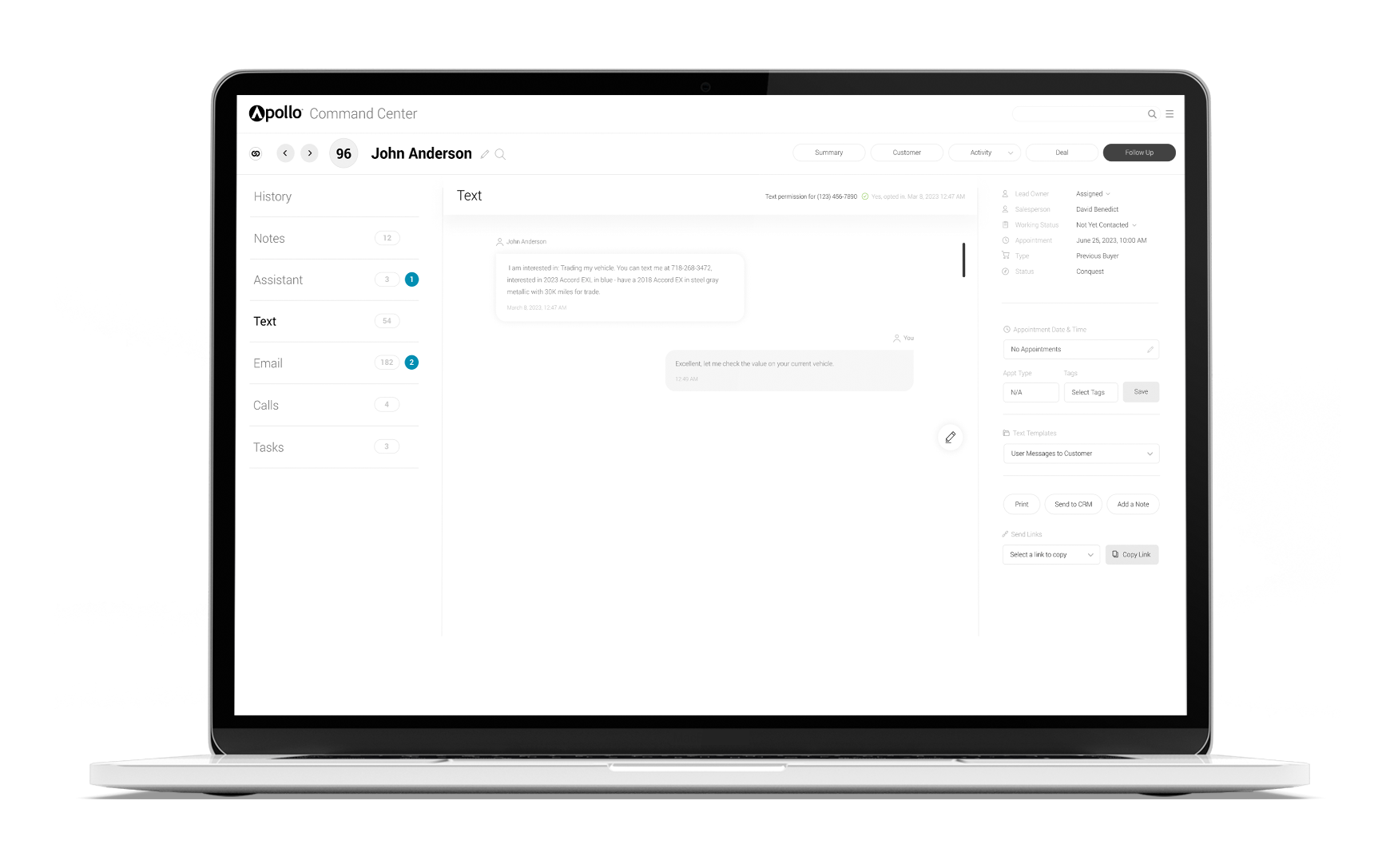

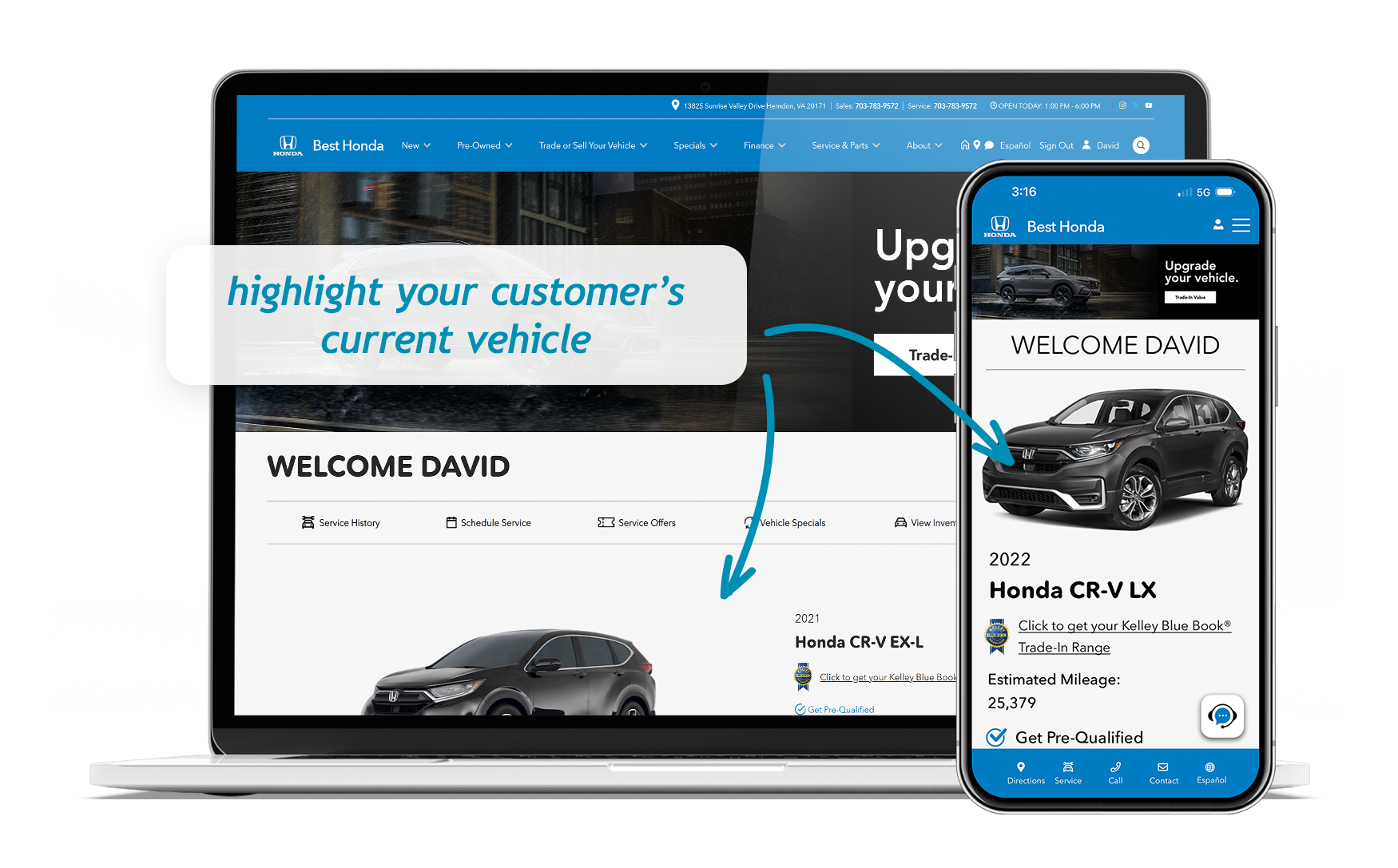

Part of meeting those needs is presenting a marketing message that connects the dealership with customers in a meaningful way. To do this, Paragon Honda and Paragon Acura have partnered with Team Velocity to present their marketing and direct mail, including using Apollo, a data-mining solution, to provide the right message to the right contact at the right time.

“[In addition] we’ve been utilizing a vehicle exchange program for several years and targeting customers with the highest likelihood of doing business with us now and in the future,” Benstock said. “That’s worked out for us.”

The availability of consumer data has never been higher, and that ability gives dealerships, like Paragon, tools to connect with consumers directly. “We’re taking a closer look at our CRM and data that’s available from our customers and making sure that, when we speak to our customers, we’re speaking from the knowledge that we should and do have about that customer,” Benstock said.

From an industry-wide perspective, Benstock knows this data has not been utilized to the same full potential other businesses have been successful with. “Why is it that many other retailers in other industries seem to be able to better target their customers than an automobile dealer when we’ve got incredible data on our customers? We know their buying patterns. We know their product selections and desire. We know their budgeting information. I don’t think we do a great job as an industry in effectively communicating with our customer in a personalized manner.”

Benstock believes that the auto industry has lagged behind this curve due to one glaring reason – if a consumer wanted to buy a new car, they had to go to a franchised car dealership. As a result, the auto sales industry has been slow to react to changes. That luxury, Benstock believes, is quickly coming to an end as the consumer’s very relationship to vehicles is evolving. “Take Uber, for example,” he said. “They are offering fractional ownership opportunities or fractional ride-share opportunities. When I say fractional, I don’t mean monthly. I can pay per ride. I can have the car I want, the size I need, delivered when I want, where I want. Many customers are finding this more efficient than owning their own automobile. Then add into that, the autonomous car that is going to be a part of our future. The driver is the biggest expense of Uber. So, Uber will then become even more of value as there will no longer be a need for a driver. That’s just one disruption.”

“Then you’ve got Elon Musk and the Tesla group, going outside of the traditional franchised dealer system saying, ‘We think we can do it better,’” Benstock said. “They’re offering different products in a different manner. It’s interesting to see the initial success they’re having. They’re doing quite well in the high-end luxury market and seem to have taken over a pretty good amount of the market share.”

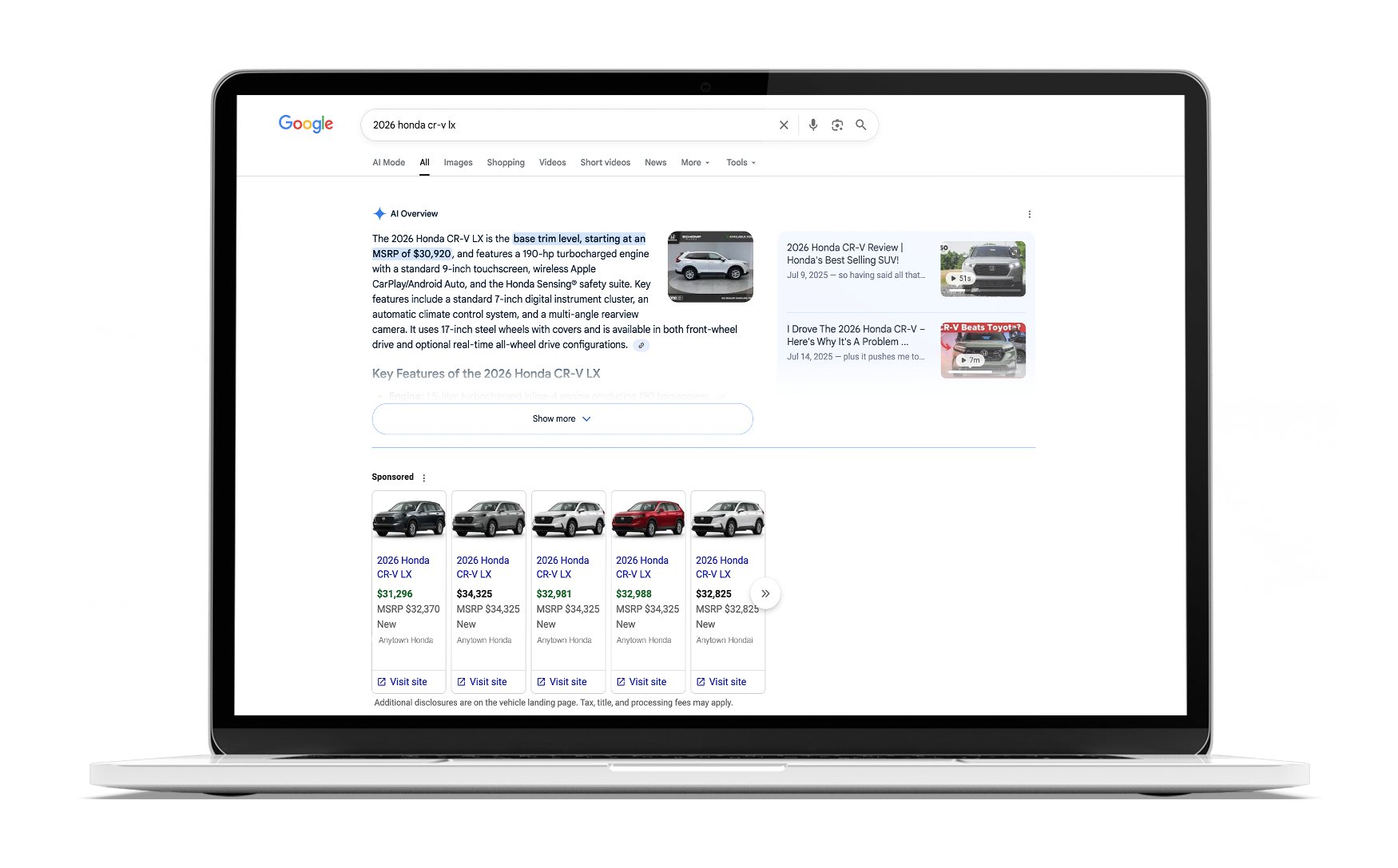

Consumer behavior has also disrupted the marketing landscape. “We’re certainly looking at how easy is it for our customers to do business with us online,” Benstock said. “The Internet, for most of us, has gone from informational 10 or 15 years ago to transactional today. Fully transactional. I think auto retailers have not been quick to embrace that. More and more, we’re realizing as a group that we need to do a better job there.

New customers, new sales methods

This innovative insight into the sales process was the catalyst for Paragon Direct. “We’ve built it for speed,” Benstock said. “Not that our customers would need to conduct a transaction in under a minute, but pretty much they can get to a negotiated price by themselves in under a minute. If they have a trade involved, or there’s financing involved, it will take slightly longer, but customers can navigate on their cell phone or however they access the Internet [with ease].”

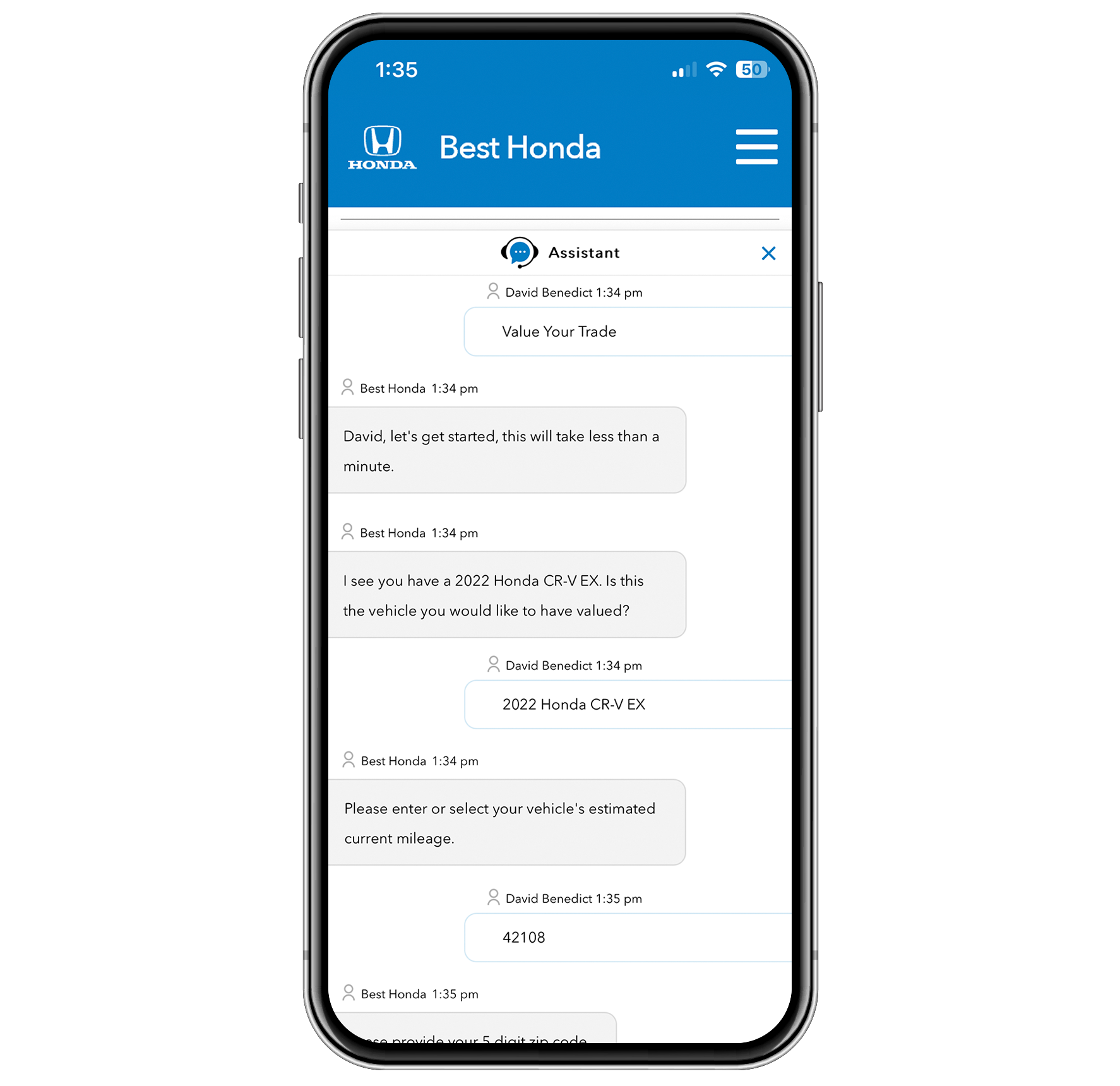

Before this new transaction model can be fully adopted, however, some psychological barriers need to be overcome — both on the customer’s and the dealership’s side. “From the consumer standpoint, there’s a natural distrust of automobile dealers,” Benstock said. “So, when you’re offering to do this transaction completely online, and you’re offering transparency, it’s not something that they’re used to getting from dealers. Also, they’re not 100 percent comfortable doing such a transaction online yet. They will be, but initially, we are finding many of our customers are getting 70 or 80 percent through and then electing to conclude the transaction in the dealership. The good thing is they save a lot of time by doing most of the transaction online.”

From the dealership’s side, while transparency might be a scary prospect, it’s one Benstock believes must be implemented. “Our philosophy is that transparency can and should improve revenue by making it easier for customers to have access to the information they want online,” he said. “Imagine if you wanted to buy an iPhone online and they told you, ‘Come on in, and we’ll give you the price.’ It’s preposterous, and yet in dealerships around the country, that’s exactly what happens.”

Holistic dealerships

In addition to changing the way dealerships interact with their customers, Benstock believes the way internal departments interact with each other needs to change as well. “Each department used to have to stand on its own independently,” he said. “Now, we need an interdependence of the departments. We have to look holistically at the profit centers at the dealership. For instance, you get the new car manager who doesn’t want to take a short deal when there’s a trade in. By not taking that deal, however, they’ve deprived the used car manager of a car and deprived the service department of a service RO. They didn’t look at that deal holistically. What gives any one manager the right to cut out those other departments? The managers of today need to have an excellent understanding of the complete business.”

The future

“I think the current state of customer satisfaction with the buying process makes our market ripe for disruption,” Benstock said. In addition, he believes that even the model of automobile ownership will soon change. “I think dealerships are going to see consumers paying a monthly payment and being able to drive [or] shift out of cars without long-term commitments,” he said, “very much like what we’re doing with cell phones today. Let’s call it ‘flexible drive ownership.’ It will be the ability to pay a fixed monthly payment and drive an SUV when you need an SUV, to drive a coupe when you need a coupe and a sports car when you want to drive a sports car.”

Benstock sees these changes as revolutionary for the auto sales business but believes dealers and GMs who consistently react instead of proactively meet this future will suffer. “I think you’re going to continue to see more decompression,” he said. “I think you’re going to see a reduction in the number of dealerships and a reduction in the number of people employed at dealerships. I think dealerships are going to be distributions points, and dealerships are going to have to be moving at the speed of the customer wherever the customer wants to be.”

Where some see a crisis, Benstock considers an opportunity for those willing to embrace it. “Change is going to come whether we like it or not,” he said. “The saying is ‘change or be changed.’ What our dads did, or our mentors did, our predecessors did, some of those basic business philosophies certainly hold true. Others need to be completely revisited. We have to adapt. We have to adapt and be very, very flexible in our beliefs.”